In today's globalized economy, the stock market landscape has become increasingly diverse. Understanding the differences between the international stock market and the US stock market is crucial for investors looking to diversify their portfolios. This article delves into the key distinctions and provides valuable insights into both markets.

Market Size and Structure

The US stock market is the largest and most developed in the world. It includes major exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. The US market is highly regulated and offers a wide range of investment options, including stocks, bonds, ETFs, and mutual funds.

In contrast, the international stock market is more fragmented and diverse. It includes various stock exchanges across different countries, each with its unique structure and regulatory environment. Key international exchanges include the London Stock Exchange, Tokyo Stock Exchange, and Hong Kong Stock Exchange.

Market Dynamics

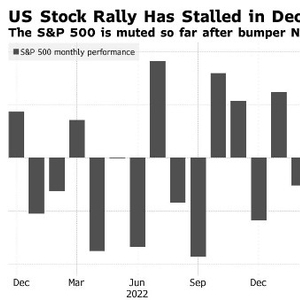

The US stock market is often characterized by high volatility and rapid price movements. This can be attributed to the active participation of institutional investors and the presence of numerous market makers. The S&P 500 and the Dow Jones Industrial Average are popular benchmarks used to gauge the overall performance of the US stock market.

On the other hand, the international stock market tends to be less volatile and more stable. This is due to factors such as lower levels of institutional participation and varying regulatory frameworks. The FTSE 100 and the Nikkei 225 are commonly used benchmarks for the London and Tokyo stock markets, respectively.

Investment Opportunities

The US stock market offers a wide array of investment opportunities, including companies from various sectors and industries. It is home to many of the world's largest and most successful companies, such as Apple, Google, and Microsoft.

The international stock market also presents numerous investment opportunities, but these are often more concentrated in specific sectors or regions. For example, the Nikkei 225 focuses on Japanese companies, while the FTSE 100 includes a mix of UK and international companies.

Risk and Return

Investing in the US stock market generally offers higher returns but also comes with higher risk. The high volatility and rapid price movements can lead to significant gains or losses. The VIX (Volatility Index) is often used to measure the level of risk in the US stock market.

In contrast, the international stock market provides a more balanced risk-to-return profile. While returns may be lower than those in the US market, the lower volatility and diverse range of investment options can help mitigate risk.

Case Studies

A notable case study is the tech sector, which has seen significant growth in both the US and international markets. Companies like Apple and Samsung have driven the tech sector in the US, while companies like Huawei and Xiaomi have dominated the international market.

Another case study is the financial sector, which has seen substantial growth in both markets. Major US banks like JPMorgan Chase and Goldman Sachs have outperformed their international counterparts, while European banks like HSBC and BNP Paribas have also performed well.

Conclusion

Understanding the differences between the international stock market and the US stock market is essential for investors looking to diversify their portfolios. While the US market offers high returns and volatility, the international market provides stability and diverse investment opportunities. By carefully considering their investment goals and risk tolerance, investors can make informed decisions to maximize their returns.

Infosys Stock Price US: Current Trends and ? us stock market live