Are you looking to diversify your investment portfolio and capitalize on the potential of and stocks? If so, you've come to the right place. This article delves into the world of and stocks, explaining their unique benefits and how they can help you achieve financial growth. From understanding the basics to exploring real-life examples, we'll guide you through the ins and outs of investing in and stocks.

What Are and Stocks?

First things first, let's define and stocks. And stocks refer to shares of a company that have been issued to a specific entity or individual. These stocks can be traded on the stock market, just like any other stock. The main difference between and stocks and regular stocks is the nature of the ownership and the rights attached to these shares.

The Advantages of Investing in and Stocks

Higher Returns: One of the primary advantages of investing in and stocks is the potential for higher returns. Since and stocks are often issued to private entities, they can offer higher dividend yields and capital appreciation compared to regular stocks.

Diversification: Investing in and stocks allows you to diversify your portfolio, reducing your exposure to market volatility. By adding and stocks to your portfolio, you can potentially earn higher returns while minimizing risks.

Access to Exclusive Opportunities: and stocks can provide you with access to exclusive investment opportunities. These stocks are often issued to private entities, giving you a chance to invest in promising companies before they go public.

Understanding the Risks

While and stocks offer numerous advantages, it's essential to be aware of the risks involved. Here are a few things to keep in mind:

Limited Information: Since and stocks are issued to private entities, you may have limited access to information about the company. This can make it challenging to assess the company's financial health and performance.

Liquidity Issues: and stocks may be less liquid than regular stocks, meaning it can be difficult to buy or sell these shares at a favorable price.

Volatility: Just like any other investment, and stocks can be highly volatile, leading to significant price fluctuations.

Real-Life Examples

To illustrate the potential of and stocks, let's take a look at a few real-life examples:

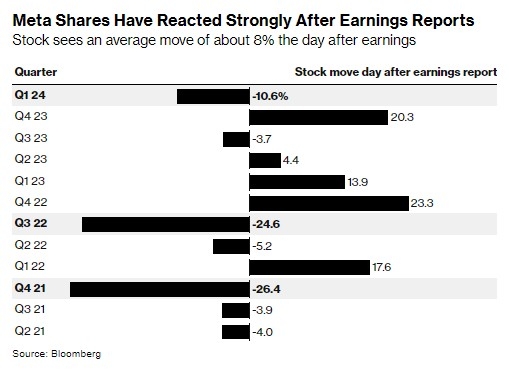

Facebook (now Meta Platforms, Inc.): Before going public, Facebook raised funds by issuing and stocks to private investors. These investors enjoyed significant returns when Facebook went public in 2012.

Tesla, Inc.: Tesla, another highly successful company, raised funds through and stocks before going public. Early investors in Tesla's and stocks saw substantial gains when the company went public in 2010.

Conclusion

Investing in and stocks can be a powerful way to grow your investment portfolio and achieve financial success. By understanding the advantages and risks, you can make informed decisions and capitalize on the potential of and stocks. So, if you're looking to diversify your investments and seek higher returns, consider adding and stocks to your portfolio.

Nestle US Stock Price: A Comprehensive Anal? new york stock exchange