In the vibrant and ever-evolving landscape of the US stock market, entertainment stocks have emerged as a significant and lucrative sector. From movie studios to streaming giants, the entertainment industry has captivated the imagination of investors and consumers alike. This article delves into the key players, trends, and potential opportunities within the entertainment stocks sector in the United States.

The Powerhouse of Movie Studios

The backbone of the entertainment industry in the US is undoubtedly the movie studios. Companies like Disney, Warner Bros., and Universal Pictures have been at the forefront of producing box-office hits for decades. These studios not only create content that resonates with audiences but also leverage their vast libraries of movies and characters to generate revenue through licensing, merchandising, and theme parks.

The Rise of Streaming Services

The advent of streaming services has revolutionized the entertainment industry. Platforms like Netflix, Amazon Prime Video, and Disney+ have disrupted traditional distribution models and given consumers the freedom to watch their favorite content at their convenience. These streaming giants have become major players in the entertainment stocks space, attracting substantial investment and driving significant growth.

Key Entertainment Stocks to Watch

When it comes to investing in entertainment stocks, there are several key players worth considering:

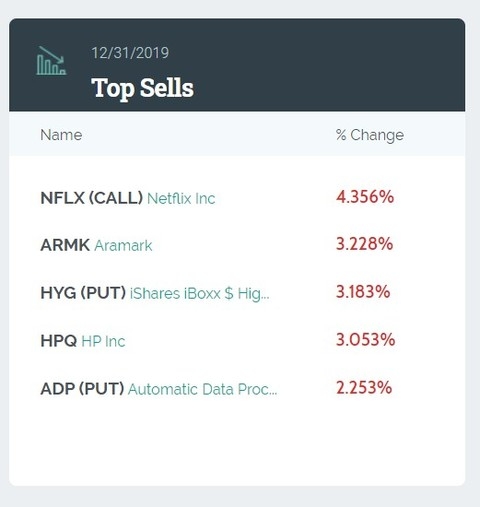

Netflix (NFLX): As the leading streaming service, Netflix has a vast library of content and a strong subscriber base. The company continues to invest in original programming, which has helped it maintain its competitive edge in the market.

Amazon (AMZN): Amazon's Prime Video service offers a wide range of content and has become a major competitor to Netflix. The company's extensive resources and reach provide it with a solid foundation for growth.

Disney (DIS): Disney has a diverse portfolio of entertainment assets, including its iconic movie studios, theme parks, and streaming services like Disney+. The company's strong brand and content library make it a compelling investment opportunity.

Universal Pictures (NBCUniversal): A division of Comcast, Universal Pictures has a long history of producing successful movies and television shows. The company's parent company, NBCUniversal, also owns a stake in streaming service Peacock.

Trends to Watch

Several trends are shaping the entertainment industry and impacting entertainment stocks:

Content Localization: As global audiences become more diverse, entertainment companies are increasingly focusing on creating content that resonates with specific regions and demographics.

Experiential Entertainment: Companies are exploring new ways to engage consumers through immersive experiences, such as virtual reality (VR) and augmented reality (AR) technologies.

Merchandising: The entertainment industry has a strong merchandising presence, and companies are finding new ways to leverage their intellectual property through various products and partnerships.

Case Study: Netflix's International Expansion

A prime example of the success of entertainment stocks is Netflix's international expansion. By adapting its content to local tastes and cultures, Netflix has been able to attract millions of subscribers in countries like South Korea and Brazil. This strategic approach has not only bolstered Netflix's revenue but has also positioned the company as a global leader in the streaming industry.

In conclusion, the entertainment stocks sector in the US is a dynamic and exciting area for investors. With the rise of streaming services, the continued success of movie studios, and the increasing importance of content localization, there are numerous opportunities for growth and investment. As the industry continues to evolve, keeping a close eye on key players and emerging trends will be crucial for those looking to capitalize on this thriving sector.

How Many People Invest in the Stock Market ? us stock market today live cha