In the vast landscape of the U.S. stock market, small cap stocks often fly under the radar, yet they hold immense growth potential. These companies, with market capitalizations typically ranging from

Understanding Small Cap Stocks

Small cap stocks are often considered riskier than their larger counterparts, as they are typically less established and have fewer resources. However, this risk can be offset by the potential for higher returns. These companies are often in the early stages of growth, and as they scale up, their market value can skyrocket.

Key Factors Driving Growth

Innovation and Growth: Many small cap stocks are at the forefront of innovation, often disrupting traditional industries. They have the agility to adapt quickly to market changes, which can lead to rapid growth.

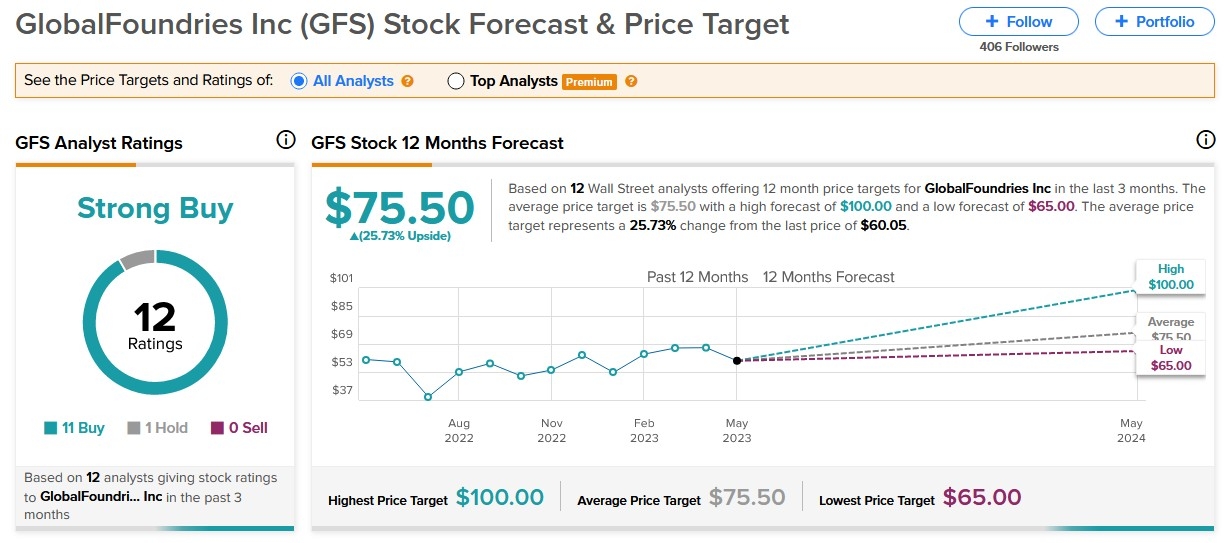

Valuation: Small cap stocks are often undervalued compared to their larger peers. This presents an opportunity for investors to buy into companies at a lower price and benefit from future growth.

Economic Cycle: Small cap stocks tend to outperform during economic upswings. As the economy grows, these companies can capitalize on increased consumer spending and business investment.

Notable Small Cap Stock Success Stories

Facebook (Now Meta Platforms): Once a small startup, Facebook revolutionized the social media landscape. Its initial public offering (IPO) in 2012 was one of the largest in history, showcasing the potential of small cap stocks.

Tesla, Inc.: Known for its electric vehicles, Tesla has become a household name. The company's market capitalization has soared over the years, making it one of the most valuable companies in the world.

Amazon.com, Inc.: Starting as an online bookstore, Amazon has expanded into various industries, including cloud computing, streaming, and more. Its growth trajectory has been nothing short of spectacular.

Investing in Small Cap Stocks

When investing in small cap stocks, it's crucial to conduct thorough research. Here are some tips to consider:

Analyze Financial Statements: Look for companies with strong revenue growth, healthy profit margins, and manageable debt levels.

Understand the Industry: Invest in companies that are well-positioned within their industry and have a clear competitive advantage.

Diversify Your Portfolio: Small cap stocks can be volatile, so it's important to diversify your portfolio to mitigate risk.

Stay Informed: Keep up-to-date with industry news and market trends to make informed investment decisions.

In conclusion, U.S. small cap stocks offer investors the potential for substantial growth, especially in industries ripe for innovation. By conducting thorough research and staying informed, investors can uncover hidden gems that could lead to significant returns. Remember, while these stocks come with higher risk, the potential rewards can be substantial.

How Many People Invest in the Stock Market ? us stock market today live cha