In the ever-changing world of investments, the question "Should I sell US stocks?" often crosses the minds of investors. This decision can be daunting, especially with the multitude of factors that influence the stock market. This article delves into the key aspects you should consider before deciding to sell your US stocks.

Understanding Market Trends

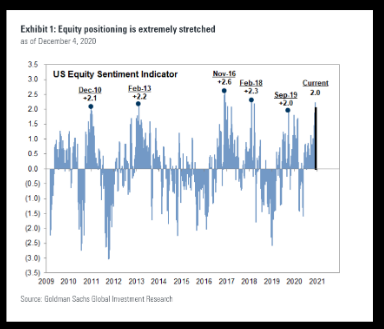

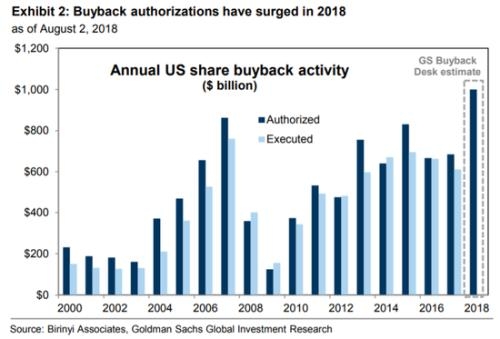

One of the primary factors to consider when deciding whether to sell your US stocks is the current market trends. It is crucial to stay updated with the latest market reports and forecasts. For instance, during the COVID-19 pandemic, many companies experienced significant stock surges, only to see them plummet as the crisis unfolded. Understanding market trends can help you make informed decisions.

Evaluating Company Performance

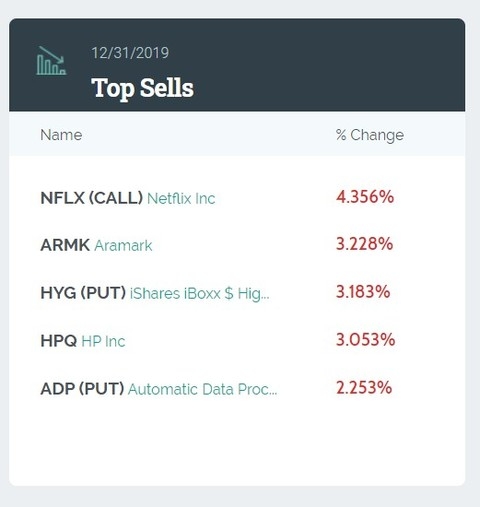

Another essential aspect is evaluating the performance of the companies in which you have invested. Look at their financial statements, including their revenue, profit margins, and debt levels. If a company’s performance is consistently declining, it might be a good idea to consider selling your stocks.

Analyzing Industry Dynamics

The industry in which a company operates can also significantly impact its stock performance. Consider the overall health of the industry and any potential changes that could affect it. For example, the renewable energy sector has seen significant growth, with companies like Tesla leading the charge. If you believe this trend will continue, holding onto your stocks might be a wise decision.

Assessing Risk Tolerance

Your risk tolerance is a crucial factor in making investment decisions. If you are a conservative investor, you might want to avoid high-risk stocks. Conversely, if you are willing to take on more risk for potentially higher returns, you might consider holding onto your stocks for longer.

Monitoring Economic Indicators

Economic indicators can also play a significant role in your decision to sell US stocks. For instance, rising interest rates can negatively impact stocks, especially in industries like real estate and utilities. Monitoring economic indicators can help you make informed decisions about when to sell.

Using Technical Analysis

Technical analysis involves analyzing statistical trends gathered from trading activity, such as price movement and volume. If technical analysis indicates a downward trend, it might be a good idea to consider selling your stocks.

Case Study: Apple Inc.

A prime example of how market trends and company performance can influence investment decisions is Apple Inc. After experiencing a significant surge in stock prices, investors were torn between selling and holding onto their stocks. However, those who decided to sell likely avoided significant losses as the stock price eventually plummeted.

Conclusion

Deciding whether to sell US stocks requires careful consideration of various factors, including market trends, company performance, industry dynamics, risk tolerance, economic indicators, and technical analysis. By understanding these factors and staying informed, you can make informed decisions about your investments. Remember, investing is a long-term endeavor, and making hasty decisions can lead to significant losses.

How Many People Invest in the Stock Market ? us stock market today live cha