Introduction:

Are you contemplating whether or not it's the right time to sell your US stocks? With the stock market's volatility and the myriad of economic uncertainties, making this decision can be daunting. This guide will help you understand the factors to consider before selling your US stocks, ensuring you make an informed choice.

Understanding the Market Conditions:

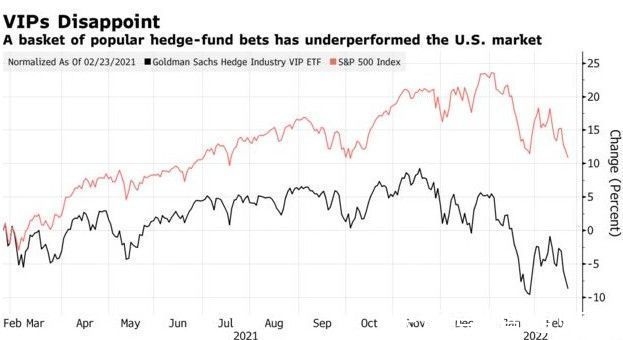

Before deciding to sell, it's crucial to assess the current market conditions. Historically, the stock market has shown a long-term upward trend, but recent fluctuations have left investors questioning the best course of action. It's essential to understand that market trends can be unpredictable and that risk tolerance varies among investors.

Financial Goals and Risk Tolerance:

Your financial goals and risk tolerance play a significant role in determining whether you should sell your stocks. If your goals are short-term and you require immediate access to your funds, selling may be the right move. Conversely, if you have long-term goals and can withstand short-term market fluctuations, you may want to hold onto your stocks.

Economic Factors:

Economic factors, such as interest rates, inflation, and unemployment, can impact the stock market. For instance, high interest rates can lead to falling stock prices as borrowing costs increase. Similarly, inflation can erode the purchasing power of your investments. It's essential to stay informed about these factors and consider how they may affect your stocks.

Dividend Yield:

One of the primary reasons for owning stocks is the potential for dividends. If your stocks are yielding a high dividend, you may want to hold onto them even if the stock price is fluctuating. However, if the dividend yield is low and the stock price is falling, selling may be a viable option.

Diversification:

Diversification is key to managing risk in your investment portfolio. If your stocks are part of a well-diversified portfolio, you may not need to sell them in response to market fluctuations. However, if your portfolio is heavily concentrated in a particular stock or sector, selling may help you reduce risk.

Tax Implications:

Selling stocks can have tax implications, so it's essential to consider these before making a decision. Long-term capital gains tax rates are typically lower than short-term rates, so it may be beneficial to hold onto stocks for at least one year. Additionally, consider any potential capital losses you may incur when selling stocks.

Case Studies:

Case Study 1:

An investor held a stock for 10 years, during which the market experienced several downturns. Despite the volatility, the investor held onto the stock and ended up realizing significant gains.

Case Study 2:

An investor decided to sell a stock that had been performing poorly for the past six months. The decision was based on a thorough analysis of the market and the investor's financial goals.

Conclusion:

Deciding whether to sell your US stocks is a complex decision that requires careful consideration of various factors. By evaluating the current market conditions, your financial goals, economic factors, dividend yield, diversification, and tax implications, you can make an informed choice. Remember, investing is about patience and discipline. Trust in your research and decision-making process, and don't let short-term market fluctuations dictate your long-term strategy.

How Many People Invest in the Stock Market ? us stock market live