In the vast landscape of the U.S. stock market, small cap stocks play a significant role. But what exactly are they, and why are they important for investors? This article delves into the definition of US small cap stocks, their characteristics, and why they can be a valuable part of an investment portfolio.

What Are US Small Cap Stocks?

US small cap stocks are shares of publicly traded companies with a market capitalization of less than $2 billion. These companies are typically smaller and less established than their larger counterparts, often referred to as large cap or mega cap stocks. While small cap stocks may not have the same level of visibility or stability as larger companies, they often offer higher growth potential and a chance to invest in emerging industries.

Characteristics of Small Cap Stocks

1. Market Capitalization: As mentioned earlier, the primary characteristic of small cap stocks is their market capitalization. This figure represents the total value of a company's outstanding shares and is calculated by multiplying the number of shares by the current share price.

2. Size and Growth: Small cap companies are often in the early stages of their development, which means they have the potential for rapid growth. However, this growth comes with increased risk, as these companies may not have the financial stability or infrastructure of larger corporations.

3. Industry Focus: Small cap stocks are often found in niche industries or emerging markets. This can provide investors with exposure to sectors that may not be represented in larger indices.

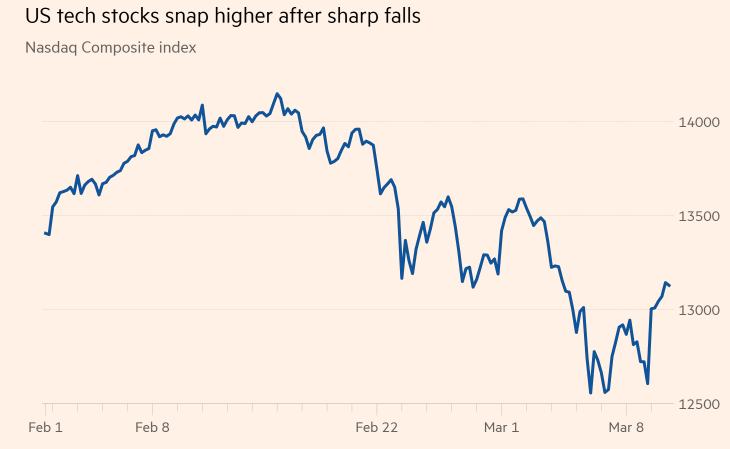

4. Volatility: Due to their smaller size and higher risk profile, small cap stocks tend to be more volatile than large cap stocks. This means their prices can fluctuate significantly in a short period of time.

Why Invest in Small Cap Stocks?

Despite the risks, there are several compelling reasons to consider investing in small cap stocks:

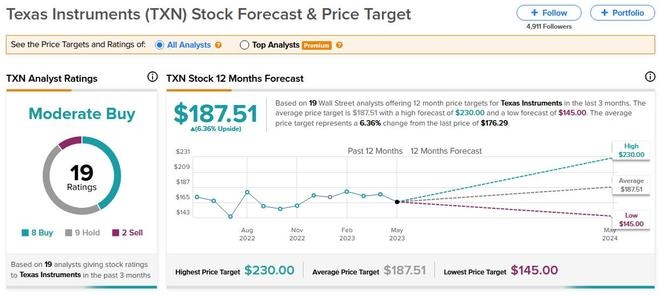

1. Growth Potential: Small cap companies often have the potential for significant growth, which can lead to substantial returns for investors.

2. Diversification: Including small cap stocks in a diversified portfolio can help reduce overall risk, as these stocks tend to perform differently than larger companies.

3. Access to Emerging Markets: Small cap stocks provide investors with access to emerging industries and markets, which can offer unique investment opportunities.

4. Value Creation: Investing in small cap stocks can be a way to support innovation and growth in the economy.

Case Study: Amazon

One of the most notable examples of a small cap stock that grew into a giant is Amazon. When it went public in 1997, Amazon had a market capitalization of just

This case study highlights the potential of small cap stocks to deliver extraordinary returns. However, it also serves as a reminder of the risks involved, as Amazon faced numerous challenges in its early years.

Conclusion

US small cap stocks are a unique and valuable part of the stock market. While they come with higher risk, they also offer the potential for significant growth and diversification. By understanding the definition and characteristics of small cap stocks, investors can make informed decisions about their investment strategy.

Best Dividend Yield US Stocks: Top 5 Invest? us stock market today