In the ever-evolving world of finance, understanding stock market expectations is crucial for investors looking to make informed decisions. Whether you're a seasoned trader or a beginner, this guide will help you navigate the complexities of market expectations, providing you with the knowledge to make sound investments.

Understanding Market Expectations

What Are Stock Market Expectations?

Stock market expectations refer to the collective beliefs and forecasts of investors regarding the future performance of the stock market. These expectations are influenced by various factors, including economic indicators, corporate earnings reports, and geopolitical events.

Factors Influencing Stock Market Expectations

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation play a significant role in shaping market expectations. For instance, a strong GDP growth rate may indicate a robust economy, leading to higher stock prices.

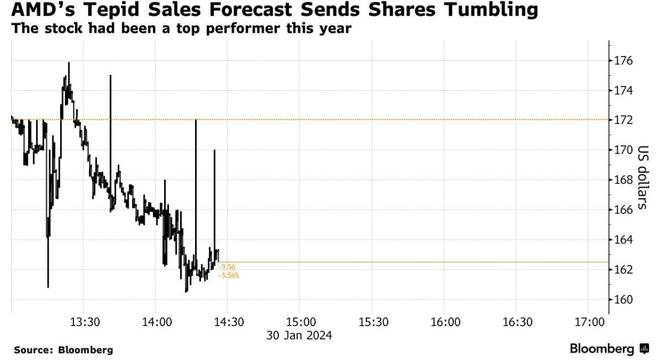

Corporate Earnings Reports: Companies' earnings reports provide insights into their financial performance and future prospects. Positive earnings reports can boost investor confidence and drive stock prices higher.

Geopolitical Events: Events such as elections, trade wars, and political instability can significantly impact market expectations. Investors often react to these events by adjusting their portfolios accordingly.

Analyzing Stock Market Expectations

To analyze stock market expectations, investors can use various tools and techniques:

Technical Analysis: Technical analysis involves studying historical price and volume data to identify patterns and trends. By analyzing these patterns, investors can gain insights into market expectations.

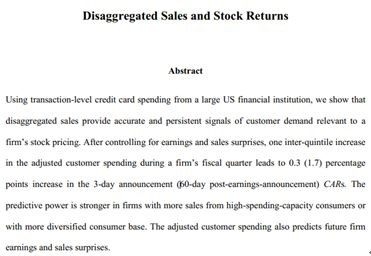

Fundamental Analysis: Fundamental analysis involves evaluating a company's financial statements, industry trends, and economic indicators to determine its intrinsic value. This analysis helps investors assess whether the market's expectations are justified.

Sentiment Analysis: Sentiment analysis involves analyzing the mood of the market by examining news, social media, and other sources. This analysis can provide valuable insights into market expectations.

Case Study: The 2020 Stock Market Crash

One of the most significant events in recent stock market history was the 2020 stock market crash, triggered by the COVID-19 pandemic. As the virus spread, investors became increasingly concerned about the economic impact, leading to a sharp decline in stock prices.

However, as the pandemic subsided and economies began to recover, investor sentiment shifted, and stock prices started to rise. This case study highlights the importance of understanding market expectations and adapting to changing circumstances.

Navigating Stock Market Expectations: Best Practices

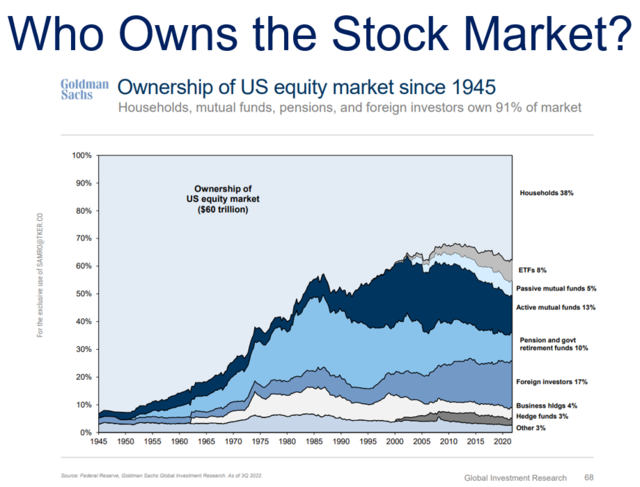

Diversify Your Portfolio: Diversifying your portfolio can help mitigate risks and protect your investments during periods of uncertainty.

Stay Informed: Keeping up with the latest economic news and market trends is crucial for making informed investment decisions.

Avoid Emotional Investing: Emotional reactions can lead to poor investment decisions. Stay disciplined and stick to your investment strategy.

Seek Professional Advice: If you're unsure about your investment decisions, consider seeking advice from a financial advisor.

In conclusion, understanding stock market expectations is essential for investors looking to succeed in the financial markets. By analyzing various factors and using the right tools, you can navigate the complexities of market expectations and make sound investment decisions.

Does Japan Nintendo Stock Affect US Nintend? us stock market today