Understanding Meip-Us Stock

The term "meip-us stock" may sound complex, but at its core, it refers to investing in US stocks with the aim of maximizing profits. In this article, we'll delve into the ins and outs of investing in US stocks, offering insights and strategies to help you achieve financial success.

The Importance of Research

One of the key elements of successful stock investment is thorough research. It's crucial to understand the companies you're considering investing in. This involves analyzing financial statements, studying industry trends, and staying updated on news that could impact the company's performance.

Diversification is Key

Diversification is a vital strategy when it comes to investing in stocks. By spreading your investments across different companies and sectors, you reduce the risk associated with investing in a single stock. This is particularly important in the volatile stock market, where a single company's failure can lead to significant losses.

Analyzing Financial Statements

Analyzing financial statements is an essential part of research. It allows you to gauge a company's financial health, profitability, and stability. Key metrics to consider include revenue, earnings per share (EPS), return on equity (ROE), and price-to-earnings (P/E) ratio.

The Role of Brokerage Firms

Brokerage firms play a significant role in stock investing. They provide access to the stock market, offer research and analysis, and facilitate transactions. When choosing a brokerage firm, consider factors such as fees, customer service, and available resources.

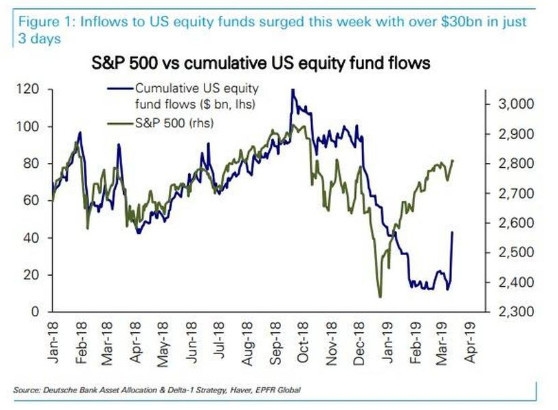

Market Timing

Market timing is the art of buying and selling stocks at the right time. While many investors believe that timing the market is nearly impossible, it can still be a valuable strategy. Staying informed about market trends and economic indicators can help you make informed decisions.

The Impact of Dividends

Dividends are a significant factor to consider when investing in stocks. They provide a steady income stream and can enhance the overall return on your investment. Companies with a strong dividend history often demonstrate financial stability and profitability.

Case Study: Apple Inc.

One of the most successful companies in the stock market is Apple Inc. Since going public in 1980, Apple has grown into one of the world's largest and most valuable companies. Its consistent growth, innovation, and dividend payments have made it a favorite among investors. By understanding the factors that have contributed to Apple's success, you can gain valuable insights for your own investments.

Staying Committed

Successful stock investing requires staying committed to your strategy. It's important to avoid making impulsive decisions based on short-term market fluctuations. Instead, focus on your long-term goals and stick to your investment plan.

Conclusion

Investing in US stocks can be a rewarding way to grow your wealth. By conducting thorough research, diversifying your portfolio, and staying informed, you can maximize your profits and achieve financial success. Remember, successful stock investing requires patience, discipline, and a long-term perspective.

Top Performing Sectors in the US Stock Mark? new york stock exchange