In the bustling world of stock trading, the term "tilt pot stock" has gained significant attention. But what exactly does it mean, and how does it fare in the dynamic US market? This article delves into the intricacies of tilt pot stocks, their characteristics, and their performance in the US market.

What is a Tilt Pot Stock?

A tilt pot stock, also known as a "penny stock," refers to a company's share that is priced below $5. These stocks are often considered high-risk and speculative, attracting investors who are looking for potential high returns. However, they also come with a higher chance of losing the invested capital.

Characteristics of Tilt Pot Stocks

- Low Price: The most defining characteristic of a tilt pot stock is its low price. This makes them accessible to a broader range of investors.

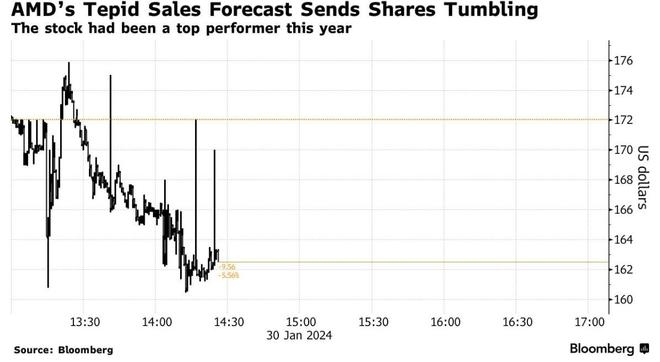

- High Volatility: Tilt pot stocks are known for their high price volatility, which can lead to significant gains or losses in a short period.

- Small Market Capitalization: These stocks are typically issued by small companies with a low market capitalization, which makes them more prone to market fluctuations.

- Speculative Nature: Tilt pot stocks are often speculative, with limited fundamental analysis available.

Performance in the US Market

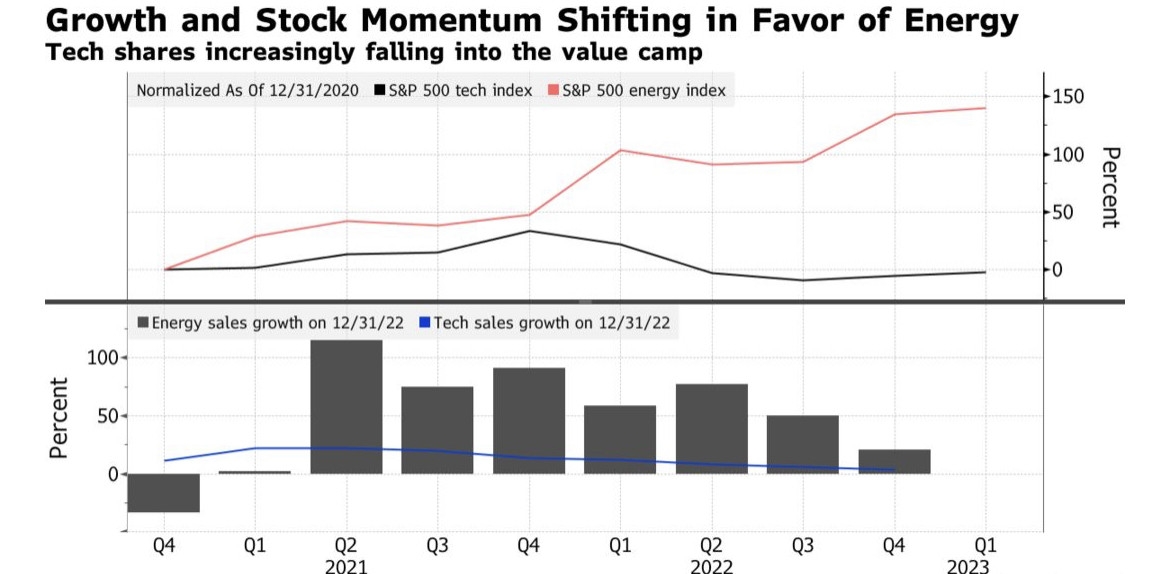

The US market, being the largest and most liquid in the world, offers unique opportunities and challenges for tilt pot stocks. Here's a closer look at their performance:

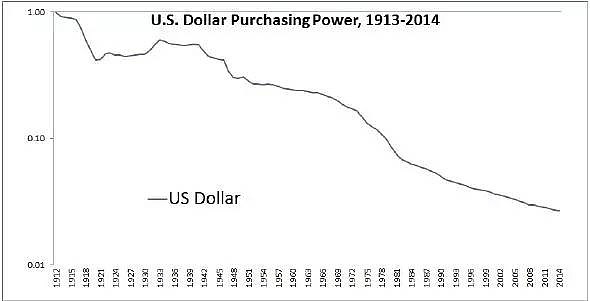

- Risks and Rewards: Tilt pot stocks in the US market come with both high risks and potential rewards. Investors must be prepared for significant price volatility and the possibility of losing their entire investment.

- Market Sentiment: The US market is highly sentiment-driven, and tilt pot stocks can be significantly affected by market trends and news.

- Regulatory Environment: The US regulatory environment is stringent, ensuring that tilt pot stocks are subject to strict reporting and disclosure requirements. This provides some level of protection for investors.

Case Studies

To better understand the dynamics of tilt pot stocks in the US market, let's look at a couple of case studies:

- Case Study 1: A small biotech company, with a market capitalization of

20 million, released promising results from its clinical trials. The stock, priced at 1, saw a surge in trading volume and price, reaching5 within a month. However, the stock then plummeted to 1 after the FDA raised concerns about the trial results. - Case Study 2: A startup in the renewable energy sector, with a market capitalization of

30 million, secured a large contract with a government agency. The stock, priced at 2, saw a significant increase in trading volume and price, reaching10 within a week. However, the stock then stabilized at 5 as investors awaited more concrete news on the company's growth prospects.

Conclusion

Tilt pot stocks, while offering potential high returns, come with significant risks. Investors must conduct thorough research and be prepared for market volatility. The US market provides a unique environment for tilt pot stocks, where both risks and rewards are abundant. By understanding the characteristics and performance of tilt pot stocks, investors can make informed decisions and navigate the dynamic US market.

Title: In-Depth Analysis of ADLS.pk: An Ess? us stock market live