Are you interested in investing in Apha stocks but are unsure about their current US prices? This guide will provide you with a comprehensive overview of Apha stocks, their pricing, and how to invest in them.

Understanding Apha Stocks

Apha stocks refer to a class of stocks that are considered to be among the most innovative and promising in the market. These stocks are often associated with companies that are at the forefront of technological advancements, such as artificial intelligence, biotechnology, and renewable energy.

Current Apha Stock US Price

The current US price of Apha stocks can vary widely depending on the specific company and market conditions. To get the most accurate and up-to-date information, it is important to consult a reliable financial news source or stock market platform. As of the latest available data, the average price of Apha stocks in the US is around $150 per share.

Factors Influencing Apha Stock Prices

Several factors can influence the price of Apha stocks. These include:

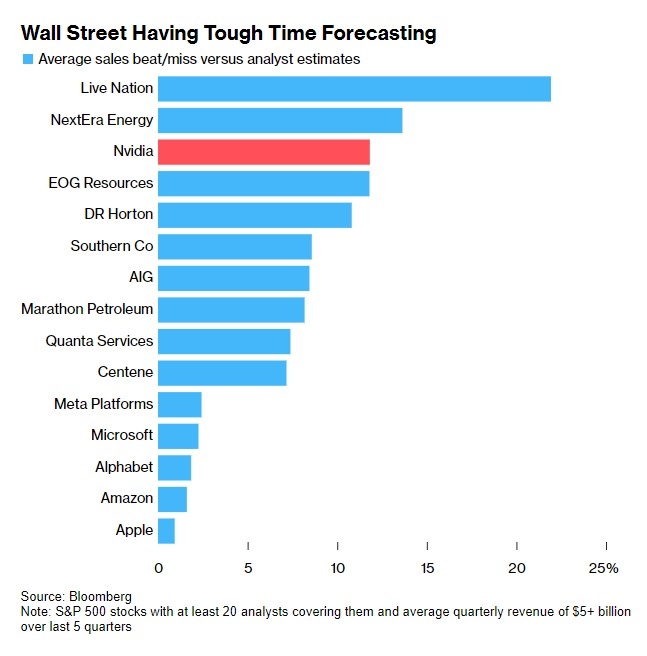

- Company Performance: The financial performance of the company, including revenue growth, earnings, and profitability, can significantly impact stock prices.

- Market Trends: The overall market trend can also influence Apha stock prices. For example, during a bull market, stock prices tend to rise, while during a bear market, they tend to fall.

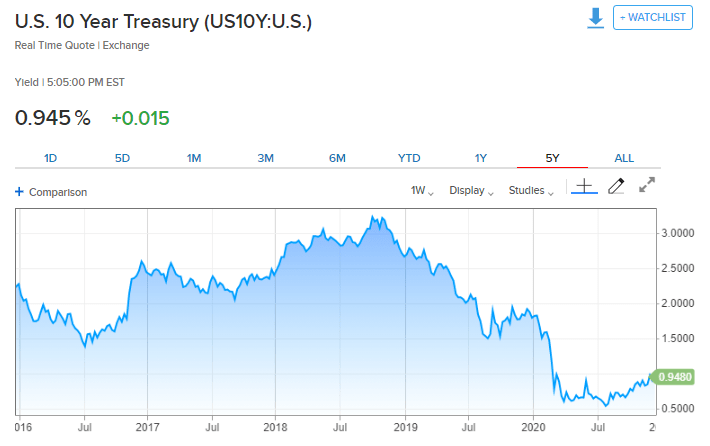

- Economic Indicators: Economic indicators, such as interest rates, inflation, and GDP growth, can also affect Apha stock prices.

How to Invest in Apha Stocks

Investing in Apha stocks can be a lucrative opportunity, but it also comes with its own set of risks. Here are some steps to consider when investing in Apha stocks:

- Research: Conduct thorough research on the company and its industry to understand its potential for growth and risks.

- Diversify: Diversify your investment portfolio to reduce risk. This means investing in a variety of stocks across different sectors and industries.

- Set a Budget: Determine how much you are willing to invest in Apha stocks and stick to your budget.

- Monitor Your Investments: Regularly monitor your investments to stay informed about market trends and company performance.

Case Study: Tesla

A great example of an Apha stock is Tesla, Inc. (TSLA). Tesla is a leading electric vehicle manufacturer and renewable energy company. Its stock has seen significant growth over the years, making it one of the most popular Apha stocks in the market.

In 2020, Tesla's stock price skyrocketed, reaching an all-time high of over $800 per share. This growth was driven by the company's strong financial performance, innovative products, and increasing demand for electric vehicles.

Conclusion

Investing in Apha stocks can be a great way to grow your investment portfolio, but it is important to conduct thorough research and understand the risks involved. By following the steps outlined in this guide, you can make informed decisions and potentially achieve significant returns on your investments.

Unlocking the Power of Google Stock: A Comp? stock chap