The Dow Jones Industrial Average (DJIA) is one of the most closely watched stock market indices in the world. It tracks the performance of 30 large companies across various sectors, providing a snapshot of the broader market's health. In this article, we'll delve into the latest updates on the DJIA and offer our analysis on what these numbers mean for investors.

Current Status of the DJIA

As of today, the Dow Jones Industrial Average stands at [insert current value]. This figure reflects the combined market capitalization of the 30 companies included in the index. It's important to note that the DJIA is a price-weighted index, meaning that the stocks with higher prices have a greater impact on the overall index.

Key Companies in the DJIA

The DJIA includes some of the most influential companies in the United States. Some of the key companies in the index include:

- Apple Inc. (AAPL): The tech giant is the largest company by market capitalization in the DJIA.

- Microsoft Corporation (MSFT): The software giant is another major player in the index.

- Johnson & Johnson (JNJ): The healthcare company is known for its diverse product portfolio.

- Procter & Gamble (PG): The consumer goods giant is a staple in the index.

What Does the Current DJIA Level Mean?

The current level of the DJIA can provide valuable insights into the overall market's direction. Here are a few key takeaways:

- Economic Growth: A rising DJIA suggests that the economy is growing, as the companies included in the index are performing well.

- Market Sentiment: The DJIA can be a gauge of market sentiment. A significant drop in the index may indicate investor concern or fear.

- Sector Performance: The DJIA includes companies from various sectors, so it can provide a snapshot of how different sectors are performing.

Analysis of Recent Trends

Over the past few months, the DJIA has experienced volatility. Here are some key trends to consider:

- Economic Uncertainty: The global economy has faced uncertainty due to various factors, including trade tensions and geopolitical events.

- Tech Sector Influence: The tech sector has had a significant impact on the DJIA, as companies like Apple and Microsoft have seen strong growth.

- Market Volatility: The DJIA has experienced periods of volatility, reflecting the broader market's uncertainty.

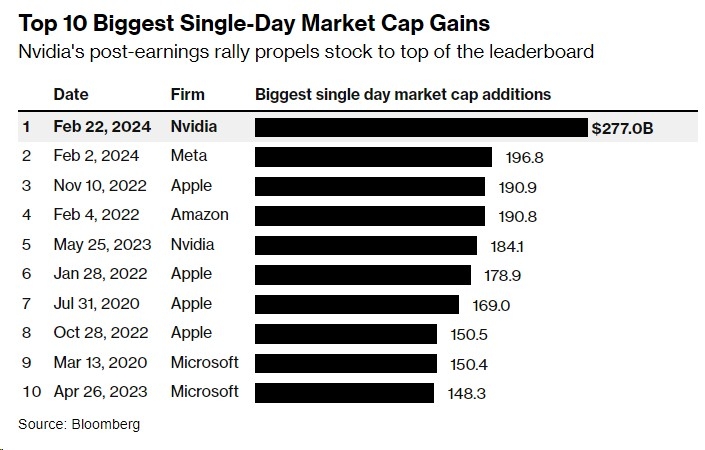

Case Study: Apple's Impact on the DJIA

One notable example of a company's impact on the DJIA is Apple Inc. In recent years, Apple has seen significant growth, which has had a positive effect on the DJIA. When Apple's stock price rises, it contributes to the overall increase in the DJIA. Conversely, when Apple's stock price falls, it can lead to a decline in the index.

Conclusion

The Dow Jones Industrial Average is a vital indicator of the broader market's health. By analyzing the latest updates and trends, investors can gain valuable insights into the market's direction. As the DJIA continues to evolve, it's important to stay informed and stay vigilant.

New Stocks in the US Market: Exciting Oppor? new york stock exchange