In the ever-evolving world of technology and e-commerce, Alibaba Group Holding Limited (BABA) has made a significant move by announcing a stock split. This decision has sparked a lot of interest among investors and shareholders alike. In this article, we will delve into the details of the Alibaba US stock split, its implications, and what it means for the future of the company.

What is a Stock Split?

Before we dive into the specifics of Alibaba's stock split, it's important to understand what a stock split is. A stock split is a corporate action where a company divides its existing shares into multiple shares. This process does not change the overall value of the company but increases the number of shares outstanding.

Alibaba's Stock Split Details

Alibaba's stock split is set to take place in the second quarter of 2023. The company has announced a 20-for-1 stock split, meaning that for every share an investor holds, they will receive 20 additional shares. This move is aimed at making the stock more accessible to a wider range of investors.

Why is Alibaba Implementing a Stock Split?

There are several reasons why Alibaba has decided to implement a stock split. Firstly, it is a way to make the stock more affordable and accessible to retail investors. By increasing the number of shares outstanding, the price per share will decrease, allowing more investors to participate in the company's growth.

Secondly, a stock split can boost investor confidence and attract more attention from the market. It is often seen as a positive sign by investors, indicating that the company is performing well and has a strong future outlook.

Implications of the Stock Split

The Alibaba US stock split is expected to have several implications for the company and its investors. Here are some key points to consider:

- Price Per Share: As mentioned earlier, the price per share will decrease after the stock split. This is likely to attract more retail investors who may find the stock more affordable.

- Market Capitalization: The overall market capitalization of the company will remain the same after the stock split. This means that the stock split will not change the company's overall value.

- Trading Volume: It is expected that the trading volume of Alibaba's stock will increase after the stock split, as more investors will be able to participate in the market.

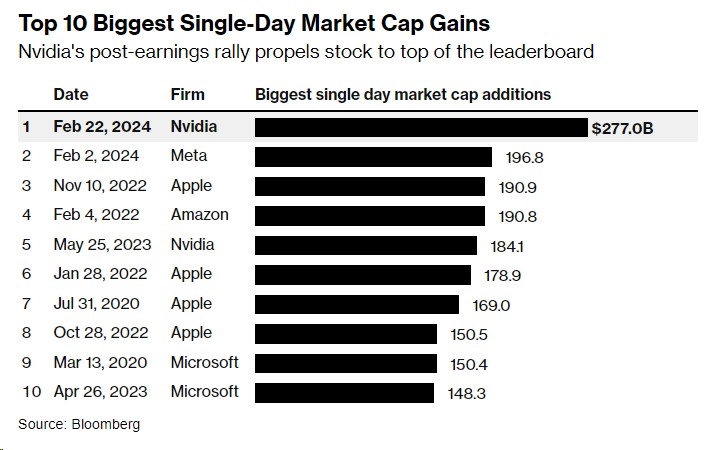

Case Study: Apple's Stock Split

To put things into perspective, let's take a look at a case study of Apple's stock split. In 2014, Apple implemented a 7-for-1 stock split, which reduced the price per share from

Conclusion

In conclusion, Alibaba's US stock split is a significant move that is expected to have a positive impact on the company and its investors. By making the stock more accessible and affordable, Alibaba is setting the stage for continued growth and success. As with any corporate action, it's important for investors to do their due diligence and understand the potential implications before making any investment decisions.

Huawei US Stock: The Comprehensive Guide to? us flag stock