In the fast-paced world of finance, staying ahead of market trends is crucial for investors. One of the most effective tools for doing so is the stock market graph. This article delves into the significance of stock market graphs, their types, and how they can help you make informed investment decisions.

What is a Stock Market Graph?

A stock market graph is a visual representation of stock prices over a specific period. It provides a clear and concise overview of how a stock has performed, allowing investors to identify trends, patterns, and potential opportunities. By analyzing these graphs, investors can gain valuable insights into the market and make more informed decisions.

Types of Stock Market Graphs

There are several types of stock market graphs, each with its unique features and applications:

Line Graphs: These graphs display the closing prices of a stock over time. They are ideal for identifying long-term trends and patterns.

Bar Graphs: Bar graphs show the opening, closing, highest, and lowest prices of a stock over a specific period. They are useful for analyzing short-term price movements and volatility.

Candlestick Graphs: Similar to bar graphs, candlestick graphs provide more detailed information about price movements. The 'body' of the candlestick represents the opening and closing prices, while the 'wicks' indicate the highest and lowest prices.

Point and Figure Graphs: These graphs are based on price changes rather than time. They are useful for identifying long-term trends and are less prone to noise and volatility.

How to Read a Stock Market Graph

Reading a stock market graph requires a basic understanding of its components:

Time Frame: The time frame of the graph determines the period over which the data is displayed. Common time frames include daily, weekly, monthly, and yearly.

Price Levels: The horizontal axis of the graph represents price levels, while the vertical axis represents time.

Trend Lines: Trend lines connect price points to identify the direction of the market. Uptrend lines slope upwards, while downtrend lines slope downwards.

Support and Resistance Levels: These levels indicate where the stock is likely to find support or resistance. Support levels are where the stock has previously found support, while resistance levels are where the stock has previously faced resistance.

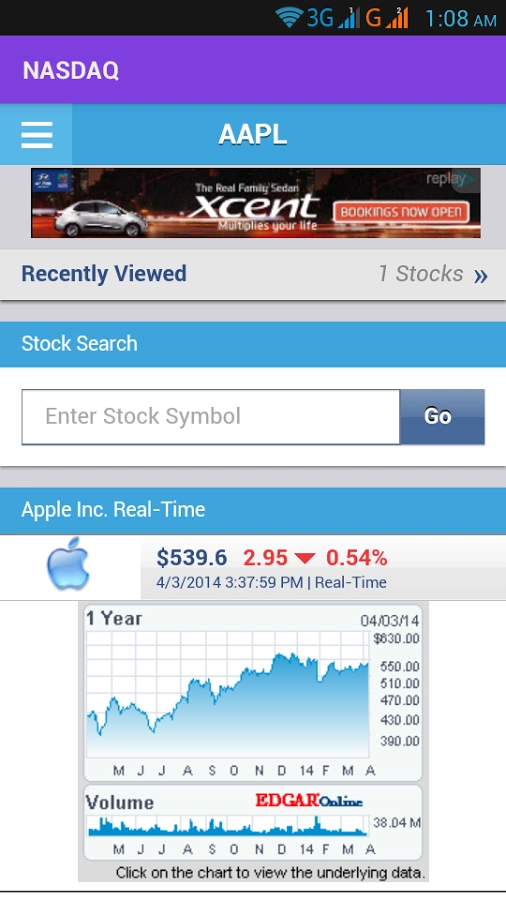

Case Study: Apple Inc. (AAPL)

Let's take a look at the stock market graph of Apple Inc. (AAPL) to understand how to interpret it. In the past year, AAPL has shown a strong uptrend, with several support and resistance levels. By analyzing the graph, we can identify key price points and potential entry and exit strategies.

Conclusion

Stock market graphs are invaluable tools for investors looking to stay ahead of market trends. By understanding the different types of graphs and how to read them, investors can make more informed decisions and potentially increase their chances of success. Remember, the key to successful investing lies in thorough research and analysis.

Indian ADRs in the US Stock Market: A Compr? stock chap