In the ever-evolving world of finance, staying informed about the markets is crucial. One of the most significant indices in the United States is the NYSE:ALL, also known as the NYSE Composite Index. This article aims to provide a comprehensive guide to understanding what the NYSE:ALL index represents, its significance, and how it can impact investors.

What is the NYSE:ALL Index?

The NYSE:ALL index is a broad-based index that tracks the performance of all the stocks listed on the New York Stock Exchange (NYSE). It includes both domestic and international companies, representing a wide range of industries and market capitalizations. This index is considered one of the most comprehensive and diverse measures of the U.S. stock market.

Significance of the NYSE:ALL Index

The NYSE:ALL index is a vital tool for investors, analysts, and market participants for several reasons:

- Comprehensive Market Overview: The index provides a snapshot of the overall market's performance, making it an essential tool for investors looking to gauge the market's health.

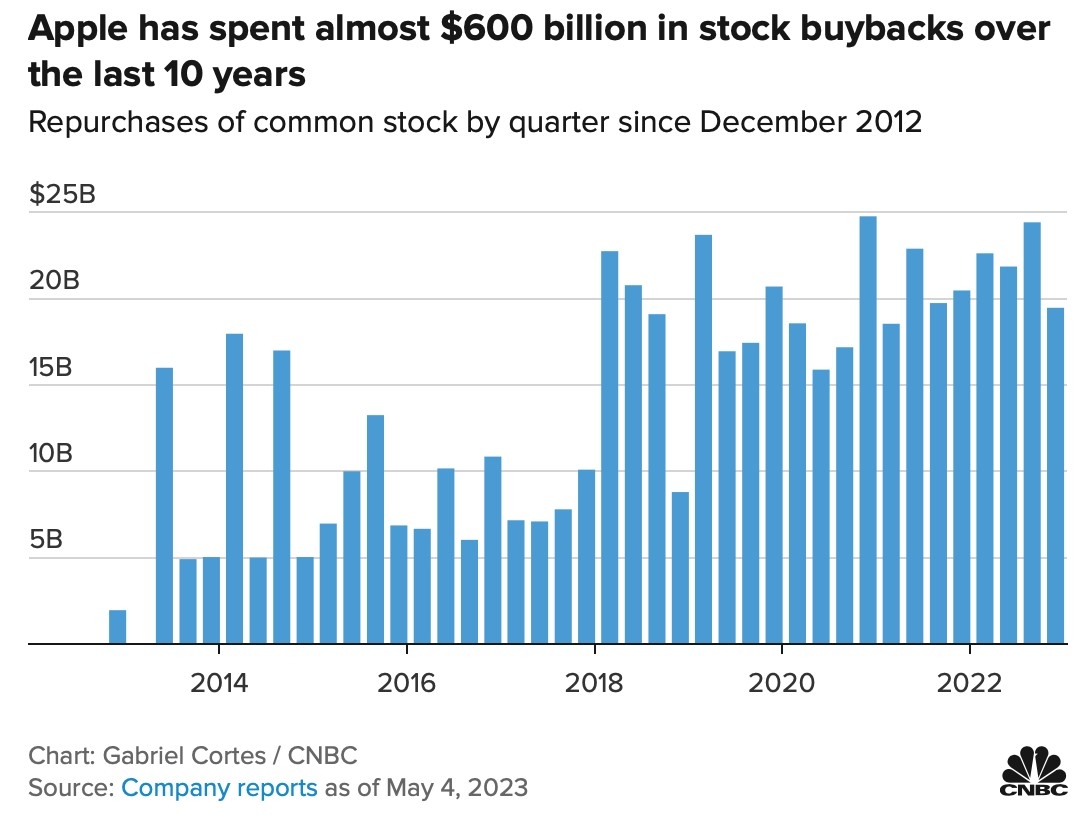

- Inclusion of Major Companies: The index includes some of the largest and most influential companies in the U.S., such as Apple, Microsoft, and Johnson & Johnson.

- Industry Representation: The index covers a broad range of industries, including technology, healthcare, finance, and consumer goods, allowing investors to analyze market trends across various sectors.

- Historical Performance: By examining the historical performance of the NYSE:ALL index, investors can gain insights into market trends and potential investment opportunities.

How the NYSE:ALL Index Impacts Investors

The NYSE:ALL index can have a significant impact on investors in several ways:

- Investment Decisions: Investors often use the index as a benchmark to compare the performance of their portfolios against the broader market.

- Market Trends: By analyzing the movements of the NYSE:ALL index, investors can identify emerging trends and potential investment opportunities.

- Risk Management: The index can help investors assess the overall market risk and make informed decisions about their investment strategies.

Case Study: Impact of the NYSE:ALL Index on Tech Stocks

One notable example of the NYSE:ALL index's impact on specific sectors is the technology industry. In recent years, the technology sector has accounted for a significant portion of the NYSE:ALL index, with companies like Apple and Microsoft contributing heavily to its performance.

During the tech boom of the late 1990s, the technology sector experienced rapid growth, which was reflected in the NYSE:ALL index. This period demonstrated how the index can be a powerful indicator of market trends and potential investment opportunities.

Conclusion

The NYSE:ALL index is a crucial tool for understanding the broader market's performance and identifying potential investment opportunities. By staying informed about the index and its constituent companies, investors can make more informed decisions and navigate the complex world of finance with greater confidence.

Meituan Stock US: A Comprehensive Analysis ? us flag stock