In the dynamic world of stock market investments, Paycom US stands out as a notable player. Understanding the current Paycom US price stock and its potential is crucial for investors seeking to capitalize on the market trends. This article delves into a comprehensive analysis of Paycom US, exploring its recent stock price, growth prospects, and the factors that influence its market performance.

Understanding Paycom US

Paycom US, founded in 1998, is a leading provider of cloud-based human capital management (HCM) software. The company offers a comprehensive suite of solutions, including payroll, HR, time and attendance, and talent management. Paycom's commitment to simplifying HR processes has positioned it as a favorite among small and medium-sized businesses.

Recent Stock Price Analysis

As of the latest trading data, the Paycom US stock price has been fluctuating within a certain range. While the stock has shown significant growth over the years, it's important to note the recent performance and market trends.

Key Factors Influencing Paycom US Stock Price

Several factors have a direct impact on the Paycom US stock price. Here are some of the most notable:

Financial Performance: Paycom's strong financial performance, including consistent revenue growth and profit margins, has contributed to its rising stock price.

Market Trends: The HCM software industry has seen a surge in demand, especially as businesses seek to streamline their HR processes. This has positively impacted Paycom's stock price.

Strategic Partnerships: Paycom's strategic partnerships with major players in the tech industry have also played a significant role in its market performance.

Economic Factors: Global economic conditions, such as inflation and interest rates, can affect the stock price of Paycom US.

Case Studies

To further understand the impact of these factors, let's take a look at some case studies:

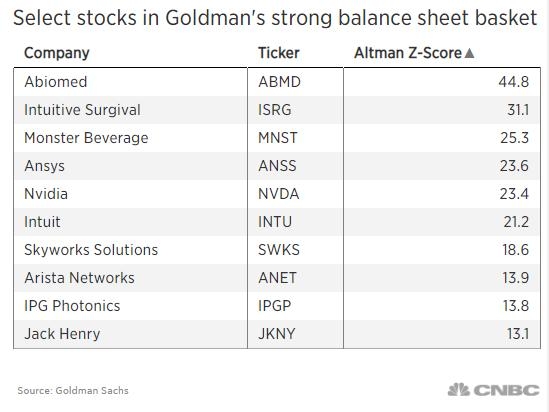

Strategic Partnership with Intuit: In 2021, Paycom entered into a strategic partnership with Intuit, a leading provider of financial and tax services. This partnership helped Paycom expand its market reach and enhance its product offerings, leading to a positive impact on its stock price.

Revenue Growth: Paycom's revenue growth has been impressive over the years. For instance, in 2020, the company reported a revenue increase of 30% year-over-year, which positively influenced its stock price.

Conclusion

In conclusion, the Paycom US price stock presents a promising investment opportunity. Understanding the factors that influence its stock price and market performance is crucial for investors looking to capitalize on this trend. With a strong financial performance, strategic partnerships, and a growing demand for HCM software, Paycom US is poised for continued growth in the coming years.

Best US Stock Trading Platforms 2025: Top P? us stock market today live cha