In the world of investing, the term "aftermarket stock" refers to shares of a company that are traded after the initial public offering (IPO). These stocks offer a unique opportunity for investors to capitalize on market dynamics and potential growth. This article delves into the intricacies of aftermarket stocks, highlighting their benefits, risks, and key strategies for successful investment.

Understanding Aftermarket Stocks

Aftermarket stocks are often overlooked by many investors, but they can be a valuable part of a diversified portfolio. These stocks are typically available on major exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ, and can be bought and sold like any other stock.

Benefits of Investing in Aftermarket Stocks

- Potential for Growth: Aftermarket stocks often offer the potential for significant growth, especially if the company is performing well post-IPO.

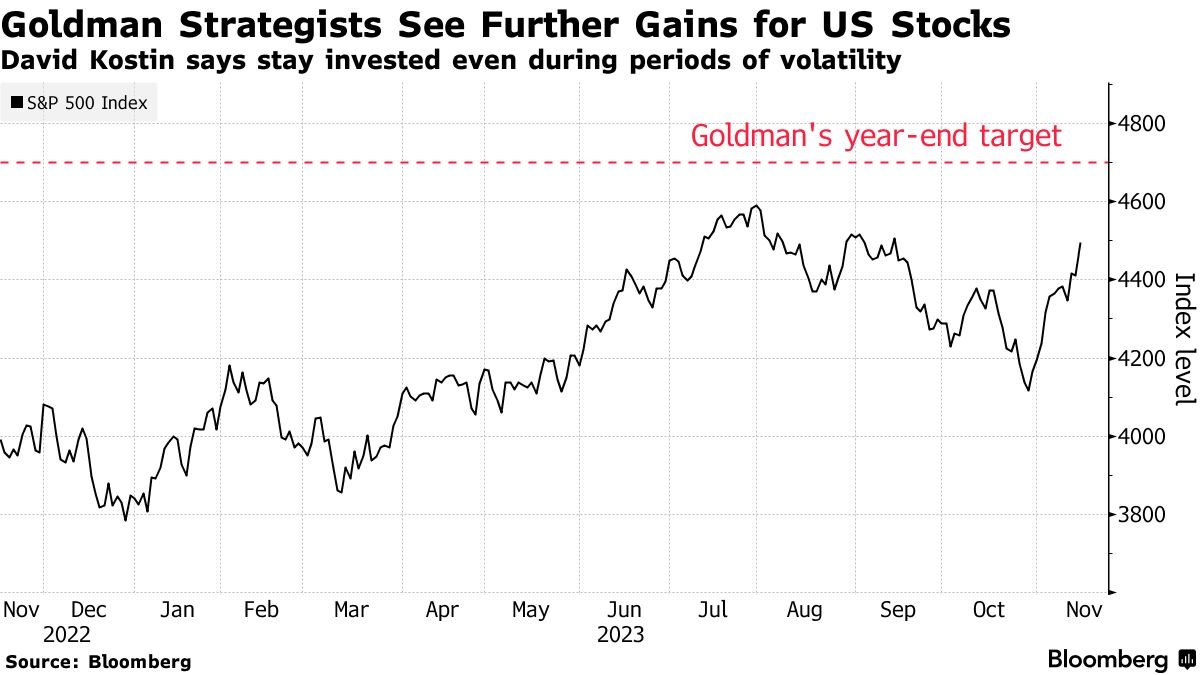

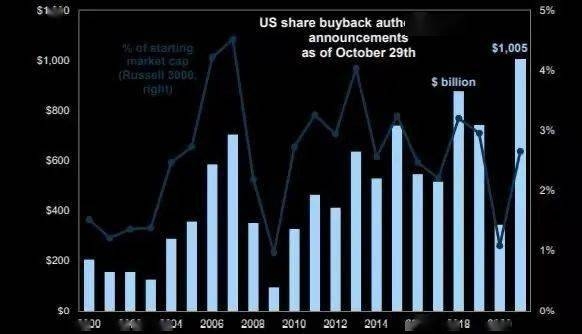

- Market Dynamics: Investors can capitalize on market dynamics, such as increased liquidity and volatility, which can lead to better trading opportunities.

- Access to Information: Aftermarket stocks are subject to the same regulatory requirements as pre-IPO stocks, ensuring transparency and access to relevant information.

Risks Associated with Aftermarket Stocks

While there are numerous benefits, it's important to be aware of the risks involved:

- Volatility: Aftermarket stocks can be highly volatile, which can lead to significant price swings.

- Liquidity Issues: Some aftermarket stocks may have lower liquidity, making it more difficult to buy or sell shares at desired prices.

- Market Manipulation: There is always a risk of market manipulation, especially in smaller or less established companies.

Strategies for Investing in Aftermarket Stocks

- Research and Due Diligence: Conduct thorough research and due diligence to identify companies with strong fundamentals and potential for growth.

- Diversification: Diversify your portfolio to mitigate risks associated with investing in a single stock.

- Risk Management: Set clear risk management parameters, including stop-loss orders, to protect your investment.

Case Studies

Company A: This technology company experienced a significant increase in its stock price after its IPO, driven by strong revenue growth and positive market reception. Investors who bought into the aftermarket and held onto their shares saw substantial returns. Company B: Despite a promising IPO, this company faced challenges post-IPO, leading to a decline in its stock price. Investors who did not conduct proper research and due diligence suffered significant losses.

Conclusion

Aftermarket stocks can be a valuable addition to any investment portfolio. By understanding the benefits, risks, and strategies associated with investing in these stocks, investors can make informed decisions and potentially reap significant rewards. Remember to conduct thorough research, diversify your portfolio, and manage risks effectively to maximize your chances of success.

BHP Stock Price US: What You Need to Know? us flag stock