In the globalized world of finance, international share prices play a crucial role in the investment landscape. Whether you're a seasoned investor or just dipping your toes into the market, understanding how these prices fluctuate and what drives them is essential. This article delves into the factors that influence international share prices, the role of global markets, and how investors can navigate this complex terrain.

Global Market Dynamics

The international share price is influenced by a variety of global market dynamics. These include economic indicators, political events, and currency fluctuations. For instance, a strong GDP growth in a particular country can boost the share prices of companies based there, as investors anticipate higher profits.

Economic Indicators

Economic indicators such as unemployment rates, inflation, and interest rates are key factors that can impact international share prices. A low unemployment rate and low inflation typically signal a healthy economy, which can lead to higher share prices. Conversely, rising interest rates can make borrowing more expensive for companies, potentially lowering their share prices.

Political Events

Political events, such as elections or policy changes, can also have a significant impact on international share prices. For example, if a new government is elected with policies that are favorable to certain industries, the share prices of companies within those industries may rise.

Currency Fluctuations

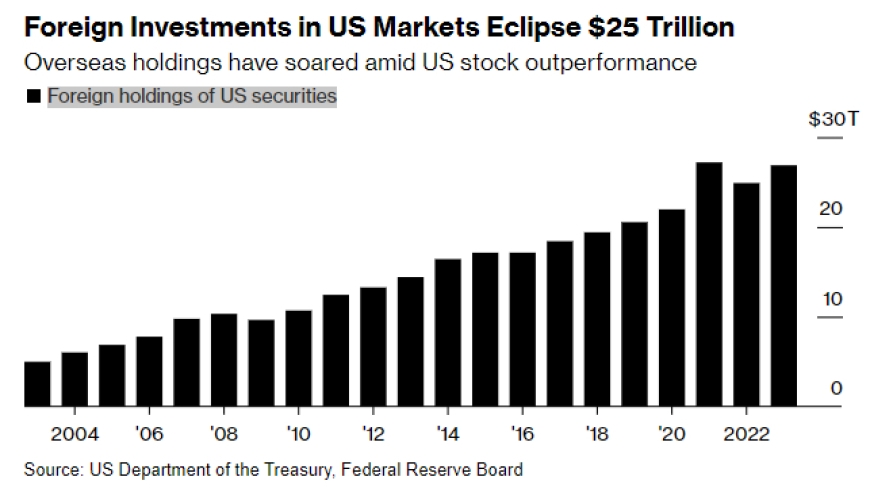

Currency fluctuations are another critical factor in international share prices. When a country's currency strengthens, its companies' shares may become more expensive for foreign investors, potentially lowering demand and share prices. Conversely, a weaker currency can make a company's shares more attractive to foreign investors, potentially increasing demand and share prices.

Investor Sentiment

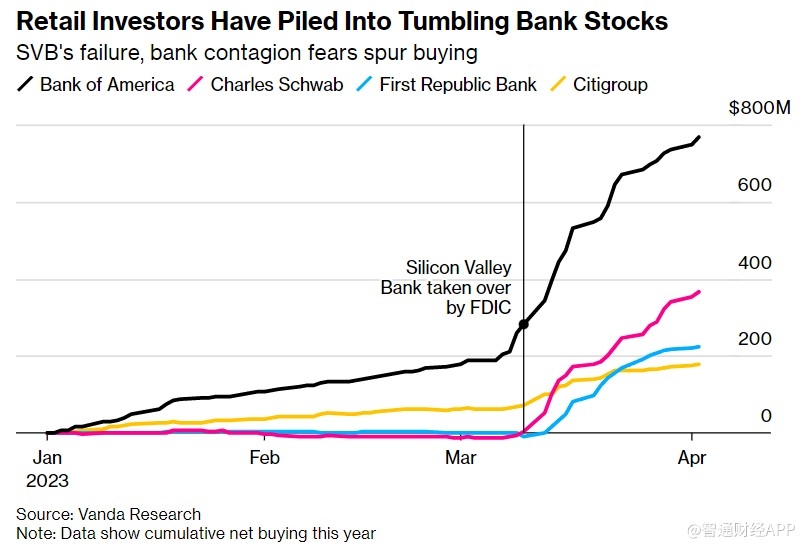

Investor sentiment is also a major driver of international share prices. When investors are optimistic about the future of the market, they are more likely to buy shares, pushing prices up. Conversely, when investors are pessimistic, they may sell their shares, leading to a decline in prices.

Case Studies

Let's consider a hypothetical case. Company X, a global pharmaceutical giant, is expected to release a new drug that could revolutionize treatment for a common disease. If the drug is successful, it could significantly boost the company's profits, leading to an increase in its international share price. However, if clinical trials show negative results, the share price could plummet.

Another example is the impact of the COVID-19 pandemic on international share prices. Many companies, especially those in the travel and hospitality sectors, saw their share prices plummet as the pandemic led to travel restrictions and reduced consumer spending. Conversely, companies in the technology and healthcare sectors saw their share prices soar as demand for their products and services increased.

Navigating the Market

For investors looking to navigate the international share price landscape, it's crucial to stay informed and stay diversified. This means understanding the global economic and political landscape, keeping an eye on economic indicators, and being aware of currency fluctuations.

Conclusion

Understanding international share prices requires a comprehensive understanding of global market dynamics, economic indicators, political events, currency fluctuations, and investor sentiment. By staying informed and diversified, investors can make more informed decisions and navigate the complexities of the global market.

Unlock the Power of HTTP Stocks: A Comprehe? us stock market today live cha