In the ever-evolving world of stock markets, keeping a close eye on major players is crucial for investors. One such company that has been a subject of interest is US Steel. This article delves into the latest developments, trends, and insights surrounding US Steel's stock market performance. From market analysis to potential risks and opportunities, we'll explore what investors need to know about US Steel.

Understanding US Steel's Market Position

US Steel is one of the largest steel producers in the world, with a significant presence in the United States. The company operates in various segments, including flat-rolled products, tubular products, and distribution. Its diverse product portfolio and strong market position have made it a key player in the steel industry.

Recent Stock Performance

In recent years, US Steel's stock has experienced both ups and downs. Several factors have influenced its performance, including global economic conditions, steel prices, and company-specific developments. Let's take a closer look at some of the key factors that have impacted US Steel's stock.

Global Economic Conditions

The global economy plays a crucial role in determining steel demand and, subsequently, steel prices. During periods of economic growth, steel demand tends to rise, leading to higher prices and improved profitability for steel producers. Conversely, during economic downturns, steel demand may decline, putting pressure on prices and profitability.

Steel Prices

Steel prices are a major driver of US Steel's stock performance. The company's profitability is closely tied to the price of steel, which is influenced by various factors, including supply and demand dynamics, raw material costs, and currency exchange rates. Fluctuations in steel prices can have a significant impact on US Steel's financial results and, consequently, its stock price.

Company-Specific Developments

US Steel's stock performance is also influenced by company-specific developments, such as cost-cutting initiatives, expansion plans, and strategic partnerships. For instance, the company's recent investments in new technologies and facilities have aimed to improve efficiency and reduce costs, potentially enhancing its competitive position in the market.

Key Insights and Analysis

1. Market Trends

The steel industry is experiencing a shift towards higher-value products and increased focus on sustainability. This trend is expected to benefit US Steel, as the company has been investing in advanced manufacturing technologies and sustainable practices.

2. Competitive Landscape

The steel industry is highly competitive, with numerous players vying for market share. However, US Steel's strong market position and diverse product portfolio have allowed it to maintain a competitive edge.

3. Potential Risks

Despite its strengths, US Steel faces several risks, including volatile steel prices, trade policies, and economic uncertainties. Investors should be aware of these risks and consider them when making investment decisions.

Case Studies

To illustrate the impact of market trends and company-specific developments on US Steel's stock, let's consider two case studies:

1. Impact of Global Economic Conditions

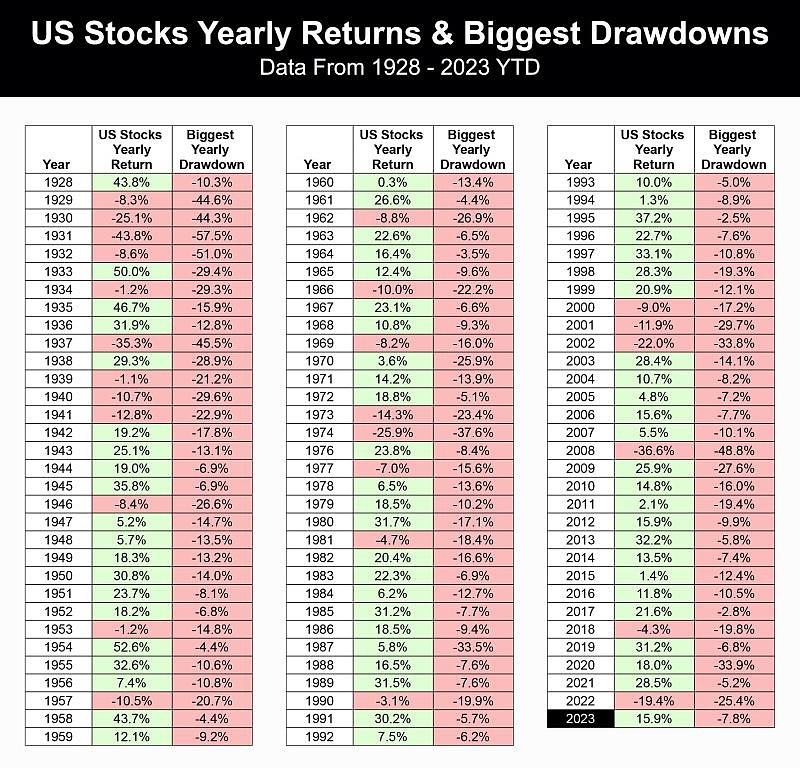

During the 2008 financial crisis, steel demand plummeted, leading to a significant decline in steel prices. US Steel's stock was not immune to this downturn, as the company's profitability was negatively affected. However, the company's strong market position and cost-cutting measures helped it navigate the crisis and emerge stronger.

2. Impact of Company-Specific Developments

In 2019, US Steel announced a major expansion project aimed at increasing its production capacity and improving efficiency. This expansion was well-received by investors, leading to a surge in the company's stock price.

Conclusion

US Steel remains a key player in the steel industry, with a strong market position and diverse product portfolio. While the company faces several risks, its strategic investments and focus on sustainability have positioned it well for future growth. Investors interested in the steel industry should closely monitor US Steel's stock performance and consider the factors that influence its market dynamics.

Consumer Products Stocks and US Growth Char? us stock market today