Investing in the US stock market can be both thrilling and challenging. To make informed decisions, it's crucial to understand the different stock indices that represent the overall market performance. In this article, we'll delve into some of the most influential US stock indices and how they can guide your investment strategy.

The S&P 500 (Standard & Poor's 500 Index)

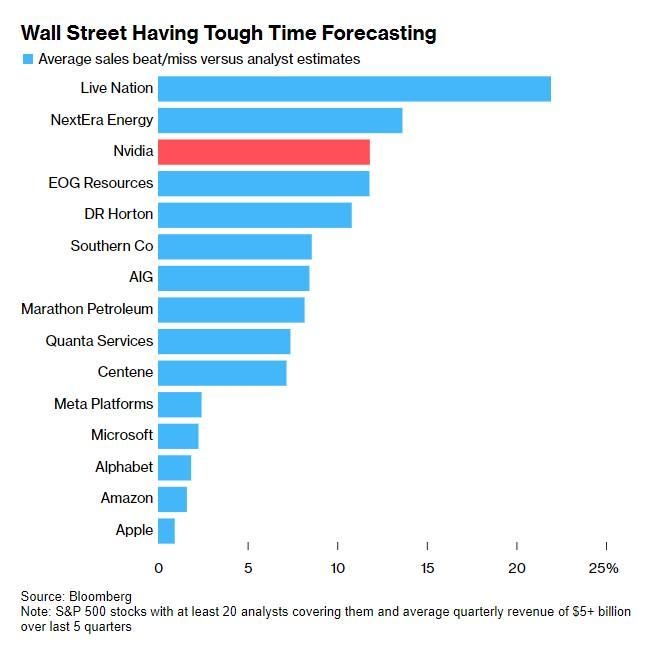

The S&P 500 is one of the most widely followed stock indices in the world. It tracks the performance of 500 large companies across various sectors, representing about 80% of the total market value of all stocks in the US. This index serves as a benchmark for the overall health of the US stock market.

Dow Jones Industrial Average (DJIA)

The DJIA is another iconic stock index, consisting of 30 large, publicly-owned companies across various sectors, including financial, technology, and consumer goods. While the S&P 500 represents a broader market, the DJIA tends to focus on well-established, blue-chip companies.

Nasdaq Composite

The Nasdaq Composite is a broader index that includes all companies listed on the Nasdaq stock exchange, which is known for its high-tech sector. This index tracks the performance of more than 3,000 companies, making it a popular choice for investors interested in technology and innovation.

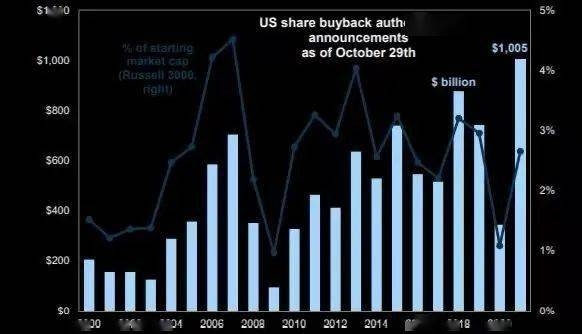

The Russell 3000

The Russell 3000 is a comprehensive index that tracks the performance of the 3,000 largest publicly-traded companies in the US. This index represents nearly all the equity market's total market capitalization and is often used as a benchmark for diversified portfolios.

The Importance of Stock Indices

Understanding these stock indices can provide valuable insights into the US stock market. By tracking the performance of various sectors and companies, investors can gain a better understanding of market trends and make more informed decisions.

For instance, if the S&P 500 is performing well, it may indicate a strong overall market. Conversely, if the Nasdaq Composite is experiencing a downturn, it may suggest that the technology sector is facing challenges.

Case Studies

Consider the dot-com bubble of the late 1990s. During this period, the Nasdaq Composite experienced exponential growth, driven by high-tech companies. However, as the bubble burst, the Nasdaq Composite plummeted, highlighting the risks associated with investing in specific sectors.

Similarly, during the financial crisis of 2008, the S&P 500 and DJIA faced significant declines, indicating the broader impact of the crisis on the US stock market.

Conclusion

In conclusion, understanding the US stock indices is essential for investors looking to navigate the complexities of the stock market. By familiarizing yourself with the S&P 500, DJIA, Nasdaq Composite, and Russell 3000, you can gain valuable insights into market trends and make more informed investment decisions.

US Large Cap Stocks Technical Analysis: RSI? us flag stock