The stock market is a reflection of the broader economic and political landscape of a nation. One of the most significant political events in the United States is the presidential election. This article delves into how the US elections affect the stock market, providing insights into the correlation between political changes and financial outcomes.

Understanding the Stock Market's Response to US Elections

The stock market often acts as a barometer for the public's perception of the political climate. Historically, there have been notable correlations between election outcomes and market performance. Here's how the US elections can impact the stock market:

1. Market Volatility

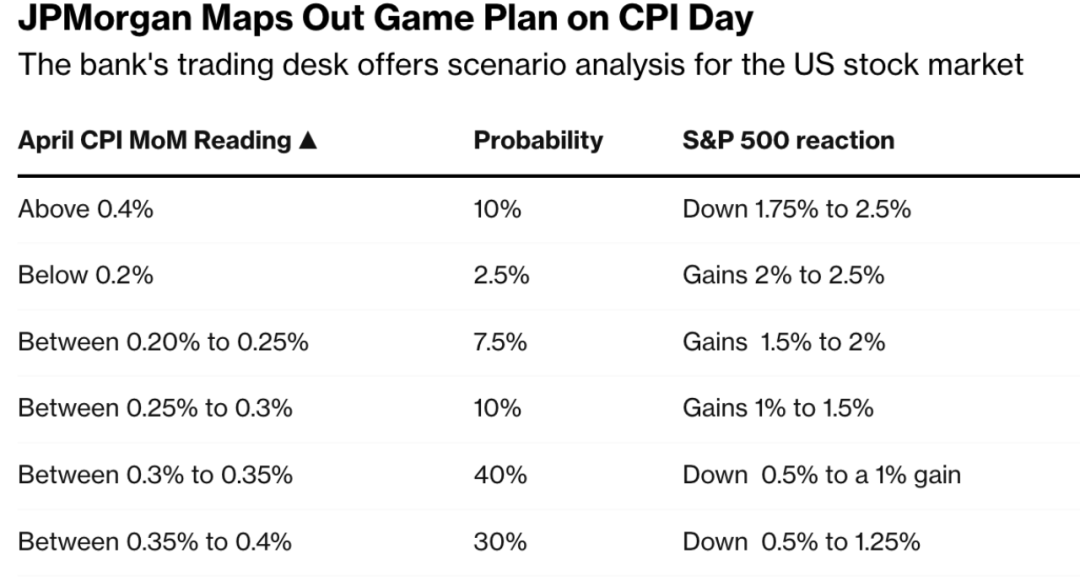

Election years are typically marked by increased market volatility. Investors often become uncertain about the future economic policies and regulations, leading to a rise in uncertainty. This uncertainty can cause stocks to fluctuate wildly in the lead-up to the election.

2. Sector Shifts

The outcome of the US elections can significantly affect different sectors of the stock market. For instance, a win for a particular political party might boost the healthcare or technology sector, while another might favor the financial or energy sector.

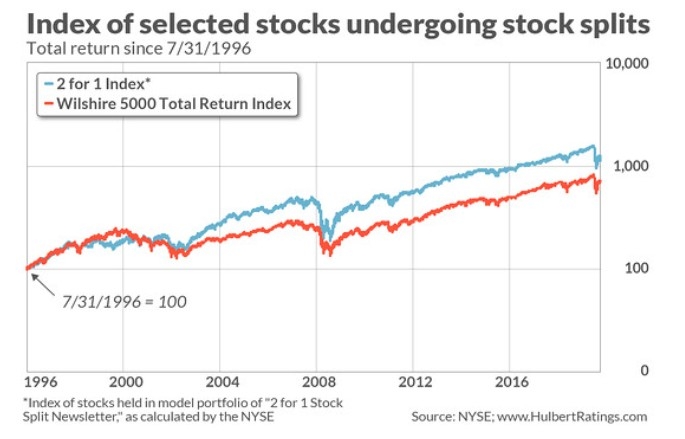

3. Market Trends

Historical data suggests that the stock market tends to perform well in the years following a presidential election. This trend is attributed to the fact that markets often anticipate the incoming administration's policies and adjust accordingly.

4. Inflation and Interest Rates

Election outcomes can influence inflation rates and interest rates, which in turn impact the stock market. For example, if an administration is perceived as more inflationary, investors might pull back from stocks and look for safer investments, such as bonds.

Case Studies

1. The 2016 Election

The 2016 US presidential election saw a surprising win for Donald Trump. The stock market initially reacted negatively, but soon recovered. Over the following months, the market saw a significant upswing, largely attributed to investor optimism about Trump's proposed tax cuts and deregulation policies.

2. The 2020 Election

The 2020 election was one of the most contentious in recent history, with the stock market experiencing significant volatility leading up to the result. However, the market quickly stabilized once Joe Biden was declared the winner. This reflects the market's anticipation of a return to more traditional policies.

Conclusion

The US elections have a significant impact on the stock market. Understanding these correlations can help investors make more informed decisions. While market performance is influenced by various factors, the election outcome is often a key driver of stock market movements. As the next presidential election approaches, investors will undoubtedly be keeping a close eye on how the market reacts.

Top Ten Japanese Stocks to Buy as a US Citi? stock chap