In the volatile world of finance, the term "stocks plummeting" often sends shivers down the spines of investors and traders alike. This article delves into the causes behind stock market crashes, the implications they have on the economy, and how investors can navigate through such turbulent times.

Causes of Stock Market Crashes

Several factors can trigger a stock market crash. Economic indicators, such as rising unemployment rates or inflation, can signal potential problems ahead. Political instability or policy changes can also lead to uncertainty, causing investors to sell off their stocks. Additionally, market manipulation or insider trading can create false optimism, which eventually leads to a market crash when the truth comes to light.

One of the most famous stock market crashes occurred in 2008, following the financial crisis. The collapse of major financial institutions, such as Lehman Brothers, led to a widespread panic, causing stocks to plummet. This event highlighted the importance of regulatory oversight and the need for transparency in the financial industry.

Implications of Stock Market Crashes

The implications of a stock market crash can be far-reaching. Economic downturns often follow, leading to job losses, reduced consumer spending, and a decrease in business investment. This can further exacerbate the crisis, creating a negative feedback loop.

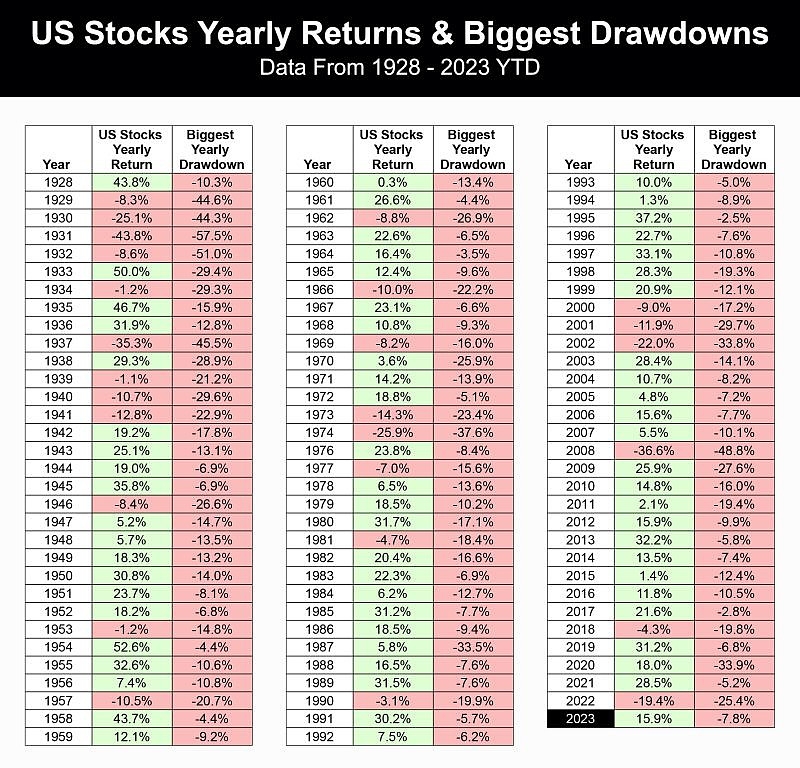

However, it's important to note that not all stock market crashes lead to economic downturns. In some cases, the market may recover relatively quickly, as seen in the dot-com bubble burst in 2000. Despite the crash, the economy continued to grow, although at a slower pace.

Navigating Turbulent Times

For investors, navigating through a stock market crash can be challenging. Here are some tips to help you stay afloat:

- Diversify your portfolio: Don't put all your eggs in one basket. Diversifying your investments can help mitigate the risk of a stock market crash.

- Stay informed: Keep up with economic news and market trends. This will help you make informed decisions and avoid making impulsive moves.

- Be patient: Don't panic and sell off your investments during a market crash. History has shown that markets often recover over time.

- Seek professional advice: If you're unsure about your investment strategy, consider consulting with a financial advisor.

Case Study: The 2020 Stock Market Crash

The COVID-19 pandemic led to a historic stock market crash in March 2020. The S&P 500 index dropped by nearly 30% in just a few weeks. However, the market quickly recovered, with the S&P 500 reaching record highs by the end of the year.

This event highlighted the importance of market resilience and the ability of investors to adapt to changing circumstances. It also underscored the need for government intervention to stabilize the economy during times of crisis.

In conclusion, "stocks plummeting" is a term that can strike fear in the hearts of investors. However, by understanding the causes and implications of stock market crashes, and by adopting a strategic approach to investing, you can navigate through turbulent times and emerge stronger.

Small Cap Biotech High Growth US Stocks: Yo? stock chap