In the ever-evolving world of the stock market, staying informed about the performance of key companies is crucial. One such company is Haleon, a leading global consumer goods company. In this article, we delve into the Haleon US stock price, examining its recent trends, potential factors influencing it, and what investors should keep an eye on.

Understanding Haleon's Stock Performance

Haleon, previously known as Reckitt Benckiser Group, has undergone a significant transformation. The company rebranded in 2021, focusing on oral care, health, and hygiene products. Since then, investors have been closely monitoring the Haleon US stock price to gauge its performance.

Recent Trends and Factors Influencing the Stock Price

Over the past few years, the Haleon US stock price has experienced both ups and downs. Several factors have contributed to these fluctuations, including:

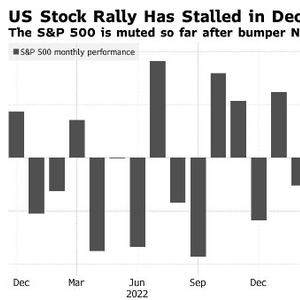

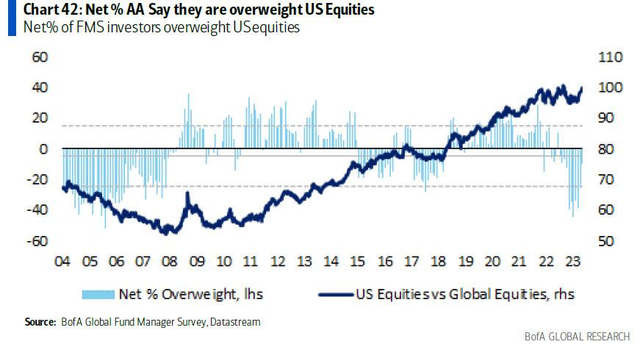

- Market Conditions: The stock market's overall performance can significantly impact individual stock prices. In times of economic uncertainty or market downturns, the Haleon US stock price may experience downward pressure.

- Company Performance: Haleon's financial results, including revenue, earnings, and growth prospects, play a crucial role in determining its stock price. Positive financial performance can drive the stock higher, while negative results can lead to a decline.

- Industry Trends: As a consumer goods company, Haleon is influenced by broader industry trends, such as changes in consumer preferences, regulatory developments, and competition. These factors can impact the company's profitability and, subsequently, its stock price.

Recent Developments and Impact on the Stock Price

One recent development that has captured investors' attention is Haleon's acquisition of GSK Consumer Healthcare. This deal, valued at approximately $12.5 billion, is expected to strengthen Haleon's position in the oral care market. While the acquisition has yet to be finalized, it has already had a positive impact on the Haleon US stock price.

Key Takeaways for Investors

When analyzing the Haleon US stock price, investors should consider the following:

- Long-term Perspective: While short-term fluctuations in the stock price can be unsettling, it's essential to focus on the company's long-term prospects and growth potential.

- Diversification: Investing in a single stock can be risky. Diversifying your portfolio can help mitigate potential losses.

- Stay Informed: Keeping up with the latest news and developments related to Haleon and the consumer goods industry can provide valuable insights into the company's future performance.

Conclusion

The Haleon US stock price has experienced significant volatility over the past few years. By understanding the factors influencing the stock price and staying informed about the company's performance and industry trends, investors can make more informed decisions. As Haleon continues to evolve and adapt to the changing consumer landscape, its stock price will undoubtedly remain a key area of interest for investors.

Unveiling the US Stock Calendar: A Comprehe? new york stock exchange