In the bustling world of investing, micro cap stocks often fly under the radar, yet they possess the potential for substantial growth. These stocks, typically valued under $50 million, are known for their high volatility and significant upside. This article delves into the upcoming catalysts that could propel US micro cap stocks to new heights.

1. Technological Advancements

Technology is a key driver for micro cap stocks. Start-ups and small companies in this sector are at the forefront of innovation, and investors are keen to identify the next big thing. Artificial intelligence, blockchain, and biotechnology are some of the emerging fields where micro cap stocks are poised to make a significant impact.

Case in point: Nanobiotix, a micro cap stock, is making waves in the biotech industry with its groundbreaking nanomedicine technology. The company's cancer treatment has shown promising results in clinical trials, making it a potential game-changer in the pharmaceutical sector.

2. Regulatory Changes

Regulatory changes can have a profound effect on micro cap stocks. For instance, the SEC's recent decision to lower the threshold for a company to be classified as a micro cap has opened doors for more companies to access capital markets.

3. Acquisition Activity

Acquisition activity is another catalyst that can boost the value of micro cap stocks. Larger companies often look to acquire innovative start-ups to stay competitive. Cybersecurity firm FireEye's acquisition of Mandiant serves as a prime example of how a micro cap stock can gain significant value through acquisition.

4. Economic Factors

Economic factors such as interest rates, inflation, and currency fluctuations can impact micro cap stocks. However, savvy investors can use these factors to identify undervalued companies with strong fundamentals.

5. Social Factors

Social factors such as environmental concerns and social responsibility are increasingly influencing investor decisions. Companies that prioritize sustainability and ethical practices are likely to attract more attention from investors, particularly in the micro cap space.

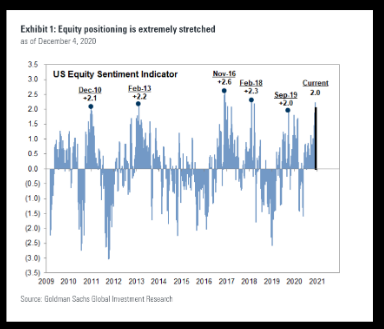

6. Market Sentiment

Market sentiment can play a crucial role in the performance of micro cap stocks. When investors are optimistic about the market, they are more likely to invest in these high-risk, high-reward stocks.

Conclusion

As we navigate through the dynamic landscape of the stock market, it's essential to stay informed about the upcoming catalysts that could impact US micro cap stocks. By keeping an eye on technological advancements, regulatory changes, acquisition activity, economic factors, social factors, and market sentiment, investors can make informed decisions and capitalize on the potential growth opportunities in this exciting sector.

How Many People Invest in the Stock Market ? us stock market today live cha