In the rapidly evolving global economy, Indian investors are increasingly eyeing opportunities beyond their borders. One of the most promising avenues for investment is the United States stock market. This article delves into the intricacies of investing in US stocks from India, offering insights and practical advice for those looking to diversify their portfolios.

Understanding the Basics

US Stock Market Overview The US stock market is one of the most robust and liquid in the world. It boasts a wide array of companies across various sectors, ranging from tech giants like Apple and Google to traditional sectors like energy and healthcare. The primary markets where US stocks are traded include the New York Stock Exchange (NYSE) and the NASDAQ.

Investment Channels from India Indian investors can access the US stock market through various channels. These include:

- Direct Investment: Buying shares of US companies directly.

- Brokers and Online Platforms: Using Indian brokers who offer access to US stocks.

- Mutual Funds and ETFs: Investing in funds that focus on US stocks.

Benefits of Investing in US Stocks from India

Diversification One of the key benefits of investing in US stocks from India is diversification. The US market offers exposure to different sectors and geographies, which can help mitigate risks associated with the Indian market.

Higher Returns Historically, the US stock market has offered higher returns compared to the Indian market. This is attributed to factors like stronger corporate governance, technological advancements, and a more mature market structure.

Currency Fluctuations Investing in US stocks also exposes Indian investors to currency fluctuations. While this can be risky, it also offers the potential for higher returns if the Indian rupee strengthens against the US dollar.

Challenges and Considerations

Regulatory Hurdles Investing in US stocks from India involves navigating complex regulatory frameworks. It is crucial to understand the tax implications and comply with regulatory requirements to avoid legal issues.

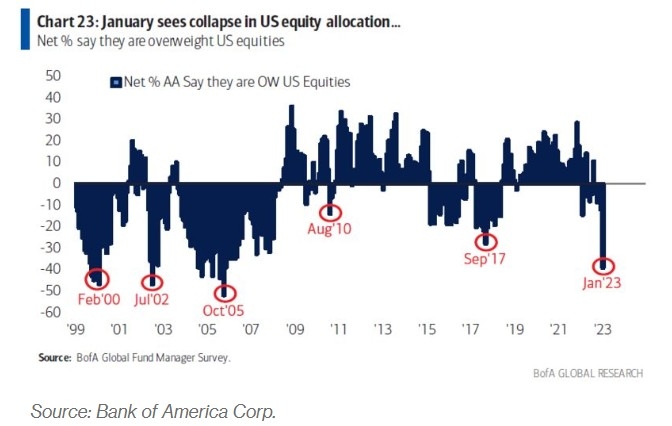

Market Volatility The US stock market is known for its volatility. Indian investors need to be prepared for market fluctuations and have a well-defined investment strategy.

Brokers and Platforms Choosing the right broker or online platform is essential for a smooth investment experience. Look for platforms that offer low transaction fees, reliable customer support, and access to a wide range of US stocks.

Case Study: Investing in Apple Inc.

Consider the case of an Indian investor who invested in Apple Inc. (AAPL) in 2020. By investing

Conclusion

Investing in US stocks from India can be a valuable addition to an investor’s portfolio. By understanding the basics, navigating the challenges, and choosing the right platforms, Indian investors can tap into the potential of the US stock market. Whether it’s for diversification, higher returns, or exposure to different sectors, investing in US stocks offers a world of opportunities.

How Many People Invest in the Stock Market ? us stock market live