Are you a Canadian investor looking to diversify your portfolio by trading U.S. stocks? If so, you've come to the right place. This comprehensive guide will walk you through the process of trading U.S. stocks from Canada, including the benefits, risks, and step-by-step instructions to get started.

Understanding the Benefits

Trading U.S. stocks from Canada offers several advantages. Firstly, the U.S. stock market is one of the largest and most liquid in the world, providing access to a wide range of companies across various industries. Secondly, trading U.S. stocks can help diversify your portfolio, reducing your exposure to the Canadian market and potentially increasing your returns. Lastly, many Canadian investors find that trading U.S. stocks offers more opportunities for growth and innovation compared to the domestic market.

Risks to Consider

While there are many benefits to trading U.S. stocks from Canada, it's important to be aware of the risks involved. Currency exchange rates can fluctuate, impacting the value of your investments. Additionally, regulatory differences between the U.S. and Canada can pose challenges, especially when it comes to tax implications and reporting requirements.

How to Trade U.S. Stocks from Canada

Choose a Broker: The first step is to select a brokerage firm that offers access to U.S. stocks. Some popular options for Canadian investors include TD Ameritrade, E*TRADE, and Charles Schwab. Be sure to research each broker's fees, platform features, and customer service.

Open an Account: Once you've chosen a broker, you'll need to open an account. This process typically involves filling out an application, providing identification, and funding your account. Some brokers may require additional documentation for international investors.

Understand the Platform: Familiarize yourself with your broker's trading platform. Most platforms offer real-time quotes, charting tools, and research resources to help you make informed investment decisions.

Research U.S. Stocks: Before making any trades, it's crucial to research the companies you're interested in. Look at their financial statements, earnings reports, and news releases. Pay attention to key metrics such as revenue, earnings per share (EPS), and price-to-earnings (P/E) ratio.

Place Your Trade: Once you've identified a stock you want to buy, place your trade through your broker's platform. Be sure to set appropriate stop-loss and take-profit levels to manage your risk.

Monitor Your Investments: Regularly review your portfolio to ensure it aligns with your investment strategy. Stay informed about market trends and company news that could impact your investments.

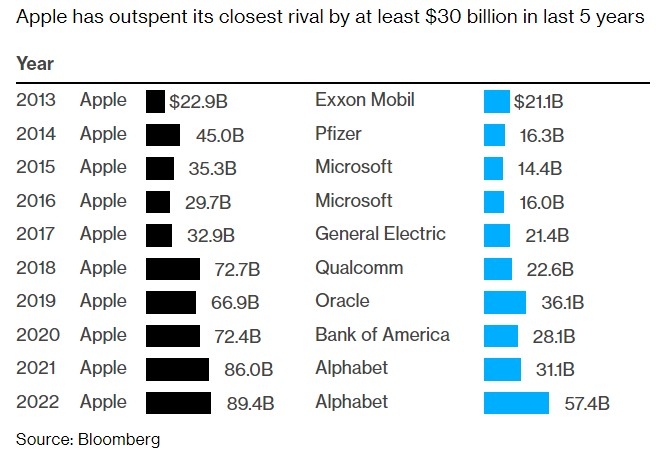

Case Study: Investing in Apple (AAPL) from Canada

Let's say you want to invest in Apple Inc. (AAPL), one of the most popular companies in the U.S. stock market. After researching the company and analyzing its financials, you decide to buy 100 shares at $150 per share.

To do this, you'll need to open an account with a broker that offers access to U.S. stocks, such as TD Ameritrade. Once your account is funded, you can place a trade for 100 shares of AAPL at

Conclusion

Trading U.S. stocks from Canada can be a valuable strategy for diversifying your portfolio and accessing a wider range of investment opportunities. By following this comprehensive guide, you can navigate the process with confidence and potentially achieve higher returns. Remember to do your research, manage your risk, and stay informed about market trends and company news.

How Many People Invest in the Stock Market ? us stock market live