In the dynamic world of financial markets, analyst rating changes can trigger significant movements in US stocks. Today, we delve into the latest ratings adjustments and their potential impact on the market. From tech giants to consumer staples, we explore how these changes could shape the landscape of US equities.

Tech Sector Takes Center Stage

The tech sector has been a hotbed of activity with several analyst rating changes today. Notably, Apple Inc. (AAPL) has seen its rating upgraded by several firms. Morgan Stanley raised its rating on Apple to "Overweight," citing strong fundamentals and growth prospects. Jefferies also upgraded the stock, forecasting robust demand for its products.

Conversely, Microsoft Corporation (MSFT) faced a downgrade from Goldman Sachs to "Neutral." The firm cited concerns about slowing revenue growth and increased competition in the cloud computing space. This move underscores the volatility within the tech sector, where analyst opinions can rapidly shift.

Consumer Staples in Focus

The consumer staples sector has also witnessed significant analyst rating changes. Procter & Gamble (PG) received a buy rating from Morgan Stanley, driven by expectations of strong earnings growth and an attractive valuation. On the other hand, Colgate-Palmolive Company (CL) faced a downgrade from Barclays to "Underweight," as the firm expressed concerns about rising input costs and a potential slowdown in sales growth.

Financials and Energy: Diverse Views

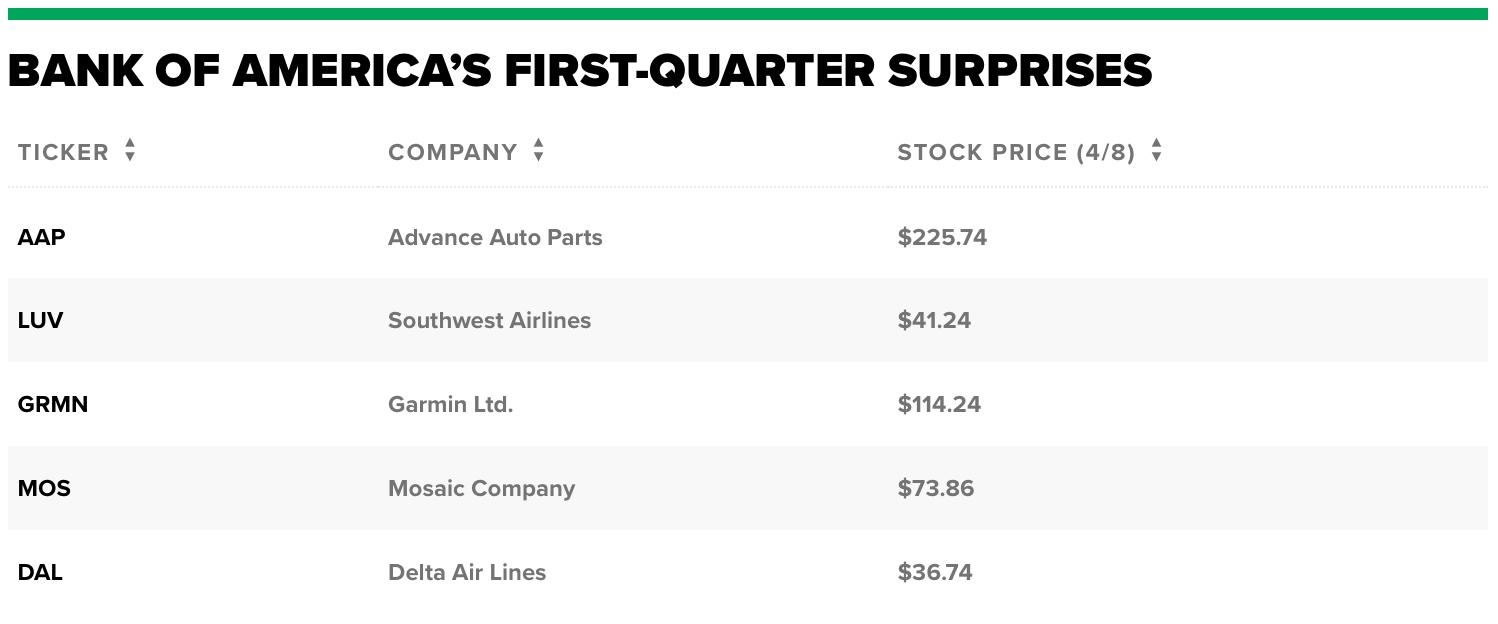

In the financial sector, Bank of America Corporation (BAC) received a buy rating from JPMorgan Chase & Co., which highlighted the bank's strong capital position and attractive valuation. Meanwhile, Wells Fargo & Company (WFC) faced a downgrade from Morgan Stanley to "Underweight," driven by concerns about regulatory challenges and a slowing mortgage market.

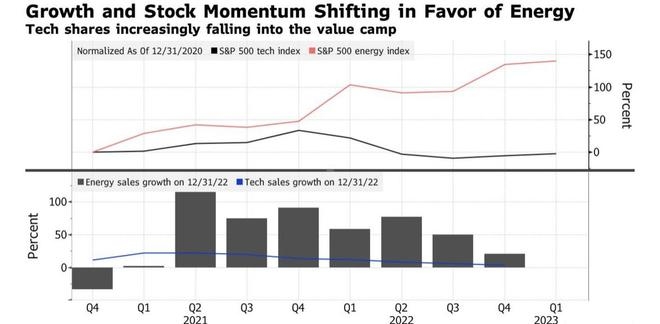

The energy sector has also seen a mix of analyst rating changes. Exxon Mobil Corporation (XOM) received an outperform rating from Morgan Stanley, citing the company's strong operational performance and attractive dividend yield. In contrast, Chevron Corporation (CVX) faced a downgrade from Mizuho Securities to "Neutral," as the firm expressed concerns about rising oil prices and increased geopolitical risks.

Case Study: Netflix, Inc. (NFLX)

To illustrate the impact of analyst rating changes, let's take a look at Netflix, Inc. (NFLX). The company received a sell rating from Morgan Stanley earlier this week, which sent its stock tumbling. The firm cited concerns about rising content costs and a potential slowdown in subscriber growth. This downgrade highlights the sensitivity of US stocks to analyst opinions and the potential for rapid price movements.

Conclusion

In conclusion, today's analyst rating changes have set the stage for significant movements in US stocks. From tech giants to consumer staples and financials to energy, these changes reflect the dynamic nature of the financial markets. As investors, it's crucial to stay informed and consider these ratings changes in the context of a broader market analysis.

How Many People Invest in the Stock Market ? us stock market today