In today's globalized economy, the stock markets of the United States, India, and Japan have become pivotal players, attracting investors from around the world. This article delves into a comparative analysis of these markets, focusing on key factors such as market capitalization, growth potential, and investment strategies.

Market Capitalization

The United States boasts the world's largest stock market, with a total market capitalization of over

Growth Potential

When it comes to growth potential, India stands out as a shining star. The country is experiencing rapid economic growth, driven by a young and growing population, increasing urbanization, and a surge in digital adoption. This has led to a surge in the number of tech startups and innovative companies, making India an attractive destination for investors.

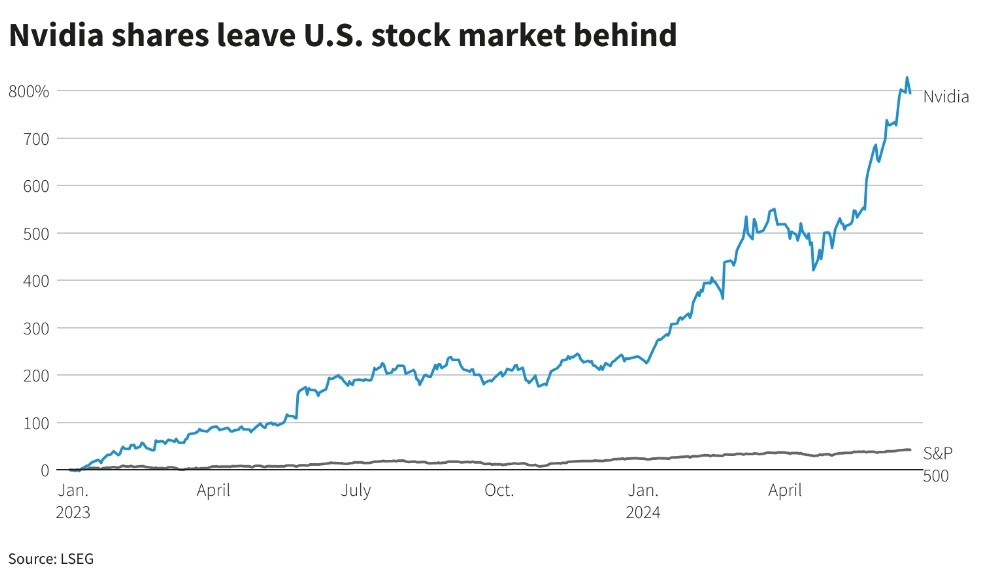

Japan, while facing demographic challenges, remains a key player in the global market. The country's strong manufacturing base, technological advancements, and stable political environment contribute to its growth potential. The United States also offers substantial growth opportunities, particularly in sectors like technology, healthcare, and renewable energy.

Investment Strategies

Investing in these markets requires a well-thought-out strategy. Here are some key considerations:

Diversification: Diversifying your portfolio across these markets can help mitigate risks and maximize returns. For instance, investing in both India and Japan can provide exposure to different economic cycles and market conditions.

Sector Focus: Focus on sectors that have high growth potential, such as technology, healthcare, and consumer goods. In India, sectors like e-commerce, fintech, and renewable energy are expected to witness significant growth. Similarly, in Japan, sectors like robotics, automation, and biotechnology offer promising opportunities.

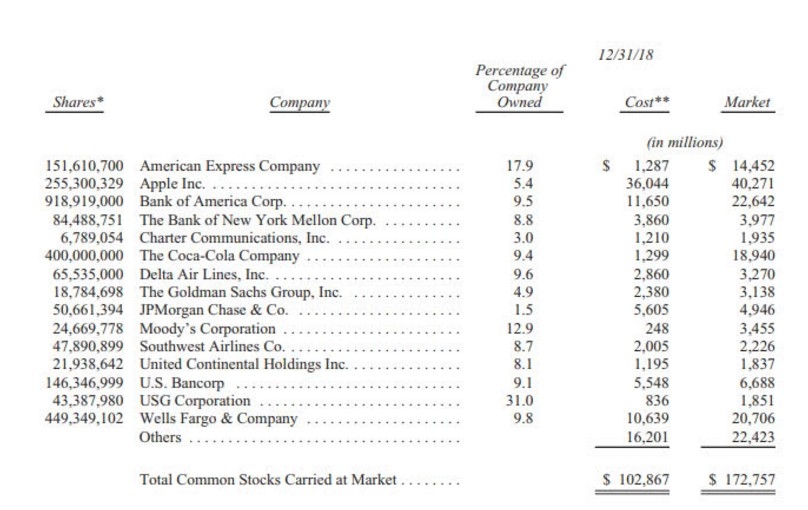

Company Research: Conduct thorough research on individual companies before investing. Look for companies with strong fundamentals, such as robust financials, strong management, and a competitive edge in their respective industries.

Case Studies

To illustrate the potential of these markets, let's consider a few case studies:

Reliance Industries: This Indian conglomerate has seen significant growth over the years, driven by its diverse business portfolio, including oil and gas, retail, and telecommunications. Investing in Reliance Industries can provide exposure to the fast-growing Indian market.

Toyota: As one of Japan's largest companies, Toyota has a strong presence in the global automotive industry. Investing in Toyota can provide exposure to the stable Japanese market and its technological advancements.

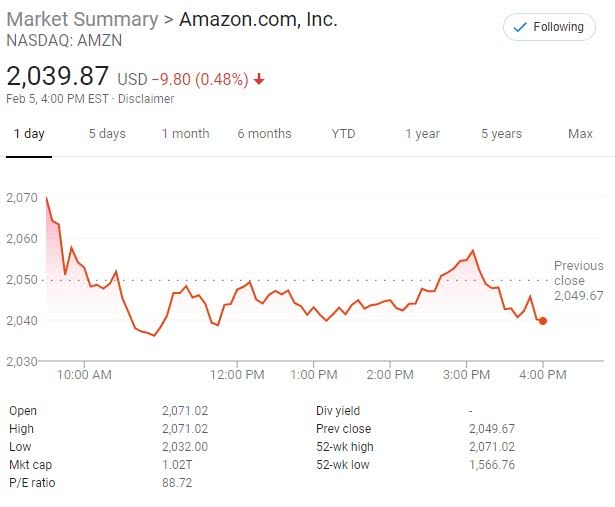

Apple: With its market dominance in the technology sector, Apple remains a favorite among investors. Investing in Apple can provide exposure to the dynamic US market and its innovative products.

In conclusion, investing in the stock markets of the United States, India, and Japan requires careful consideration of various factors. By focusing on market capitalization, growth potential, and investment strategies, investors can make informed decisions and maximize their returns.

US Navy Stocking Hats: A Stylish and Symbol? new york stock exchange