In today's fast-paced business world, understanding the intricacies of finance and financial strategies is crucial for success. Whether you're a seasoned entrepreneur or just starting out, mastering the basics of finance can make a significant difference in your business's growth and profitability. This article delves into the essentials of finance and financial strategies, providing insights and practical advice to help you navigate the complex world of money management.

Understanding Finance

Finance, at its core, is the management of money and other assets. It involves making decisions about how to allocate resources, manage risks, and achieve financial goals. Finance can be broadly categorized into three main areas: personal finance, corporate finance, and public finance.

Personal Finance: This is about managing your personal finances, including budgeting, saving, investing, and retirement planning. It's essential to have a solid understanding of personal finance to ensure financial stability and security.

Corporate Finance: This involves managing the financial activities of a company. It includes raising capital, managing debt and equity, and making investment decisions. Corporate finance aims to maximize shareholder value and ensure the company's long-term success.

Public Finance: This refers to the management of government finances. It involves raising revenue, managing public debt, and allocating resources for public services.

Key Financial Strategies

To effectively manage your finances, it's crucial to adopt the right financial strategies. Here are some key strategies to consider:

Budgeting: Creating a budget is the foundation of sound financial management. It helps you track your income and expenses, identify areas where you can cut costs, and save for future goals.

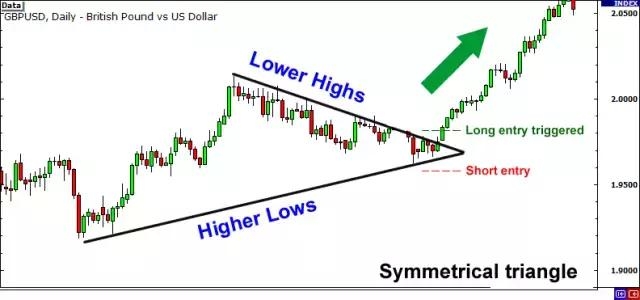

Investing: Investing is a powerful tool for growing your wealth over time. By investing in stocks, bonds, real estate, or other assets, you can potentially earn higher returns than keeping your money in a savings account.

Risk Management: Risk management involves identifying, assessing, and mitigating potential risks to your finances. This can include insuring your assets, diversifying your investments, and maintaining an emergency fund.

Debt Management: Managing debt is crucial to avoid financial strain. Focus on paying off high-interest debt first, and consider consolidating or refinancing loans to lower your monthly payments.

Case Studies: Successful Financial Strategies

Several businesses have successfully implemented financial strategies to achieve remarkable growth. Here are a couple of examples:

Apple Inc.: Apple's financial strategy has been focused on innovation, cost control, and efficient capital allocation. The company has consistently generated significant revenue and profits, making it one of the most valuable companies in the world.

Warby Parker: This eyewear company has successfully implemented a direct-to-consumer business model, which has allowed them to offer high-quality products at competitive prices. Their financial strategy includes tight cost control and smart marketing.

Conclusion

Understanding finance and implementing effective financial strategies is essential for achieving your financial goals. By adopting sound financial practices, you can ensure financial stability, grow your wealth, and achieve success in your personal and professional life. Keep learning and adapting to the ever-changing financial landscape, and you'll be well on your way to financial success.

Understanding the Correlation Coefficient o? us flag stock