In the United States, a government shutdown can be a pivotal event that has significant implications for various sectors, with the stock market often serving as a bellwether for economic and political developments. As we look ahead to 2025, this article delves into how a potential US government shutdown might impact the stock market and examines historical precedents to provide insights into this scenario.

Understanding the Impact of Government Shutdowns on the Stock Market

When the US government shutdowns, various departments and agencies halt their operations. This includes the closure of non-essential government services and a temporary halt in funding for many federal programs. Historically, such events have had varying impacts on the stock market, depending on the duration and context of the shutdown.

Short-term Impacts

Immediate Stock Market Decline: A sudden government shutdown often leads to an immediate decline in stock prices. This is because investors are concerned about the potential for economic uncertainty and reduced government spending.

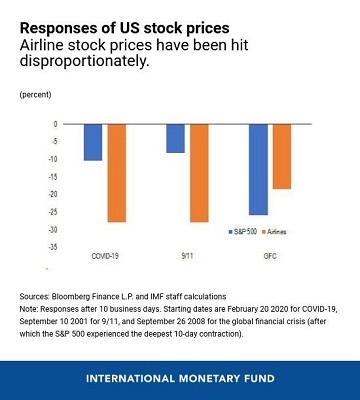

Sector-Specific Reactions: Some sectors are more directly affected than others during a government shutdown. For instance, defense companies may see their shares rise due to the expectation of increased government spending in the aftermath of the shutdown. Conversely, sectors like tourism, which rely on government services, may suffer significant losses.

Long-term Impacts

Economic Uncertainty: If a government shutdown is prolonged, it can lead to a loss of consumer confidence and reduced economic activity. This can have a long-term impact on the stock market, with investors becoming more risk-averse.

Historical Precedents

To gain insights into how a government shutdown might affect the stock market in 2025, let's examine some historical precedents:

Government Shutdown of 2018: In December 2018, the US government shutdown lasted 35 days. During this period, the stock market experienced a significant downturn, with the S&P 500 index dropping by approximately 8%. However, the market recovered relatively quickly after the shutdown ended.

Government Shutdown of 2013: The longest government shutdown in US history occurred in October 2013, lasting 16 days. The S&P 500 index dropped by about 6% during the shutdown, but the market recovered within a month.

Case Studies: Government Shutdown and Stock Market Performance

Shutdown of 2013:

- The technology sector was the most resilient, with companies like Apple and Google posting strong gains.

- Defense companies like Lockheed Martin and Raytheon saw their shares rise due to increased government spending expectations.

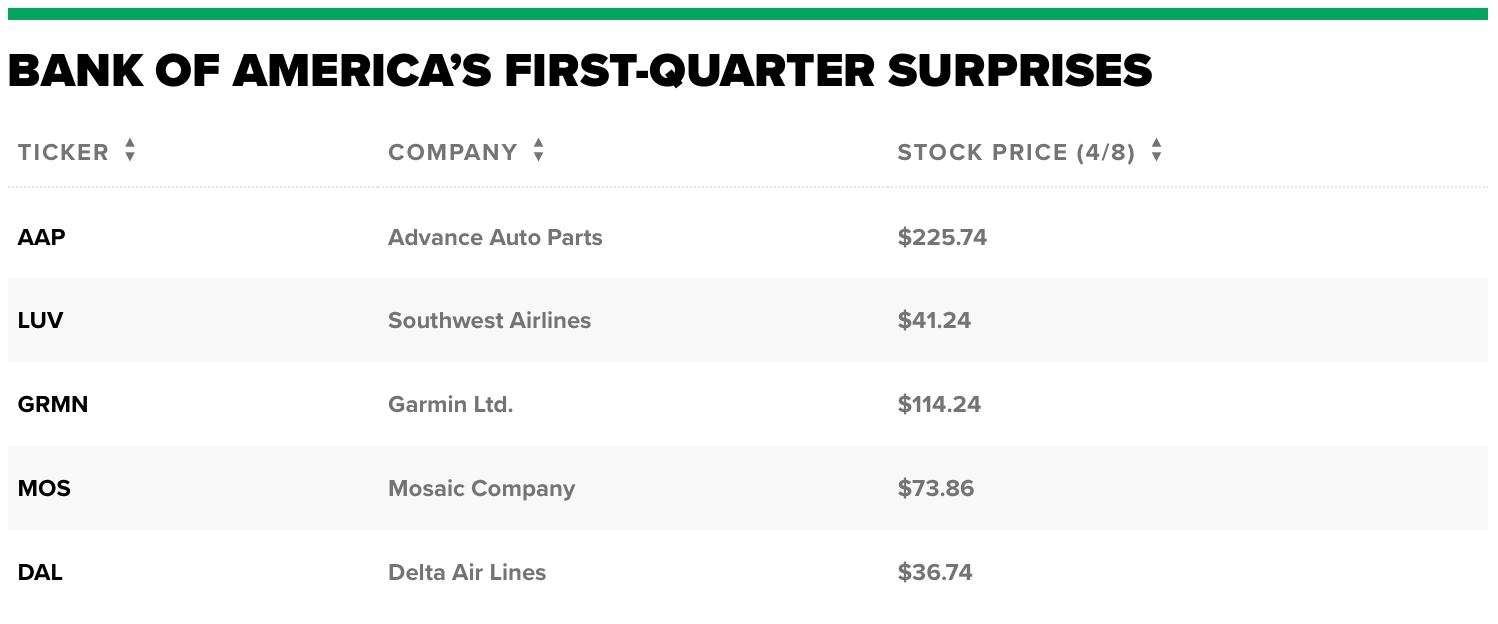

- The travel and leisure sector suffered significant losses, with airlines and hotel companies seeing their stocks decline.

Shutdown of 2018:

- The healthcare sector, which relies on government funding, was particularly hard hit, with companies like CVS Health and UnitedHealth Group seeing their shares decline.

- Energy companies, which rely on government permits, saw their shares rise slightly due to increased optimism about future government spending.

2025: What to Expect?

Given the historical precedents, it's reasonable to expect that a government shutdown in 2025 would lead to a short-term decline in the stock market, followed by a gradual recovery. However, the specific impact would depend on several factors, including the duration of the shutdown and the sectors most directly affected.

Conclusion

While a government shutdown can be a cause for concern, the stock market has historically shown resilience in the face of such events. As investors look ahead to 2025, understanding the potential impact of a government shutdown on the stock market can help them make more informed decisions.

"US Stock Futures for Thursday: A ? us stock market today