Are you a US citizen looking to diversify your investment portfolio? Have you considered adding Canadian stocks to the mix? Investing in foreign stocks can be a great way to diversify and potentially increase your returns. In this article, we'll explore whether US citizens can buy Canadian stocks, the process involved, and some key considerations to keep in mind.

Understanding the Basics

Can a US Citizen Buy Canadian Stocks? The Answer is Yes!

Contrary to popular belief, there is no legal restriction that prevents US citizens from buying Canadian stocks. However, it's important to understand the process and potential tax implications involved.

The Process of Buying Canadian Stocks

To purchase Canadian stocks, you'll need to follow a few simple steps:

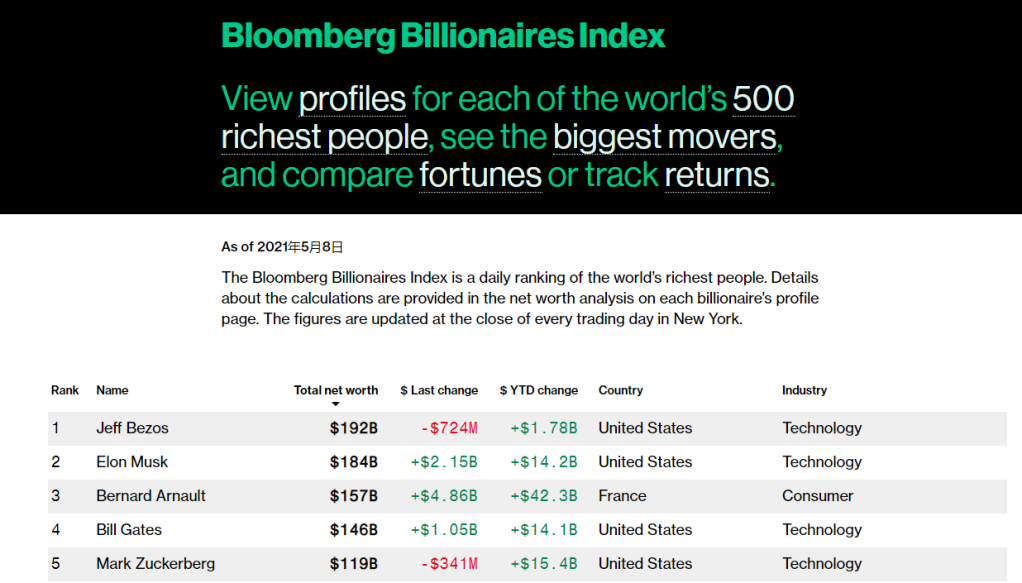

- Open a Brokerage Account: The first step is to open a brokerage account that allows you to trade Canadian stocks. Many US-based brokerage firms offer this service, including Fidelity, Charles Schwab, and TD Ameritrade.

- Research Canadian Stocks: Once you have your brokerage account, it's time to research Canadian stocks that align with your investment strategy. Look for companies in sectors that interest you and that have a strong track record of performance.

- Place Your Order: Once you've identified the Canadian stocks you want to purchase, place your order through your brokerage account. The process is similar to buying stocks listed on US exchanges.

Tax Implications

One of the most important considerations when investing in Canadian stocks is the potential tax implications. Here are some key points to keep in mind:

- Withholding Tax: Canada levies a 30% withholding tax on dividends paid to non-resident investors. However, this tax is typically credited against any US tax liability you may have on the dividends.

- Capital Gains Tax: If you sell Canadian stocks at a profit, you may be subject to capital gains tax. The tax rate will depend on how long you held the stock and your total income for the year.

- FATCA: The Foreign Account Tax Compliance Act (FATCA) requires US citizens to report foreign financial accounts and income. It's important to ensure you're compliant with FATCA when investing in Canadian stocks.

Benefits of Investing in Canadian Stocks

Investing in Canadian stocks can offer several benefits, including:

- Diversification: Adding Canadian stocks to your portfolio can help diversify your investments and reduce risk.

- Access to a Different Market: Canadian stocks offer exposure to a different market, which can provide unique investment opportunities.

- Strong Economic Performance: Canada has a strong and stable economy, making it an attractive destination for investors.

Case Study: Investing in Canadian Tech Stocks

One popular sector to invest in Canada is technology. Companies like Shopify and Shopify (TSX:SHOP) have seen significant growth and offer US investors exposure to the fast-growing e-commerce market.

Conclusion

In conclusion, US citizens can buy Canadian stocks, but it's important to understand the process and potential tax implications. By doing your research and working with a reputable brokerage firm, you can add Canadian stocks to your portfolio and potentially benefit from a different market and investment opportunities.

How Many People Invest in the Stock Market ? us stock market today