In the ever-evolving world of luxury fashion and retail, LVMH Moët Hennessy – Louis Vuitton SE (LVMH) stands as a testament to innovation and success. As one of the most influential companies in the industry, LVMH's US stock has captured the attention of investors and fashion enthusiasts alike. This article delves into the intricacies of LVMH's US stock, providing a comprehensive guide for those looking to understand its potential and risks.

Understanding LVMH

LVMH is a French multinational luxury goods conglomerate founded in 1987. The company owns a portfolio of high-end brands, including Louis Vuitton, Dior, Hennessy, and Moët & Chandon. LVMH's diverse product range spans from fashion and leather goods to wines and spirits, making it a powerhouse in the luxury market.

LVMH's US Stock Performance

LVMH's US stock has experienced remarkable growth over the years. Since its initial public offering (IPO) in 1987, the stock has seen significant appreciation, making it an attractive investment for many. However, like any investment, it's crucial to understand the factors that can impact its performance.

Key Factors Influencing LVMH's US Stock

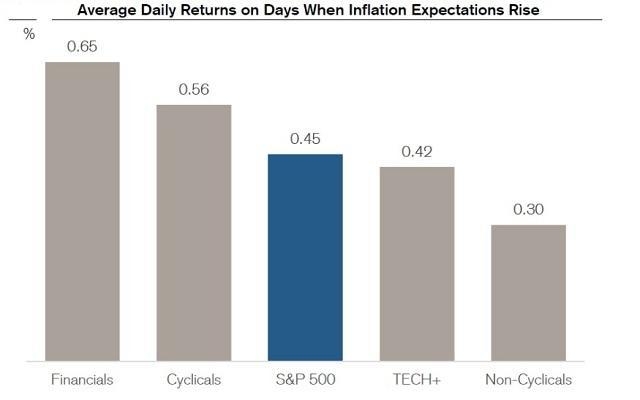

Economic Conditions: Economic factors, such as inflation, interest rates, and consumer spending, play a crucial role in LVMH's stock performance. During economic downturns, luxury spending tends to decline, which can negatively impact the company's stock.

Brand Performance: The success of LVMH's individual brands can significantly influence its stock. For instance, the launch of a new product or a successful marketing campaign can boost the company's stock, while poor performance can have the opposite effect.

Global Events: Global events, such as political instability or pandemics, can also impact LVMH's stock. The COVID-19 pandemic, for example, caused a temporary decline in luxury spending but ultimately led to a strong recovery as the market recovered.

Market Trends: Keeping up with market trends is essential for LVMH's continued success. The company's ability to adapt to changing consumer preferences and market demands can positively impact its stock.

LVMH's US Stock: A Case Study

To illustrate the impact of various factors on LVMH's US stock, let's consider a few case studies:

COVID-19 Pandemic: In 2020, the COVID-19 pandemic caused a significant decline in luxury spending. However, LVMH's ability to adapt and implement digital strategies helped mitigate the impact, leading to a strong recovery in its stock.

Luxury Market Recovery: In 2021, the luxury market experienced a strong recovery, driven by pent-up demand and increased consumer confidence. LVMH's stock benefited from this recovery, reaching new highs.

New Product Launches: The launch of new products, such as the Louis Vuitton City Bag, has contributed to LVMH's stock performance. The bag's popularity and the subsequent increase in sales helped drive the company's stock higher.

Conclusion

LVMH's US stock represents a unique opportunity for investors looking to invest in the luxury goods industry. By understanding the key factors that influence its performance, investors can make informed decisions and potentially capitalize on LVMH's continued growth. As the luxury market evolves, LVMH's ability to adapt and innovate will be crucial in maintaining its position as a leader in the industry.

US Marijuana Stocks: A Growing Industry to ? us stock market today live cha