In the fast-paced world of the stock market, staying informed about key reports is crucial for investors. These reports can significantly impact stock prices and market trends. In this article, we'll explore the schedule of reports that affect the U.S. stock market and how they can influence your investment decisions.

Economic Reports: The Cornerstone of Market Analysis

1. Gross Domestic Product (GDP) The GDP report is one of the most critical economic indicators. It measures the total value of goods and services produced within a country over a specific period. A higher GDP often indicates economic growth, which can positively impact the stock market. Conversely, a lower GDP can signal economic downturns, leading to market volatility.

2. Consumer Price Index (CPI) The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. It's a key indicator of inflation. A rising CPI can lead to higher interest rates, which may negatively affect stocks. Conversely, a falling CPI may indicate deflation, potentially benefiting the stock market.

3. Employment Reports Employment reports, such as the Non-Farm Payrolls report, provide insights into the health of the labor market. A strong employment report can boost investor confidence and drive stock prices higher. On the other hand, weak employment data can raise concerns about economic growth and lead to market sell-offs.

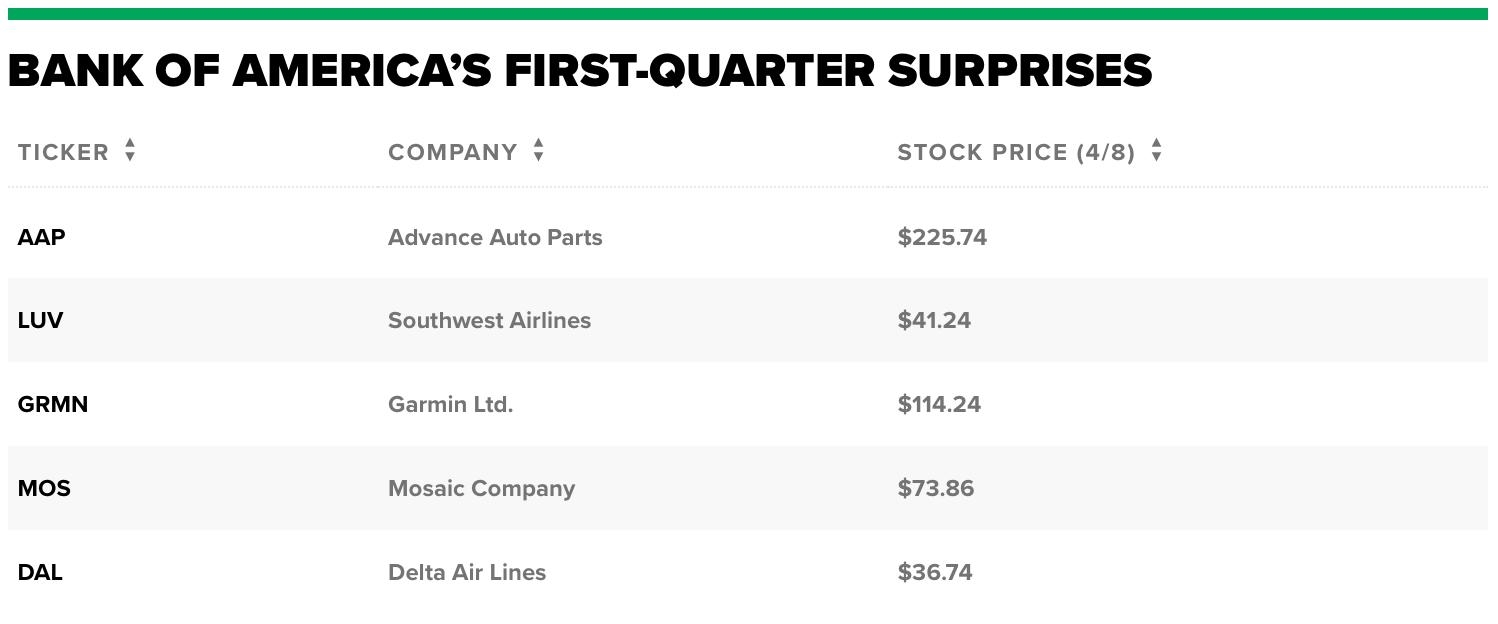

Corporate Earnings Reports

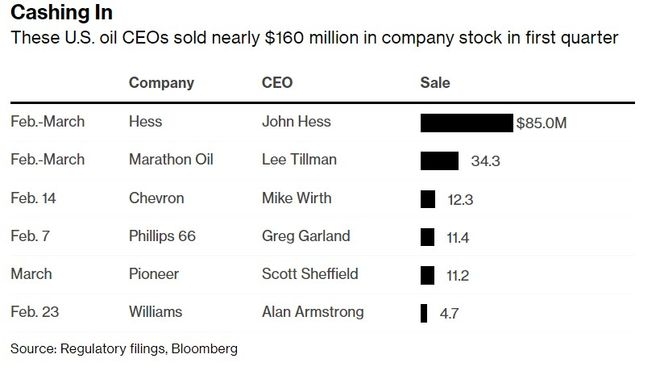

Corporate earnings reports are another critical factor affecting the stock market. These reports provide insights into a company's financial performance and can significantly impact its stock price.

1. Earnings Reports When a company releases its earnings report, investors closely analyze key metrics such as revenue, earnings per share (EPS), and profit margins. Positive earnings reports can lead to stock price increases, while negative reports can cause declines.

2. Earnings Guidance Many companies also provide earnings guidance, which is an estimate of their future financial performance. These forecasts can influence investor expectations and stock prices.

Market Indices and Economic Indicators

Several market indices and economic indicators can affect the stock market's direction.

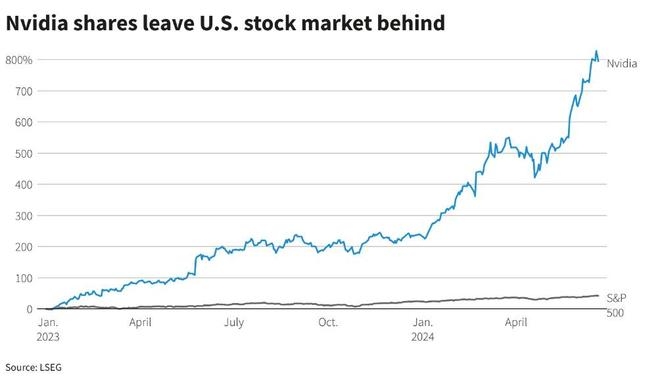

1. S&P 500 The S&P 500 is a widely followed index that tracks the performance of 500 large companies listed on U.S. exchanges. Its movements can provide insights into the overall health of the stock market.

2. Federal Reserve Policy The Federal Reserve's monetary policy, including interest rate decisions, can significantly impact the stock market. Higher interest rates can lead to higher borrowing costs for companies, potentially dampening stock prices. Conversely, lower interest rates can stimulate economic growth and boost stock prices.

Case Studies

1. The Impact of the GDP Report on the Stock Market In Q2 2021, the U.S. GDP grew at an annual rate of 6.5%. This strong growth led to increased investor confidence, resulting in a rally in the stock market.

2. The Effect of the CPI Report on Stock Prices In early 2022, the CPI in the U.S. rose to a 40-year high. This surge in inflation led to concerns about rising interest rates, causing the stock market to experience volatility.

By staying informed about these key reports and their potential impact on the stock market, investors can make more informed decisions and better manage their portfolios. Remember, understanding the schedule of reports and their implications is crucial for long-term success in the stock market.

All Us Stock Markets: A Comprehensive Overv? us stock market today live cha