Are you an Indian investor looking to diversify your portfolio? You might be wondering if you can buy US stocks. The answer is a resounding yes! Investing in US stocks can be a great way to gain exposure to a global market and potentially earn higher returns. In this article, we'll explore the process, requirements, and benefits of investing in US stocks from India.

Understanding the Basics

To begin with, Indian investors can indeed purchase US stocks. However, there are a few important considerations to keep in mind. The process involves opening a brokerage account with a foreign broker or using a global brokerage platform that supports international investors.

Opening a Brokerage Account

The first step is to open a brokerage account. You have several options, including:

- Local Indian Brokers: Some Indian brokerage firms offer accounts that allow you to invest in US stocks. These brokers typically charge a lower transaction fee compared to international brokers.

- International Brokers: If you prefer, you can open an account with a foreign broker. This might involve higher fees, but it can provide more flexibility and a wider range of investment options.

- Global Brokerage Platforms: Platforms like TD Ameritrade, E*TRADE, and Interactive Brokers allow you to invest in US stocks through your existing account. This can be a convenient option if you already have a brokerage account in the US.

Understanding the Process

Once you have your brokerage account set up, the process of purchasing US stocks is similar to buying Indian stocks. Here's a step-by-step guide:

- Research: Start by researching the stocks you're interested in. Look at their financial statements, market trends, and news releases.

- Place an Order: Log in to your brokerage account, select the stock you want to buy, and enter the desired amount or number of shares.

- Settlement: The transaction will settle in 2-3 business days. This means the stock will be added to your portfolio on the third business day after you place the order.

Benefits of Investing in US Stocks

Diversification: Investing in US stocks allows you to diversify your portfolio beyond the Indian market. This can help reduce your risk and potentially increase your returns.

Potential Higher Returns: The US stock market has historically offered higher returns compared to the Indian market. This can be a significant advantage for long-term investors.

Access to Innovative Companies: The US market is home to many innovative and global companies. Investing in these companies can give you exposure to cutting-edge technologies and products.

Tax Implications

It's important to understand the tax implications of investing in US stocks. Indian investors are subject to tax on capital gains from US stocks, just like they are for Indian stocks. The tax rate depends on the holding period and your income tax slab.

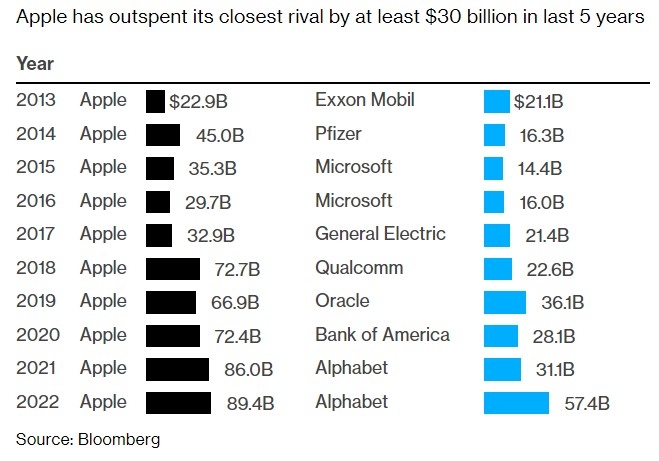

Case Study: Invest in Apple (AAPL)

Let's say you're interested in investing in Apple Inc. (AAPL). After researching the company and considering its strong financial performance and growth prospects, you decide to buy 10 shares of AAPL at

Conclusion

Investing in US stocks from India is a viable and potentially lucrative option. By following the right process and understanding the associated risks and benefits, you can diversify your portfolio and take advantage of the global market. Always remember to do thorough research and consult with a financial advisor before making any investment decisions.

Sip in US Stocks from India: A Strategic Ap? stock chap