In recent weeks, the stock market has experienced a downturn, leaving investors concerned about the future of their portfolios. This article delves into the reasons behind the decline, offers insights into how to navigate this challenging market landscape, and provides valuable tips for long-term investors.

Understanding the Downturn

Several factors have contributed to the current stock market downturn. The most significant factors include:

- Economic Uncertainty: The ongoing trade tensions between the United States and China have created uncertainty in the global economy, leading to a decline in investor confidence.

- Interest Rate Hikes: The Federal Reserve's decision to raise interest rates has made borrowing more expensive, impacting corporate profits and consumer spending.

- Political Instability: The political environment in various countries has contributed to market volatility, as investors remain cautious about potential policy changes.

Navigating the Current Market Landscape

In light of these challenges, investors must adopt a strategic approach to navigate the current market landscape. Here are some key tips:

- Diversify Your Portfolio: Diversification is crucial to managing risk and protecting your investments. By spreading your investments across various asset classes, sectors, and geographic regions, you can reduce the impact of market downturns.

- Stay the Course: It's important to maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Historically, markets have recovered from downturns, and staying invested can lead to long-term gains.

- Review Your Portfolio: Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance. Consider adjusting your asset allocation to reflect your changing financial situation or investment objectives.

Case Studies

To illustrate the impact of market downturns, let's look at two case studies:

- Dot-Com Bubble Burst (2000-2002): The dot-com bubble burst in 2000, leading to a significant decline in technology stocks. However, investors who remained invested in the market over the long term saw their portfolios recover and eventually surpass their pre-bubble levels.

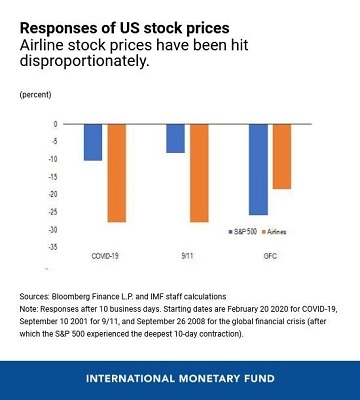

- Financial Crisis (2007-2009): The financial crisis of 2007-2009 caused a severe downturn in the stock market. Despite the sharp decline, investors who maintained a diversified portfolio and stayed the course saw their portfolios recover within a few years.

Conclusion

The current stock market downturn presents challenges for investors, but by adopting a strategic approach and maintaining a long-term perspective, you can navigate this challenging landscape and achieve your investment goals. Remember to diversify your portfolio, stay the course, and regularly review your investments to ensure they align with your financial objectives.

IG Trade: Your Gateway to Accessing US Stoc? us stock market today live cha