In today's interconnected global economy, the stock market and the US dollar play pivotal roles. This article delves into the intricate relationship between these two critical financial instruments, examining how they influence each other and the broader economic landscape.

Understanding the Stock Market

The stock market is a marketplace where shares of public companies are bought and sold. It serves as a barometer of economic health, reflecting the overall sentiment of investors. When the stock market is on an uptrend, it often signals a strong economy, while a downward trend can indicate economic turmoil.

The US Dollar's Role

The US dollar, as the world's primary reserve currency, plays a crucial role in the global financial system. It is the currency of choice for international trade and investment, making it a key driver of the global economy.

The Interplay Between the Stock Market and the US Dollar

The relationship between the stock market and the US dollar is complex and often reciprocal. Here are some key aspects of this dynamic relationship:

1. Stock Market Performance and the US Dollar

When the stock market performs well, it often leads to an appreciation of the US dollar. This is because investors tend to seek the safety of the US dollar during times of economic uncertainty, pushing its value higher. Conversely, a weak stock market can lead to a depreciation of the US dollar as investors lose confidence in the global economy.

2. Interest Rates and the US Dollar

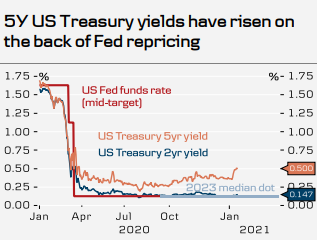

Interest rates are a significant factor in the relationship between the stock market and the US dollar. The Federal Reserve, the central banking system of the United States, sets interest rates, which can have a profound impact on the stock market and the US dollar.

When the Federal Reserve raises interest rates, it can boost the value of the US dollar. This is because higher interest rates make US investments more attractive to foreign investors, increasing demand for the US dollar. Conversely, lower interest rates can weaken the US dollar as investors seek higher yields elsewhere.

3. Inflation and the US Dollar

Inflation is another critical factor in the relationship between the stock market and the US dollar. High inflation can erode the purchasing power of the US dollar, leading to a depreciation. This can negatively impact the stock market, as companies face higher costs and reduced profitability.

Case Studies

Several recent case studies illustrate the dynamic relationship between the stock market and the US dollar:

- In 2020, the COVID-19 pandemic led to a sharp decline in the stock market and a depreciation of the US dollar. However, as the economy began to recover, both the stock market and the US dollar stabilized.

- In 2018, the Federal Reserve raised interest rates, leading to an appreciation of the US dollar and a modest increase in the stock market.

Conclusion

The stock market and the US dollar are inextricably linked, influencing each other and the broader economic landscape. Understanding this dynamic relationship is crucial for investors and policymakers alike. By monitoring these two critical financial instruments, one can gain valuable insights into the health of the global economy.

How to Buy US Stocks in Dubai: A Comprehens? us stock market today