The US residential housing stock refers to the total inventory of residential properties within the United States. This includes everything from single-family homes to multi-unit apartment buildings. Understanding the composition and characteristics of this housing stock is crucial for policymakers, real estate investors, and homeowners alike. In this article, we delve into the key aspects of the US residential housing stock, providing insights into its current state and future trends.

The Composition of the US Residential Housing Stock

The US residential housing stock is incredibly diverse, reflecting the country's vast geography and varied economic conditions. According to the U.S. Census Bureau, as of 2020, there were approximately 135.4 million housing units in the United States. Here's a breakdown of the key types:

- Single-family homes: These account for the largest share of the housing stock, with an estimated 75.9 million units. Single-family homes are typically detached structures with their own yards and garages.

- Multi-family buildings: These include apartments, condominiums, and cooperatives. There are approximately 59.5 million multi-family units in the United States.

- Mobile homes: While less common, there are still around 18.5 million mobile homes in the country.

Characteristics of the US Residential Housing Stock

The US residential housing stock exhibits several key characteristics:

- Age: The average age of homes in the United States is approximately 37 years. However, there is a significant age distribution, with older homes in some regions and newer homes in others.

- Size: The average size of a single-family home has increased over the years, with the median size now around 2,400 square feet.

- Location: The housing stock is spread across the country, with different regions having varying characteristics. For example, the Northeast has a higher concentration of older, smaller homes, while the South has a higher concentration of newer, larger homes.

Trends in the US Residential Housing Stock

Several trends are shaping the US residential housing stock:

- Rising demand for multifamily housing: As urbanization continues to grow, there is an increasing demand for multifamily housing units. This trend is particularly evident in cities with strong job markets and limited land availability.

- Renovation and modernization: Many older homes are being renovated and modernized to meet the needs of today's homeowners. This includes upgrades such as energy-efficient appliances, smart home technology, and improved insulation.

- Growth in suburban areas: As cities become more expensive, many people are choosing to live in suburban areas, which offer more affordable housing options and a higher quality of life.

Case Studies

One notable example of the impact of the US residential housing stock is the housing crisis in the aftermath of the 2008 financial crisis. Many homeowners found themselves with mortgages that exceeded the value of their homes, leading to a wave of foreclosures. This crisis highlighted the importance of a well-functioning housing market and the need for policies that support homeownership.

Another example is the growing popularity of tiny homes. These small, energy-efficient homes are becoming increasingly popular among young adults and empty nesters looking for affordable housing options.

Conclusion

The US residential housing stock is a complex and diverse collection of properties that plays a crucial role in the country's economy and society. Understanding its composition, characteristics, and trends is essential for anyone interested in the real estate market or the broader housing landscape. By staying informed, we can better navigate the ever-changing world of residential real estate.

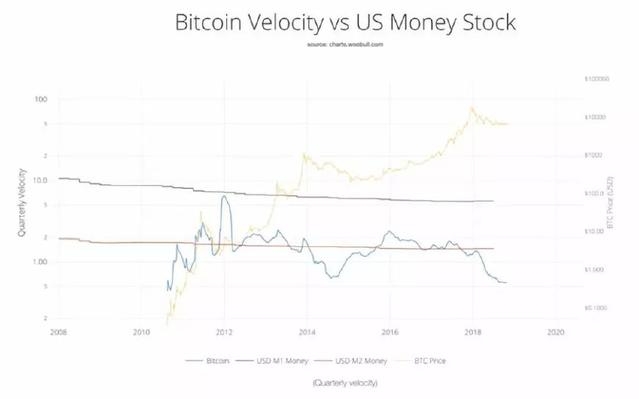

"Bitcoin Live Index vs. US Stock M? new york stock exchange