In the ever-evolving world of technology stocks, keeping a close eye on the performance of companies like Sangoma Technologies is crucial for investors. Sangoma, a leading provider of voice and data communication technologies, has seen its stock price fluctuate significantly over the years. In this article, we delve into the factors influencing Sangoma's stock price and analyze its performance in the US market.

Understanding Sangoma Technologies

Based in Ottawa, Canada, Sangoma Technologies is a global leader in providing hardware and software solutions for voice and data communications. The company's products are used in various industries, including enterprise, contact centers, and service providers. Sangoma's stock is listed on the Toronto Stock Exchange (TSX) under the symbol "SGMA," and it is also traded on the NASDAQ under the symbol "SGMO."

Factors Influencing Sangoma's Stock Price

Several factors contribute to the fluctuation of Sangoma's stock price. Here are some of the key factors to consider:

1. Market Trends and Economic Conditions

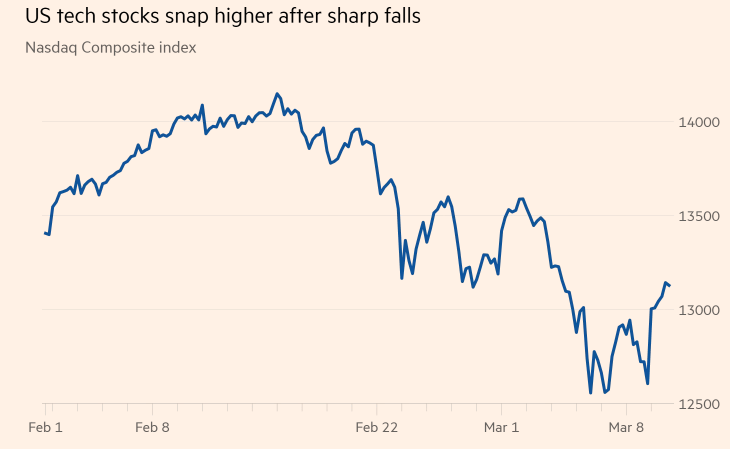

The stock market is highly influenced by economic conditions. During periods of economic growth, technology stocks tend to perform well. Conversely, during economic downturns, investors may become more cautious, leading to a decline in stock prices. It is essential to monitor the overall market trends and economic indicators to understand the potential impact on Sangoma's stock price.

2. Company Performance

Sangoma's financial performance plays a crucial role in determining its stock price. Investors closely monitor the company's revenue growth, earnings, and cash flow. Strong financial results can drive the stock price higher, while poor performance may lead to a decline.

3. Industry Dynamics

The telecommunications industry is highly competitive, with constant technological advancements and regulatory changes. Any significant event in the industry, such as a merger or acquisition, can impact Sangoma's stock price. Additionally, the company's ability to innovate and adapt to new technologies is crucial for its long-term success.

4. Investor Sentiment

Investor sentiment can have a significant impact on stock prices. Positive news, such as a successful product launch or a strategic partnership, can boost investor confidence and drive the stock price higher. Conversely, negative news or rumors can lead to a decline in stock prices.

Sangoma Stock Price Performance in the US

Sangoma's stock has seen a varied performance in the US market. Here are some key observations:

Initial Public Offering (IPO): Sangoma went public in 2011, with its stock initially trading at around $4.00 per share. Over the years, the stock price has experienced significant volatility.

Recent Performance: In the past few years, Sangoma's stock has shown a strong upward trend, with the price reaching a high of

10.00 per share in early 2021. However, the stock has since experienced a slight decline, currently trading at around 7.00 per share.Dividends: Sangoma has not paid dividends to its shareholders, which may impact the stock's attractiveness to income investors.

Conclusion

Investing in Sangoma Technologies requires a thorough understanding of the company's business, the telecommunications industry, and the broader market conditions. By considering the factors mentioned above, investors can make informed decisions about their investments in Sangoma's stock. As with any investment, it is essential to conduct thorough research and consult with a financial advisor before making any decisions.

Among Us Stocking Stuffer: The Ultimate Gui? stock chap