The 2008 stock market crash, often referred to as the "Great Recession," was a pivotal moment in global financial history. This event, which began in 2007 and lasted until 2009, had profound effects on the global economy, and its impact is still felt today. This article delves into the ways in which the 2008 stock market crash has shaped our financial landscape and continues to influence our lives.

Economic Recovery and Long-Term Consequences

One of the most immediate consequences of the 2008 stock market crash was a severe economic downturn. The crash led to widespread job losses, plummeting real estate values, and a significant decrease in consumer spending. The recovery from this recession was slow and uneven, with many countries still feeling the effects of the crash years later.

The Shift Towards Risk Aversion

The 2008 crash has led to a shift towards risk aversion in the financial industry. Banks and financial institutions have become more cautious with their lending practices, and regulators have implemented stricter regulations to prevent another financial crisis. This shift has made the financial system more stable, but it has also made it more difficult for individuals and businesses to access credit.

Impact on Retirement Savings

The 2008 stock market crash had a significant impact on retirement savings. Many individuals saw their 401(k) and IRA accounts plummet in value, leading to increased anxiety about their financial futures. This event highlighted the importance of diversifying retirement portfolios and the need for better financial planning.

The Rise of Alternative Investments

In the wake of the 2008 crash, investors have become more interested in alternative investments such as real estate, commodities, and private equity. These investments are often less correlated with the stock market and can provide a level of diversification that was lacking during the crash.

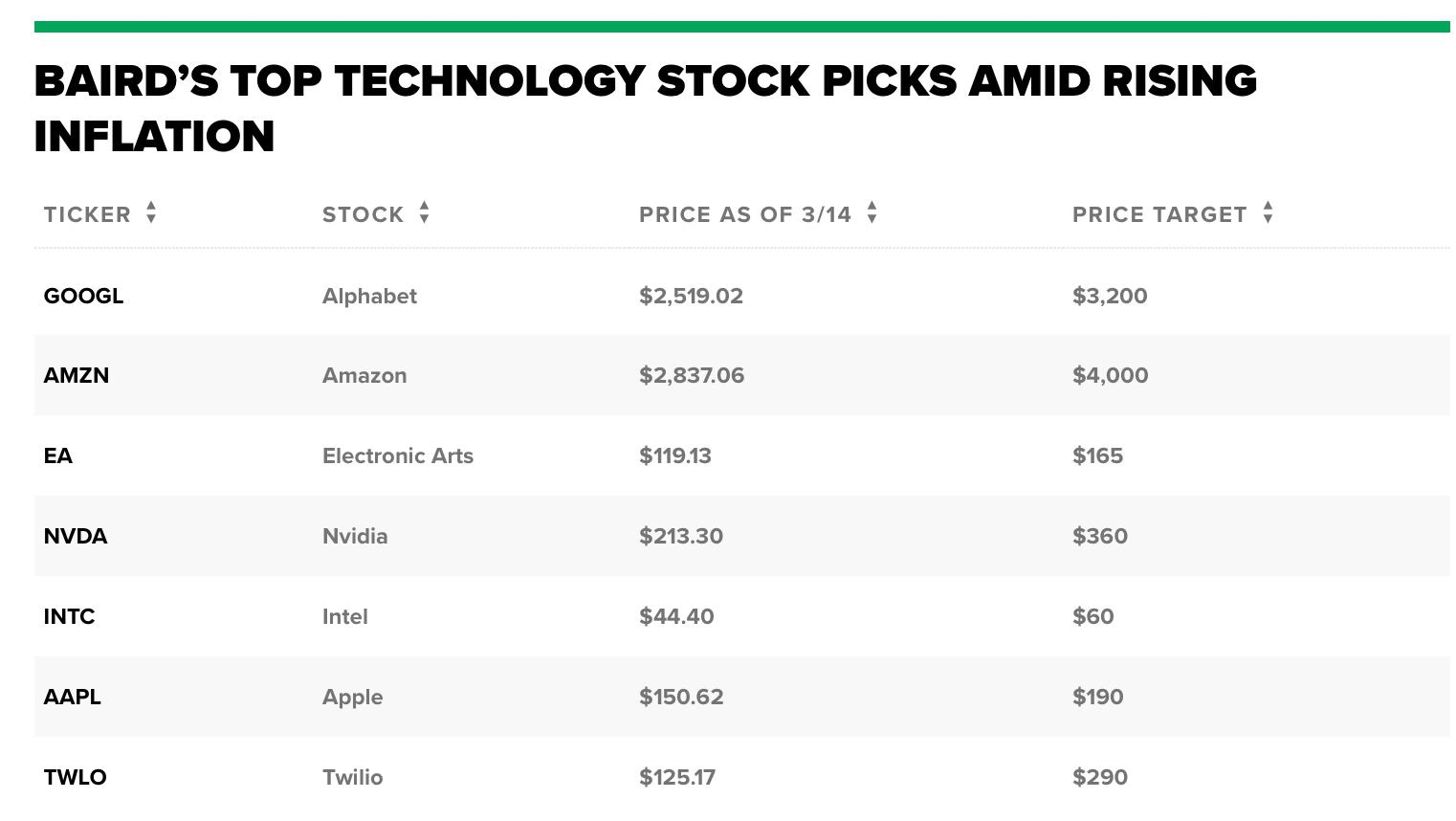

The Role of Technology in Financial Markets

The 2008 crash also accelerated the adoption of technology in financial markets. High-frequency trading, robo-advisors, and blockchain technology have all become more prevalent, providing new ways for investors to access the market and manage their investments.

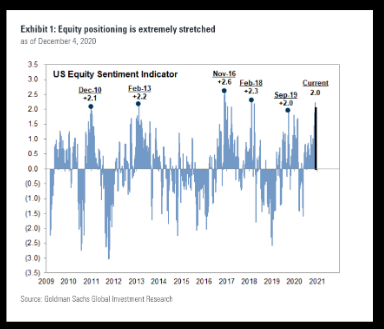

Case Study: The 2020 Pandemic and Stock Market Volatility

The 2020 COVID-19 pandemic served as a stark reminder of the vulnerabilities of the global financial system. The stock market experienced unprecedented volatility, with the S&P 500 falling more than 30% in just a few weeks. While the market recovered quickly, this event highlighted the interconnectedness of global financial markets and the potential for future crises.

Conclusion

The 2008 stock market crash has had a lasting impact on the global economy and the way we approach financial planning. While the recovery has been slow and uneven, the event has led to a more stable financial system and a greater awareness of the importance of risk management and diversification. As we continue to navigate an increasingly complex financial landscape, the lessons learned from the 2008 crash will remain relevant for years to come.

Check Toys“R”Us Stock: Your Ultimate Gu? us stock market live