The US stock market has experienced its fair share of ups and downs over the years. With the current market bottom, investors are on the lookout for opportunities to capitalize on undervalued stocks. This article delves into the best stocks to buy during this market bottom, providing insights and analysis to help you make informed investment decisions.

Understanding the Market Bottom

A market bottom is a point where the stock market reaches its lowest level before starting to recover. This is typically characterized by a significant drop in stock prices, leading to increased pessimism among investors. However, it also presents a unique opportunity for investors to buy undervalued stocks at a lower price.

Key Factors to Consider

When looking for stocks to buy during a market bottom, it's crucial to consider several key factors:

Valuation: Look for stocks that are trading at a significant discount to their historical valuations. This can be determined by analyzing metrics such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and enterprise value-to-EBITDA (EV/EBITDA).

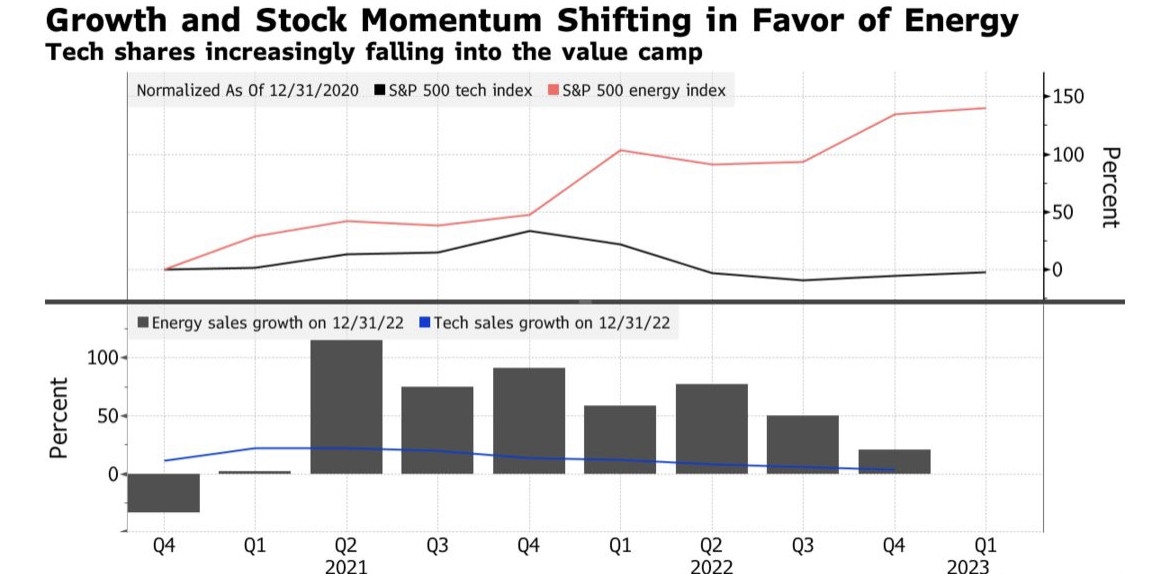

Sector Performance: Identify sectors that have been resilient during the downturn and are poised for recovery. Some sectors, such as healthcare and consumer staples, tend to perform well during economic downturns.

Company Fundamentals: Evaluate the financial health and growth prospects of individual companies. Look for companies with strong balance sheets, solid earnings growth, and a competitive advantage in their respective industries.

Top Stocks to Buy

Based on the above criteria, here are some top stocks to consider buying during the current market bottom:

Johnson & Johnson (JNJ) : As a leading healthcare company, Johnson & Johnson has a strong balance sheet and a diversified product portfolio. The company's consumer healthcare and pharmaceutical segments are expected to drive growth in the coming years.

Procter & Gamble (PG) : Procter & Gamble is a dominant player in the consumer goods industry, with a strong brand portfolio and a global presence. The company's focus on innovation and cost-cutting measures makes it a solid investment during a market downturn.

Apple (AAPL) : Apple remains one of the most valuable companies in the world, with a strong ecosystem of products and services. The company's recurring revenue model and robust cash flow make it a reliable investment during uncertain times.

Microsoft (MSFT) : Microsoft has a diverse portfolio of products and services, including cloud computing, gaming, and productivity software. The company's strong financial performance and commitment to innovation make it a solid long-term investment.

Amazon (AMZN) : Amazon has become a dominant force in the e-commerce industry, with a strong competitive advantage and a growing cloud computing business. The company's focus on innovation and expansion into new markets makes it a compelling investment during a market bottom.

Conclusion

The current market bottom presents a unique opportunity for investors to buy undervalued stocks. By considering factors such as valuation, sector performance, and company fundamentals, investors can identify promising stocks to buy during this period. As always, it's crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

"US Stock Exchange Names: A Compre? us stock market today