Are you contemplating investing in US stocks? With the stock market's unpredictable nature, it's natural to wonder if now is the right time. In this article, we'll explore the factors you should consider before making your decision. We'll delve into the current market trends, economic indicators, and historical data to help you make an informed choice.

Understanding the Current Market Trends

The stock market is influenced by various factors, including economic indicators, political events, and global trends. As of early 2023, the US stock market has been experiencing a period of volatility. However, several key trends suggest that investing in US stocks might be a viable option.

- Low Interest Rates: The Federal Reserve has been keeping interest rates low to stimulate economic growth. This has led to increased borrowing and investment, which can benefit the stock market.

- Corporate Earnings: Many US companies have reported strong earnings, driven by factors such as cost-cutting measures and improved operational efficiency.

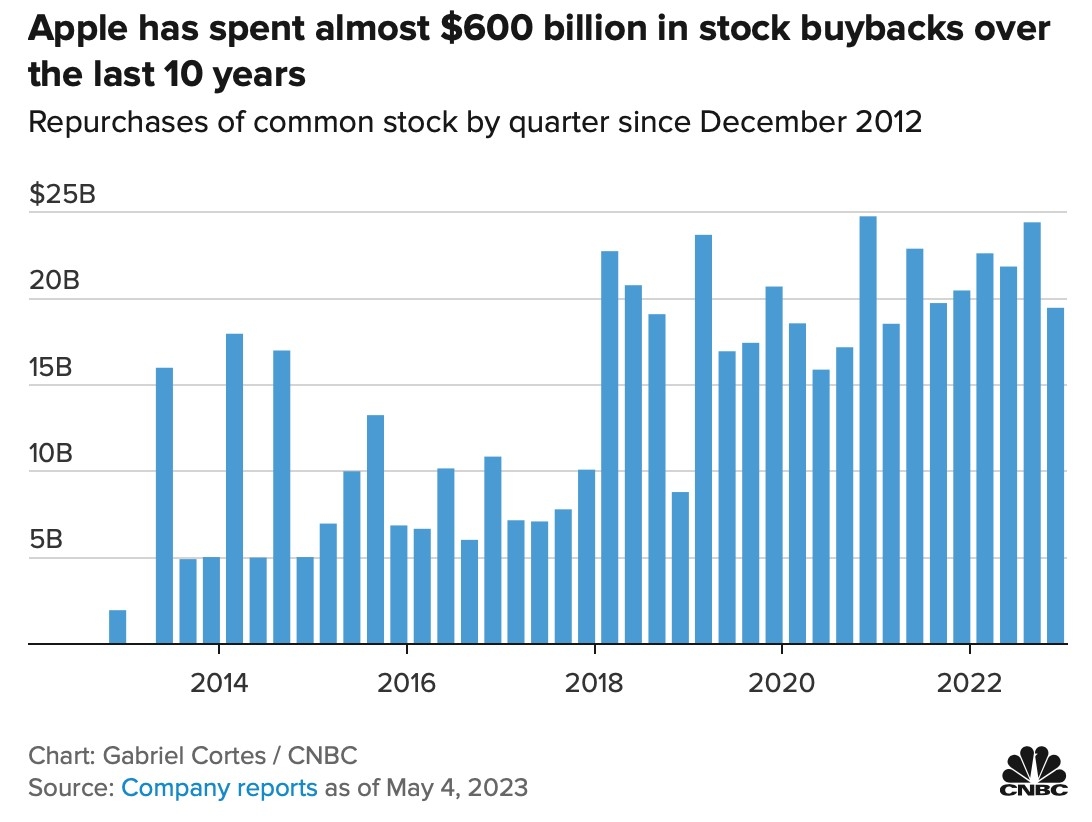

- Technological Advancements: The technology sector has been a significant driver of growth in the US stock market. Companies like Apple, Microsoft, and Amazon have continued to expand their market share and generate substantial profits.

Economic Indicators to Consider

Before investing in US stocks, it's crucial to analyze economic indicators that can provide insights into the market's future direction. Here are some key indicators to consider:

- GDP Growth: A strong GDP growth rate suggests a healthy economy, which can positively impact the stock market.

- Unemployment Rate: A low unemployment rate indicates a robust job market, which can lead to increased consumer spending and, subsequently, higher stock prices.

- Inflation: While low inflation is generally beneficial for the stock market, high inflation can erode purchasing power and negatively impact corporate earnings.

Historical Data and Market Cycles

Analyzing historical data can provide valuable insights into market cycles and potential investment opportunities. Here are some key points to consider:

- Market Cycles: The stock market has experienced various cycles over the years, including bull markets (when stock prices rise) and bear markets (when stock prices fall). Understanding these cycles can help you make informed decisions.

- Diversification: Diversifying your investment portfolio can help mitigate risks associated with market volatility. Investing in a mix of stocks, bonds, and other assets can provide a more balanced approach.

Case Studies

To illustrate the potential of investing in US stocks, let's consider a few case studies:

- Apple Inc.: Since its initial public offering (IPO) in 1980, Apple has experienced significant growth. Its stock price has soared from

22 per share to over 150 per share, making it one of the most valuable companies in the world. - Amazon.com Inc.: Launched in 1994, Amazon has become a dominant player in the e-commerce industry. Its stock price has surged from

1.50 per share to over 3,000 per share, showcasing the potential of investing in high-growth companies.

Conclusion

Investing in US stocks can be a lucrative opportunity, but it's essential to conduct thorough research and consider various factors before making your decision. By analyzing market trends, economic indicators, historical data, and case studies, you can make an informed choice that aligns with your investment goals and risk tolerance. Remember, investing in the stock market always involves risks, so it's crucial to do your homework and seek professional advice if needed.

Best Performing US Stocks Last 5 Days: Mome? us stock market today live cha