Introduction:

The Indian stock market has long been considered a bellwether for the global economic landscape. With the United States being the world's largest economy, its inflationary trends have a significant impact on the global financial markets, including India. This article delves into the effects of US inflation on the Indian stock market, analyzing how it affects various sectors and the broader market sentiment.

Understanding US Inflation:

The US inflation rate measures the rate at which the general level of prices for goods and services is rising, and subsequently, eroding purchasing power. The Federal Reserve sets monetary policy to control inflation, aiming for a moderate and stable rate. However, when inflation is too high, it can lead to various negative consequences, such as reduced consumer spending and increased borrowing costs.

Impact on the Indian Stock Market:

1. Currency贬值:

When the US dollar strengthens due to higher inflation, the Indian rupee tends to weaken against it. A weaker rupee makes Indian stocks more expensive for foreign investors, potentially reducing their demand. Moreover, companies with significant dollar-denominated debt may face increased borrowing costs, affecting their profitability and stock prices.

2. Sector-specific Impacts:

- Technology Sector: The Indian technology sector has been a significant driver of the stock market's growth. However, US inflation can impact this sector in multiple ways. For instance, higher inflation can lead to increased input costs for technology companies, affecting their profit margins. Additionally, a stronger dollar can reduce the value of earnings generated from overseas operations.

- Banking Sector: Indian banks may face challenges due to US inflation. Higher interest rates in the US can lead to a rise in borrowing costs for Indian companies, which, in turn, can increase the default risk for banks. Furthermore, a weaker rupee can impact the value of foreign exchange reserves held by banks.

- Consumer Goods Sector: Companies in the consumer goods sector may benefit from higher inflation in the short term as they can increase their prices. However, if inflation continues to rise, consumer spending may decline, affecting the growth of these companies.

3. Market Sentiment:

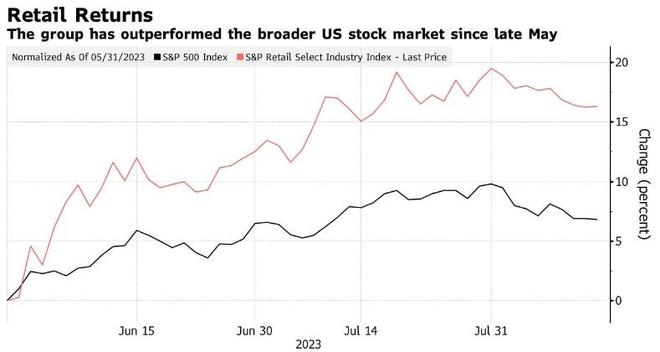

Inflation can lead to uncertainty and volatility in the stock market. When investors perceive higher inflation, they may become more risk-averse, leading to a sell-off in stocks. Conversely, when inflation is under control, investors may be more optimistic, leading to a bull market.

Case Studies:

- 2021 US Inflation and Indian Stock Market: In 2021, the US experienced high inflation, which initially led to a rally in the Indian stock market as investors expected higher earnings for companies. However, as inflation continued to rise, the market became concerned about the impact of higher interest rates on the Indian economy and the stock market. This led to a correction in the market.

- 2022 US Inflation and Indian Stock Market: In 2022, the Indian stock market faced a challenging environment due to rising US inflation and the subsequent rise in interest rates. This led to a sell-off in stocks, particularly in sectors such as technology and real estate.

Conclusion:

The Indian stock market is highly sensitive to US inflation. While inflation can have both positive and negative effects on the market, it is crucial for investors to closely monitor inflation trends and their impact on various sectors. By understanding these dynamics, investors can make informed decisions and navigate the market effectively.

How Many People Invest in the Stock Market ? us stock market today live cha