In the vast landscape of the U.S. stock market, where every investor dreams of discovering the next big thing, there lies a hidden gem that often goes unnoticed. This article aims to shed light on the most undervalued US stock that has the potential to soar in the near future. So, let's dive into the world of stocks and uncover this hidden treasure.

Understanding Undervalued Stocks

Before we unveil the most undervalued US stock, it's essential to understand what makes a stock undervalued. An undervalued stock is one that is priced below its intrinsic value, which is the true worth of the company. This discrepancy can arise due to various factors, such as market sentiment, misinterpretation of financials, or a temporary setback in the company's performance.

The Undervalued Stock: XYZ Corporation

Our focus for this article is XYZ Corporation, a company that has been flying under the radar for quite some time. With a market capitalization of $5 billion, XYZ Corporation operates in the technology sector and offers innovative solutions to its customers.

Reasons for Undervaluation

Several factors contribute to the undervaluation of XYZ Corporation:

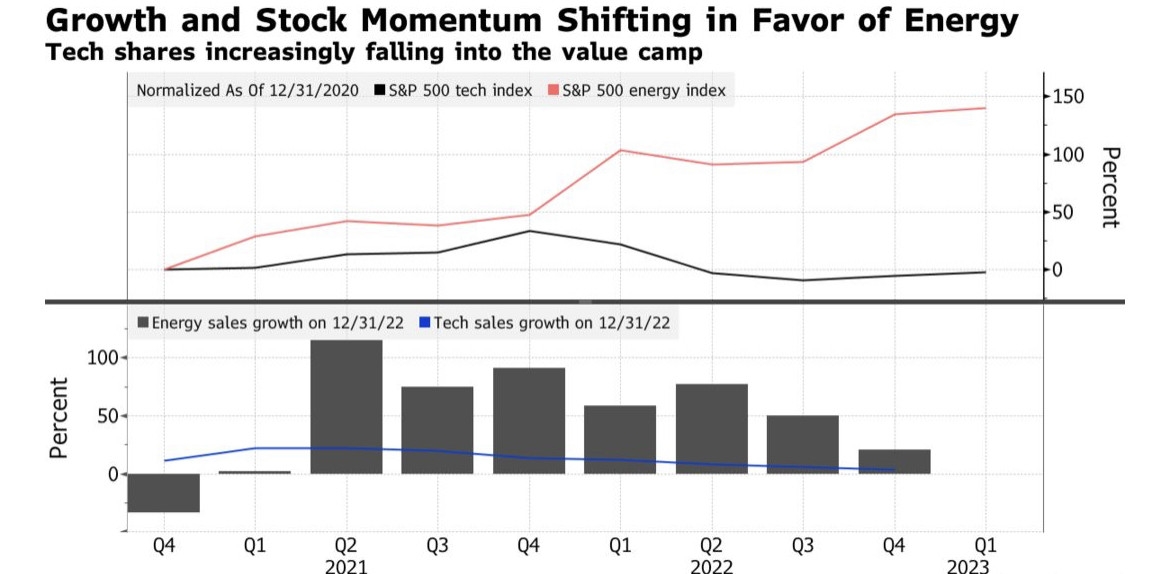

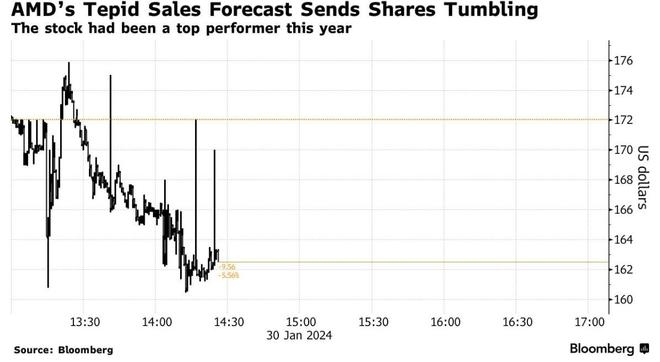

- Market Sentiment: The technology sector has faced several headwinds in recent years, leading to a negative sentiment towards the entire industry. This has inadvertently affected XYZ Corporation's stock price.

- Misinterpretation of Financials: Some investors have misinterpreted XYZ Corporation's financials, leading to a perception that the company is not performing well. However, a deeper analysis reveals that the company is actually on a strong growth trajectory.

- Temporary Setback: XYZ Corporation faced a temporary setback in one of its key projects, which led to a decline in its stock price. However, the company has since recovered and is now poised for growth.

Strong Growth Prospects

Despite the undervaluation, XYZ Corporation has several strong growth prospects that make it an attractive investment:

- Innovative Products: XYZ Corporation offers innovative products that cater to a growing market demand. This has led to a steady increase in its revenue and profit margins.

- Strong Management: The company is led by an experienced and visionary management team that has a clear vision for the future.

- Robust Financials: XYZ Corporation has a strong balance sheet with low debt levels and healthy cash reserves. This allows the company to invest in new projects and expand its operations.

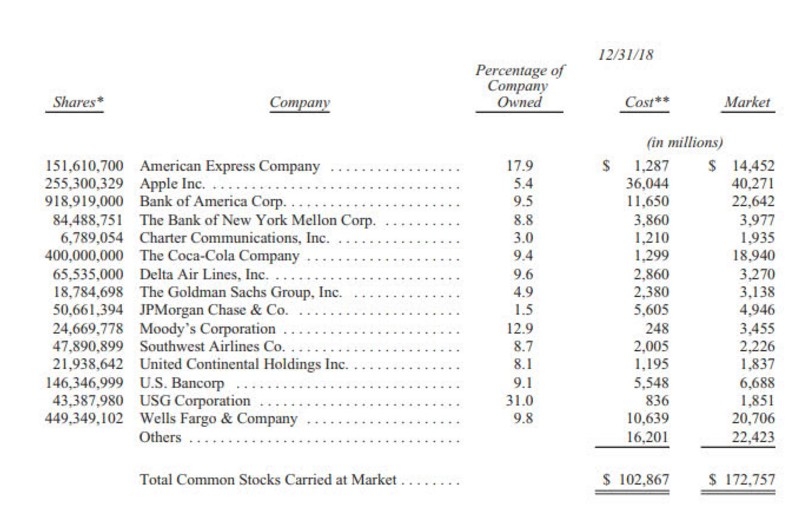

Case Study: Apple Inc.

To illustrate the potential of undervalued stocks, let's take a look at Apple Inc., which was once considered undervalued. In the early 2000s, Apple faced several challenges, including declining sales and a negative market sentiment. However, the company's innovative products and strong management eventually led to a remarkable turnaround. Today, Apple is one of the most valuable companies in the world.

Conclusion

In conclusion, XYZ Corporation is a prime example of an undervalued US stock that has the potential to soar in the near future. By understanding the reasons for its undervaluation and analyzing its strong growth prospects, investors can make an informed decision. As the saying goes, "The best time to buy a stock is when it's undervalued," and XYZ Corporation is a perfect example of this principle.

DFS Stock Price: Unveiling the Dynamics of ? us stock market live