The United Kingdom's decision to leave the European Union, commonly known as Brexit, has sent ripples through global financial markets, including the US stock market. Understanding how Brexit affects US stocks is crucial for investors and market analysts. This article delves into the implications of Brexit on US stocks, analyzing the direct and indirect impacts.

Brexit's Immediate Impact on US Stocks

Brexit's immediate impact on US stocks was largely negative. The uncertainty surrounding the UK's exit from the EU led to a sharp decline in the value of the British pound, which in turn affected US stocks with significant exposure to the UK market. Companies like Ford, Rolls-Royce, and GlaxoSmithKline, which have substantial operations in the UK, saw their stocks decline following the Brexit vote.

Long-Term Implications

While the immediate impact was negative, the long-term implications of Brexit on US stocks are more complex. Here are some key aspects to consider:

Currency Fluctuations: The weakening of the British pound has made UK goods and services cheaper for US consumers. This could benefit companies with significant UK operations, as their products become more competitive in the US market. For instance, pharmaceutical companies like GlaxoSmithKline and AstraZeneca may see increased sales in the US.

Supply Chain Disruptions: The uncertainty surrounding the future trade relations between the UK and the EU has raised concerns about supply chain disruptions. Companies with complex supply chains, particularly in the automotive and pharmaceutical industries, may face increased costs and logistical challenges. This could negatively impact their stocks in the long run.

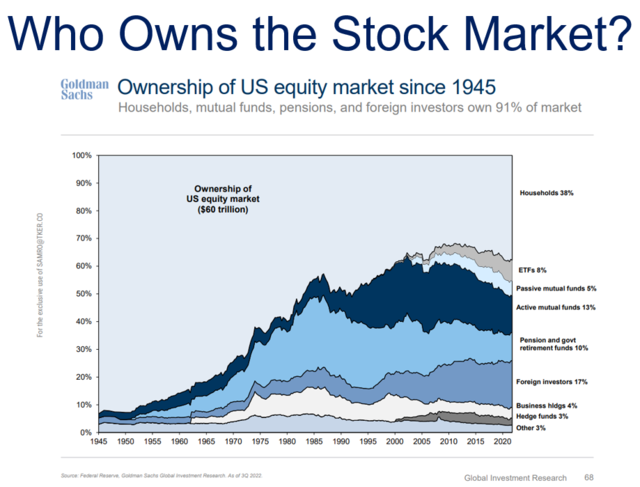

Investment Flows: Brexit has led to a decrease in foreign investment in the UK. This shift in investment flows could benefit the US stock market, as investors look for alternative investment opportunities. The US, with its stable economy and strong market, could attract more foreign capital, potentially boosting the stock market.

Sector-Specific Impacts: Certain sectors, such as financial services and technology, may be more affected by Brexit than others. Financial services companies with operations in the UK may face regulatory challenges and increased costs. Conversely, technology companies may benefit from the increased demand for digital services in the UK post-Brexit.

Case Studies

To illustrate the impact of Brexit on US stocks, let's consider two case studies:

Ford Motor Company: Ford has significant operations in the UK, including a plant in Dagenham. Following the Brexit vote, Ford's stock experienced a temporary decline. However, the company has since taken steps to mitigate the impact of Brexit, such as investing in new facilities in the UK. This suggests that while Brexit has short-term negative implications, long-term strategies can help companies navigate the challenges.

AstraZeneca: AstraZeneca, a UK-based pharmaceutical company, has seen its stock decline following the Brexit vote. However, the company has diversified its operations globally, including significant investments in the US. This diversification has helped mitigate the impact of Brexit on the company's stock.

Conclusion

Brexit has had a complex impact on US stocks. While the immediate impact was negative, the long-term implications are more nuanced. Investors and market analysts must consider various factors, including currency fluctuations, supply chain disruptions, and investment flows, to understand the true impact of Brexit on US stocks.

How Many People Invest in the Stock Market ? us stock market today