In the ever-evolving world of finance, understanding the ins and outs of the stock market is crucial for any investor. One particular area that has gained significant attention is the "NB US Stock." But what exactly is it, and how can you capitalize on its potential? This comprehensive guide will delve into the details of NB US Stock, providing you with the knowledge to make informed investment decisions.

What is NB US Stock?

NB US Stock refers to the shares of companies listed on the U.S. stock exchanges, with "NB" standing for "Non-Bank." These stocks are typically associated with financial institutions, including insurance companies, investment firms, and other financial services providers. Unlike traditional banks, these companies operate in various financial sectors, offering a diverse range of services.

Understanding the Market Dynamics

The NB US Stock market is influenced by various factors, including economic indicators, geopolitical events, and corporate performance. To make the most of your investments, it's essential to stay informed about these factors and understand how they impact the market.

Key Factors to Consider

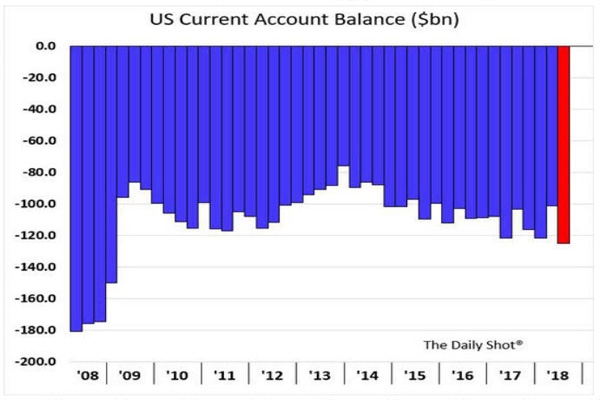

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation rates can significantly impact the NB US Stock market. A strong economy often leads to higher stock prices, while a weak economy can result in declines.

Geopolitical Events: Geopolitical events, such as elections, trade wars, and political instability, can cause volatility in the NB US Stock market. Investors should stay updated on these events and consider their potential impact on their investments.

Corporate Performance: The financial performance of individual companies plays a crucial role in the NB US Stock market. Strong earnings reports and positive outlooks can drive stock prices higher, while poor performance can lead to declines.

Investment Strategies

To maximize your returns in the NB US Stock market, it's essential to develop a well-thought-out investment strategy. Here are some key strategies to consider:

Diversification: Diversifying your portfolio can help mitigate risk and maximize returns. Consider investing in a mix of NB US Stocks across various sectors and industries.

Long-Term Investing: Investing in NB US Stocks for the long term can help you ride out market volatility and benefit from the potential growth of the companies you invest in.

Research and Analysis: Conduct thorough research and analysis before investing in any NB US Stock. This includes analyzing financial statements, understanding the company's business model, and staying informed about market trends.

Case Studies

To illustrate the potential of NB US Stocks, let's consider a few case studies:

Company A: A leading insurance company that has consistently delivered strong financial results and has a solid market position. Investing in this company's NB US Stock could provide long-term growth opportunities.

Company B: A financial services provider that has expanded its services to include digital banking solutions. This company's innovative approach to financial services has attracted a large customer base, leading to significant growth in its NB US Stock.

Conclusion

Investing in NB US Stocks can be a lucrative venture if done correctly. By understanding the market dynamics, developing a well-thought-out investment strategy, and staying informed about economic and corporate factors, you can unlock the potential of NB US Stocks and achieve your investment goals. Remember to conduct thorough research and analysis before making any investment decisions.

Unlocking the Potential of PNRA.O: A Deep D? new york stock exchange