In recent years, the US stock market has seen a surge in earnings momentum, with companies delivering impressive financial results. This article delves into the factors contributing to this momentum and examines the impact on investors. We'll explore key trends, analyze individual company performances, and discuss the broader implications for the market.

Economic Factors Fueling Earnings Momentum

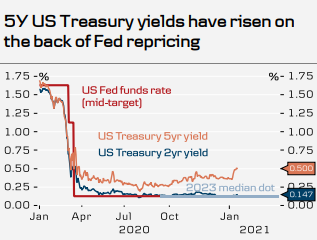

Several economic factors have contributed to the recent earnings momentum in US stocks. The strong US economy, characterized by low unemployment and robust GDP growth, has provided a favorable backdrop for corporate earnings. Additionally, the Federal Reserve's accommodative monetary policy has supported business investment and consumer spending, further boosting corporate profitability.

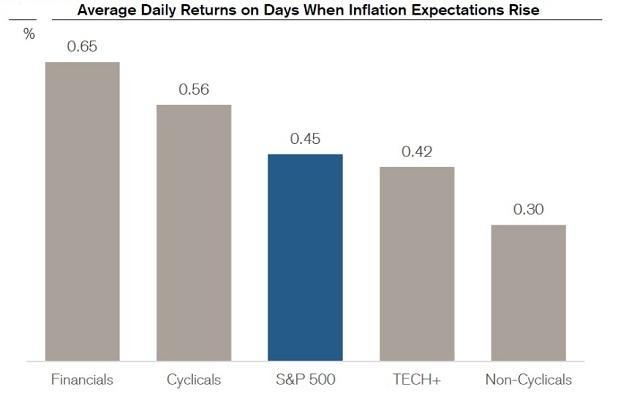

Sector Performance

Different sectors have experienced varying levels of earnings momentum. Technology and healthcare stocks have been particularly strong performers, driven by innovation and increased demand for digital solutions. For instance, Apple and Microsoft have reported significant revenue growth, with Apple's services segment contributing significantly to its overall earnings.

In contrast, the energy sector has faced challenges due to geopolitical tensions and supply chain disruptions. However, companies like ExxonMobil and Chevron have managed to maintain strong earnings, demonstrating resilience in the face of adversity.

Individual Company Performances

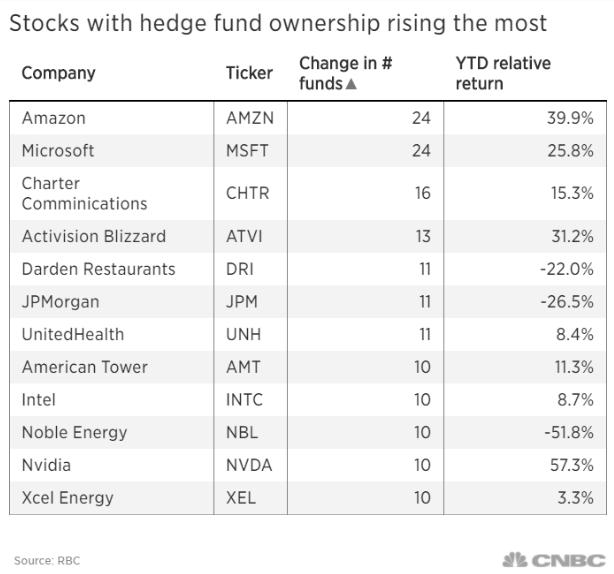

Several individual companies have stood out in terms of earnings momentum. Amazon has reported robust revenue growth, driven by its strong e-commerce business and expanding cloud services. Similarly, Facebook (now Meta) has continued to grow its advertising revenue, despite facing regulatory challenges.

Impact on Investors

The recent earnings momentum has had a positive impact on investors. Stock prices have risen, and dividend yields have remained attractive. However, investors should be cautious about overvalued sectors and individual stocks. It's crucial to conduct thorough research and consider market conditions before making investment decisions.

Case Study: Tesla

Tesla, the electric vehicle manufacturer, has been a prime example of recent earnings momentum. The company has reported significant revenue growth, driven by increased sales of its electric vehicles and energy products. Tesla's strong earnings have contributed to its soaring stock price, making it one of the most valuable companies in the world.

Conclusion

The recent earnings momentum in US stocks can be attributed to several factors, including a strong economy and technological advancements. While this momentum has provided opportunities for investors, it's essential to remain cautious and conduct thorough research. By understanding the broader market trends and individual company performances, investors can make informed decisions and capitalize on the opportunities presented by the current earnings momentum.

DJIA Closing History: Decoding the Stock Ma? us stock market today