Are you ready to take your investment journey to the next level? Whether you're a seasoned investor or just starting out, understanding the stock market is crucial. Enter the "Stock Chap," your ultimate guide to mastering the art of stock market investing. In this article, we'll delve into the key principles, strategies, and tools that will help you become a confident and successful stock market investor.

Understanding the Basics

Before diving into the intricacies of stock market investing, it's essential to understand the basics. A stock represents a share of ownership in a company. When you buy a stock, you're essentially purchasing a piece of that company. The value of your investment can increase or decrease based on the company's performance and market conditions.

The Stock Chap's Key Principles

The Stock Chap believes in the following key principles to achieve success in stock market investing:

Research and Education: Before investing, it's crucial to research and educate yourself about the market. Understand different types of stocks, market trends, and financial statements. The more you know, the better decisions you'll make.

Risk Management: Always invest with a clear understanding of your risk tolerance. Diversify your portfolio to reduce potential losses. Never invest more than you can afford to lose.

Long-term Investing: The stock market can be volatile, but long-term investing can lead to substantial returns. Focus on companies with strong fundamentals and a solid track record.

Patience and Discipline: Successful investors are patient and disciplined. Avoid making impulsive decisions based on short-term market fluctuations.

Continuous Learning: The stock market is constantly evolving. Stay updated with the latest trends, news, and developments to stay ahead of the curve.

Strategies for Success

The Stock Chap offers several strategies to help you succeed in stock market investing:

Value Investing: This strategy involves identifying undervalued stocks and holding them for the long term. Look for companies with strong fundamentals, low price-to-earnings (P/E) ratios, and a solid dividend yield.

Growth Investing: Focus on companies with high growth potential. These stocks often have higher price-to-earnings ratios but can offer significant returns.

Dividend Investing: Invest in companies that consistently pay dividends. Dividends can provide a steady income stream and can be reinvested to grow your portfolio.

Sector Rotation: Identify sectors that are performing well and invest in related stocks. This strategy can help you capitalize on market trends.

Case Studies

Let's look at a couple of case studies to illustrate the effectiveness of these strategies:

Value Investing: Warren Buffett, often referred to as the "Oracle of Omaha," is a master of value investing. His investment in Coca-Cola (KO) over the years has proven to be a wise decision, as the company has consistently delivered strong returns.

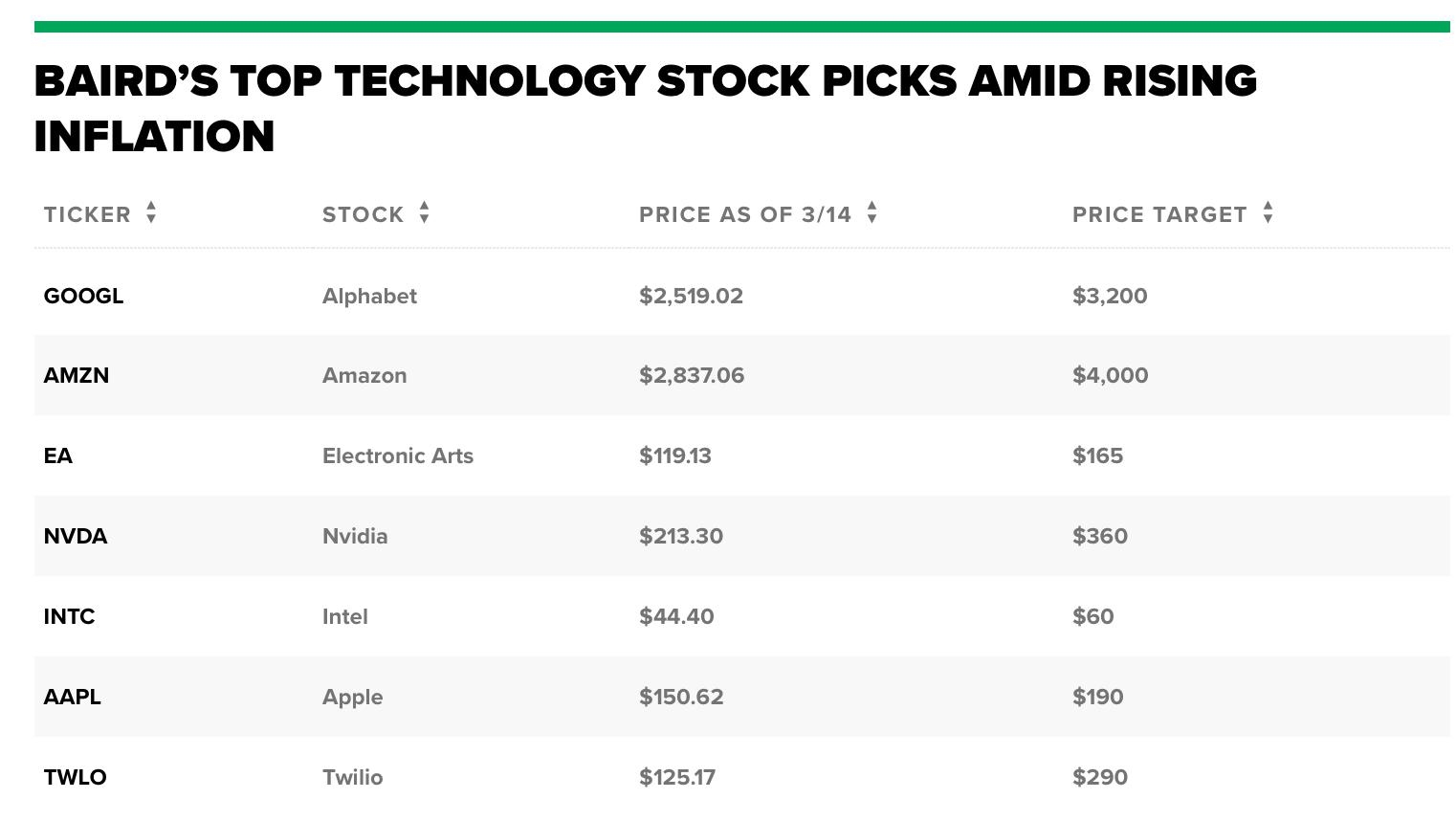

Growth Investing: Amazon (AMZN) is a prime example of a growth stock that has revolutionized the retail industry. By investing in Amazon during its early stages, investors have seen substantial returns.

Conclusion

Becoming a successful stock market investor requires knowledge, discipline, and patience. By following the Stock Chap's principles and strategies, you'll be well on your way to achieving your investment goals. Remember, the stock market is a marathon, not a sprint. Stay focused, stay informed, and you'll be well on your way to becoming a "Stock Chap" yourself.

Stock Market Download: The Ultimate Guide t? stock chap