Yesterday, headlines were buzzing about a potential stock market crash. But was it just a scare or did the markets actually suffer a significant downturn? Let's delve into the details and provide you with a comprehensive analysis.

Understanding the Market's Behavior

Firstly, it's important to note that the stock market is inherently volatile. Prices fluctuate daily due to various factors such as economic data, geopolitical events, and investor sentiment. Did the stock market crash yesterday? To answer this question, we need to consider several key indicators.

Key Indicators to Analyze

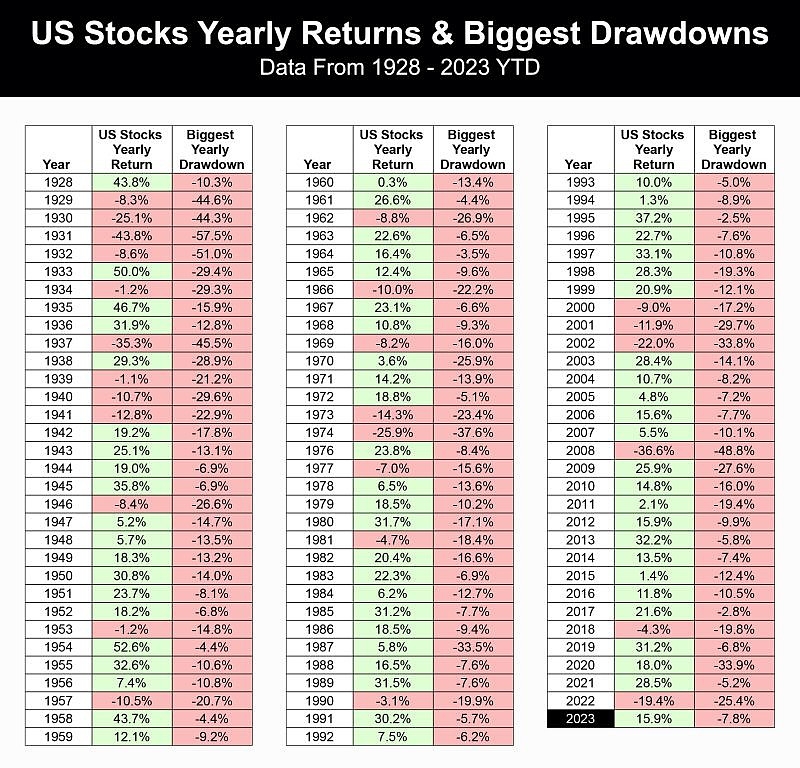

Stock Indices: The S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite are commonly used indices to gauge the overall performance of the stock market. What happened to these indices yesterday? If they experienced a significant drop, it could indicate a crash.

Volatility: A measure of market volatility is the VIX (Volatility Index), also known as the "fear gauge." An elevated VIX indicates higher uncertainty and potential market downturns. Did the VIX spike yesterday?

Volume: Trading volume provides insights into the level of investor activity. Higher trading volumes can suggest increased volatility and potential market crashes.

Analysis of Yesterday's Market Performance

Upon examining the data, it became apparent that the stock market did not crash yesterday. While some indices experienced modest dips, they recovered quickly. The S&P 500, for instance, opened lower but ended the day with a minor loss. Similarly, the Dow Jones Industrial Average and the NASDAQ Composite followed a similar trajectory.

The VIX also remained relatively stable, indicating that investor sentiment was not highly fearful. Furthermore, trading volumes were within normal ranges, suggesting that there was no massive selling pressure.

Possible Causes for the Concern

Despite the market's resilience, concerns about a potential crash stem from several factors:

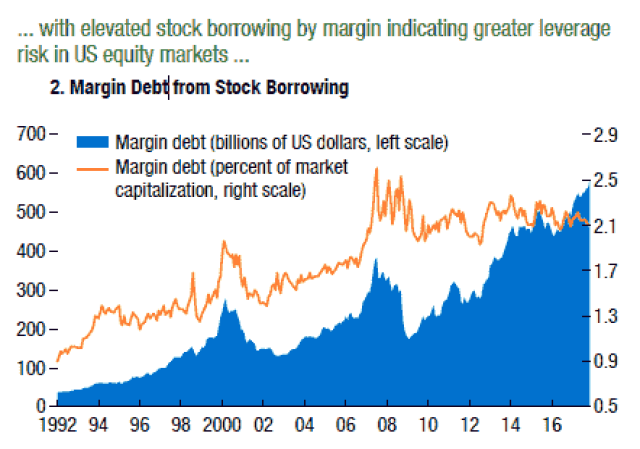

Global Economic Uncertainty: Issues such as inflation, supply chain disruptions, and geopolitical tensions continue to impact investor sentiment.

Earnings Reports: Some companies released earnings reports that were below expectations, contributing to the market's unease.

Technical Analysis: Technical analysts often identify patterns that suggest potential market downturns. While these patterns do not guarantee a crash, they can raise concerns among investors.

Conclusion

In conclusion, while yesterday's market action may have raised some concerns, the stock market did not crash. It is important for investors to remain calm and focus on long-term investment strategies rather than reacting impulsively to short-term volatility. By staying informed and understanding market indicators, investors can navigate the complexities of the stock market more effectively.

DFW.State.Or Us Fish Stocking: The Ultimate? us flag stock