In the world of investing, the price-to-earnings (P/E) ratio is a crucial metric that investors use to evaluate the value of a stock. It's a simple yet powerful tool that provides insight into a company's valuation and market sentiment. This article delves into the average P/E ratio of US stocks, exploring its significance and what it reveals about the market's current state.

What is the P/E Ratio?

The P/E ratio is calculated by dividing a company's stock price by its earnings per share (EPS). This ratio gives investors a quick glance at how much they are paying for each dollar of earnings. A higher P/E ratio suggests that investors are willing to pay more for the stock, often due to high expectations of future growth. Conversely, a lower P/E ratio may indicate that the stock is undervalued or that investors are skeptical of the company's prospects.

The Average P/E Ratio of US Stocks

The average P/E ratio of US stocks can fluctuate widely over time, influenced by economic conditions, market sentiment, and investor expectations. As of the latest data, the average P/E ratio for US stocks stands at approximately 25. This means that investors are paying around 25 times the company's earnings for each share.

What Does the Average P/E Ratio Tell Us?

The average P/E ratio can provide valuable insights into the market's overall health and investor sentiment. Here's what it tells us:

- Market Valuation: A high average P/E ratio suggests that the market is expensive, as investors are willing to pay a premium for stocks. Conversely, a low average P/E ratio indicates that the market is undervalued, as investors are skeptical of future growth prospects.

- Economic Conditions: During periods of economic growth, the average P/E ratio tends to rise as investors become more optimistic about the future. Conversely, during economic downturns, the average P/E ratio tends to fall as investors become more cautious.

- Market Sentiment: The average P/E ratio can also reflect market sentiment. For example, a rising P/E ratio may indicate that investors are bullish on the market, while a falling P/E ratio may indicate that investors are bearish.

Case Studies

To illustrate the impact of the average P/E ratio, let's consider two case studies:

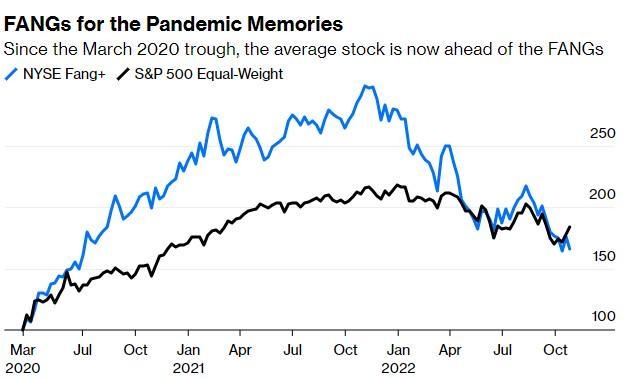

- Tech Bubble of 2000: During the late 1990s, the average P/E ratio of US stocks skyrocketed, reaching a peak of over 40. This was driven by the dot-com boom, as investors were willing to pay exorbitant prices for internet stocks. However, when the bubble burst in 2000, the average P/E ratio plummeted to around 15, reflecting the market's subsequent correction.

- Financial Crisis of 2008: In the lead-up to the financial crisis, the average P/E ratio of US stocks reached a high of approximately 25. As the crisis unfolded, the average P/E ratio fell to around 12, reflecting the market's widespread panic and economic uncertainty.

Conclusion

The average P/E ratio of US stocks is a valuable metric that provides investors with insights into the market's valuation, economic conditions, and investor sentiment. By understanding this ratio, investors can make more informed decisions and better navigate the complex world of investing.

Is the US Stock Open Today? Your Ultimate G? new york stock exchange