The US stock market has long been a beacon of economic growth and investment opportunity. Investors from around the world pour their capital into American stocks, hoping to capitalize on the market's potential. But what is the average growth rate of the US stock market, and what does it mean for investors? This article delves into the numbers, providing a comprehensive overview of the average growth rate and its implications.

What is the Average Growth Rate of the US Stock Market?

The average growth rate of the US stock market can vary widely depending on the time frame and the specific index being analyzed. Historically, the S&P 500, a widely followed benchmark for the US stock market, has delivered an average annual return of around 10% over the long term. However, this figure is not a guarantee of future performance and can fluctuate significantly from year to year.

Long-Term vs. Short-Term Growth

When discussing the average growth rate of the US stock market, it's important to differentiate between long-term and short-term growth. Over the long term, the stock market has historically shown a consistent upward trend, driven by factors such as economic growth, corporate earnings, and technological advancements. In contrast, short-term growth can be volatile, influenced by market sentiment, political events, and economic indicators.

Factors Influencing Stock Market Growth

Several factors contribute to the growth of the US stock market. These include:

- Economic Growth: A strong economy typically leads to higher corporate earnings, which in turn drive stock prices higher.

- Corporate Earnings: Companies with strong financial performance tend to see their stock prices rise.

- Interest Rates: Lower interest rates can make borrowing cheaper, leading to increased investment and economic growth.

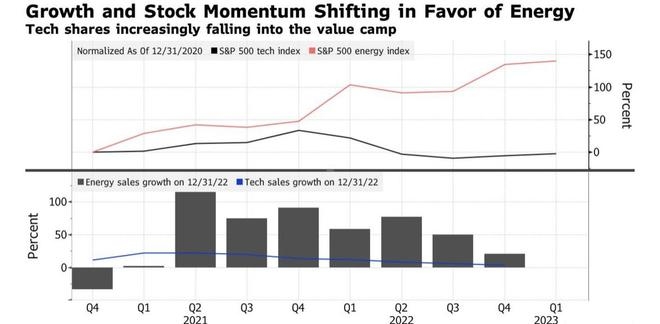

- Inflation: Moderate inflation can be beneficial for the stock market, as it can lead to higher corporate earnings and stock prices.

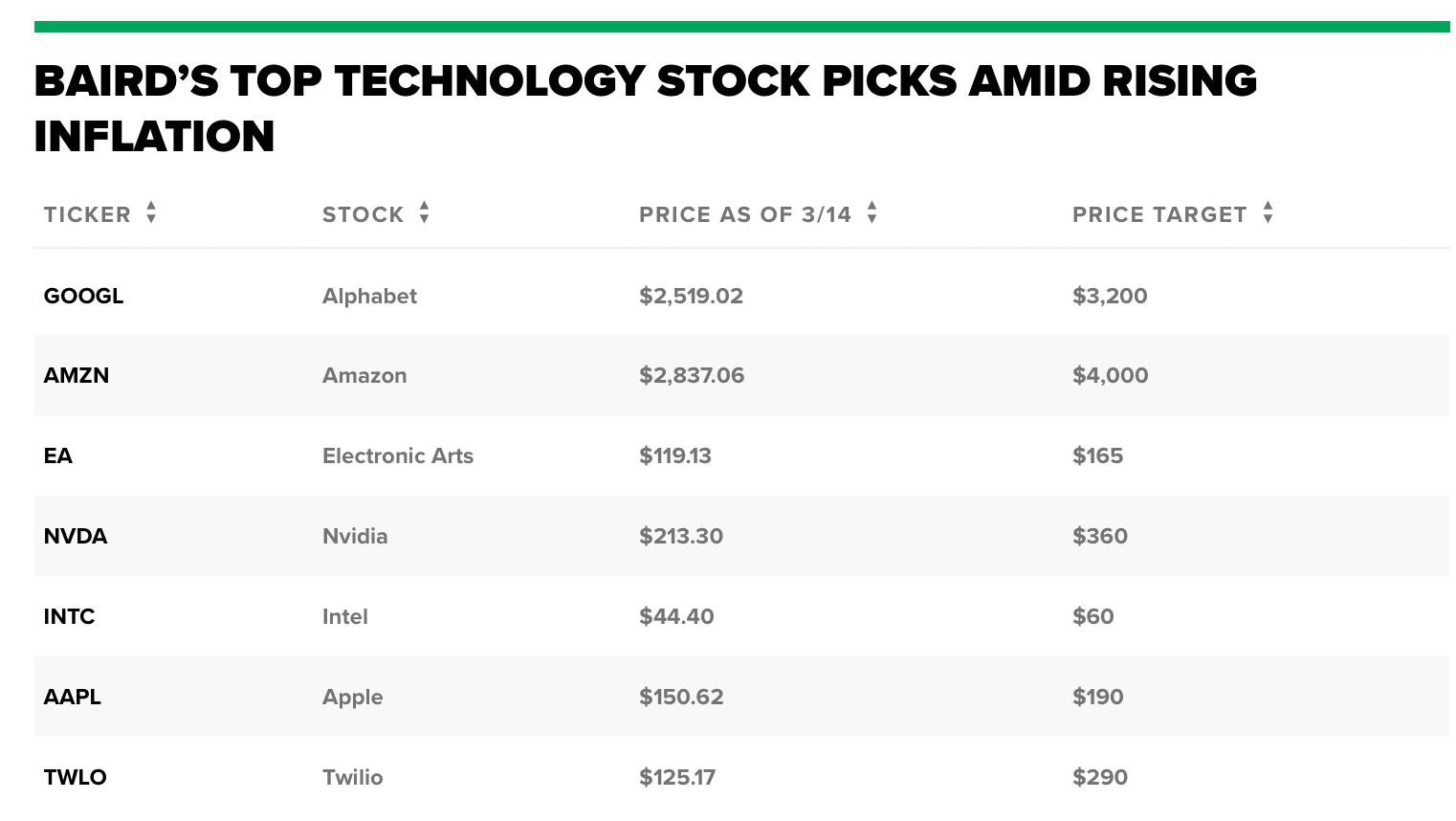

- Technological Advancements: Technological innovation can drive economic growth and create new investment opportunities.

Case Studies

To illustrate the impact of these factors, let's consider a few case studies:

- The Dot-Com Bubble: In the late 1990s, the tech sector experienced explosive growth, driven by the rise of the internet. However, this bubble eventually burst, leading to significant losses for investors.

- The Financial Crisis of 2008: The global financial crisis had a profound impact on the US stock market, leading to a sharp decline in stock prices. However, the market eventually recovered, driven by government intervention and improved economic conditions.

- The COVID-19 Pandemic: The pandemic caused a significant downturn in the stock market, but it also led to a surge in certain sectors, such as technology and healthcare.

Conclusion

Understanding the average growth rate of the US stock market is crucial for investors looking to make informed decisions. While the market has historically delivered strong returns, it's important to recognize the risks and factors that can influence performance. By staying informed and diversifying their portfolios, investors can position themselves for long-term success in the US stock market.

Canada Stocks vs. US Stocks: A Comprehensiv? us flag stock